疫情過後 A股成國際資金長遠配置之選

摘要

在新型冠狀病毒疫情中,究竟全球哪一個股市的表現相對強韌?結果可能令投資者大感意外。

截至5月15日,MSCI中國A股在岸指數(以美元計)年初至今僅跌約3%1,表現不單領先離岸中國股市指數,也優於歐美股市(見圖1)。專責管理安聯神州A股基金的基金經理黃瑞麒解釋,環球股市表現波動,主要是疫情及油價崩盤所致,而兩者對於中國A股的負面影響都較低。

疫情無阻國際資金流入A股

在疫情方面,中國內地最先爆發新型冠狀病毒疫情,但也是最快平息下來,股市亦隨之回復。至於油價方面,中國是石油進口國,而且石油能源只佔A股指數極少比重,所以能源股大挫對A股市場的負面影響也相對輕微。更重要的,是A股市場由散戶主導,他們對於中國政府的政策更加敏感,當政府推出刺激經濟方案,散戶的反應更加積極,因此A股市場今年的表現較外圍更佳。

此外,疫情也無阻國際資金透過互聯互通流入A股的大趨勢。中國是全球第二大經濟體,但在MSCI世界指數,A股的佔比少於1%,在MSCI新興市場指數中也僅佔4%。隨著A股在國際指數的權重逐步提升,A股將會是國際投資者的長遠資產配置目標。

是次的環球股市下挫,再次印證了分散風險的重要性。A股有多達八成的成交量來自散戶,他們和國際機構投資者的投資行為大相逕庭,因此A股與環球各大股市的相關性一向較低,能發揮分散投資的功用。黃瑞麒指,隨着A股市場逐步開放,與外圍股市的相關性料會慢慢提升,不過這會是一個漫長的過程,至少在未來三年A股都是相對獨立的市場。

特朗普就任以來A股升四成

展望未來,儘管中美關係再次緊張起來,但他相信對A股的影響料也是微不足道,原因是美國機構投資者持有的A股,僅佔A股總市值的1%左右2。事實上,中美關係對中國股票的影響,並非想像中嚴重。自特朗普於2017年1月正式就職美國總統以來,到今年4月20日,MSCI中國指數累積上升了42%3,勝於美國標普500指數的37%3。而中國為了擺脫對外國科技及電子零部件的依賴,將致力於自主研發及創新,擁有相關技術的企業有望脫穎而出,反造就了嶄新的投資機會。

把握多元新經濟機遇

黃瑞麒補充,疫症更為內地經濟結構帶來了一些顛覆性的變化。「在過去幾年,本來仍有很多民眾不習慣線上購物或使用線上服務,但在疫情封城期間,大部分消費者都習慣了在網上訂購日常用品,壯大了相關企業的客戶群,並為投資者帶來機遇。」

相較於本港股市,A股市場擁有更為豐富多元的新經濟板塊,例如5G設備、健康護理、生物科技、工業自動化、新能源及旅遊娛樂等,令投資者可從中國的經濟轉型過程中獲得更大的潛在收益。

安聯神州A股基金 - 知多一點點:

.安聯神州A股基金投資於中國A股市場,以達致長期資本增值。

.此基金須承受重大風險包括投資/一般市場、國家及區域、新興市場、公司特定與貨幣〔尤其是人民幣〕的風險。

.此基金運用RQFII制度及滬/深港通投資中國A股市場,而須承受相關風險包括額度限制、規則及規例的更改、基金匯回款項限制、交易限制、中國市場波動及不穩定、潛在的結算及交收困難、中國經濟、社會和政治政策的變動及中國內地稅務等風險。

.此基金可投資於金融衍生工具,會涉及較高的槓桿、交易對手、流通性、估值、波幅、市場及場外交易風險。此基金的衍生工具風險承擔淨額最高可達此基金資產淨值的50%。

.投資所涉及的風險可能導致投資者損失部分或全部投資金額。

.閣下不應僅就此文件而作出投資決定。

註:此基金派息由基金經理酌情決定。派息或從基金資本中支付,或實際上從資本中撥付股息。這即等同從閣下收入及/或原本投資金額或從金額賺取的資本

收益退回或提取部份款項。這或令每股資產淨值即時下降,及令可作未來投資的基金資本和資本增長減少。因對沖股份類別參考貨幣與此基金結算貨幣之間的

息差,有關對沖股份類別之分派金額及資產淨值會因而更受到不利影響。

2. 資料來源:高盛全球投資研究部、Wind、環亞經濟數據、美國財政部、彭博,截至2020年5月18日。美國的中國A股和香港上市股票持倉是根據美國財政部披露的數據估計。美國持有的美國上市中國股票是按美國機構投資者持倉總數,除以市場的上市股票總數而計算,而市場的上市股票總數建基於彭博的股票數據。

3. 資料來源:湯森路透DataStream、安聯投資,表現數據分別按MSCI中國指數及標普500指數由2017年1月20日至2020年4月30日累積表現計算。

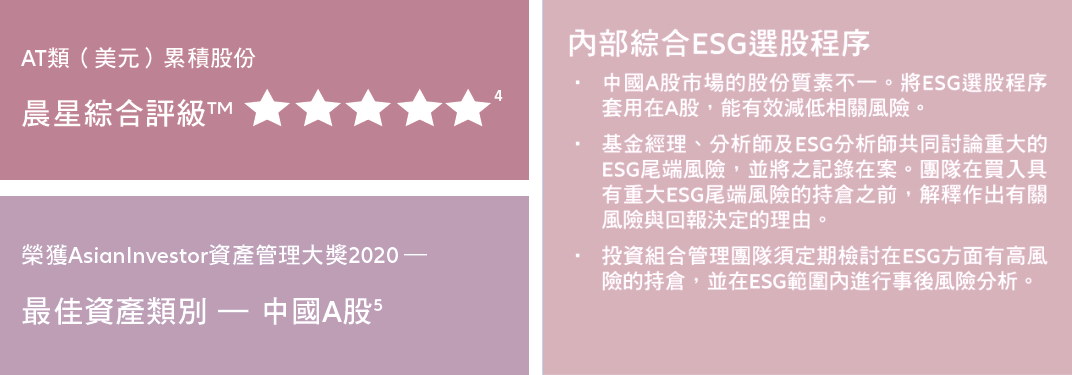

4. 資料來源:晨星,截至30/04/2020。© 2020 晨星(亞洲)有限公司(“晨星”)。版權所有。本文件內所提供的資料:(1)為晨星及/或其內容供應商的專營資料;(2) 不可複製或轉載;及 (3) 並未就所載資料的完整性、準確性及時間性作出任何保證。晨星及其內容供應商對於閣下使用任何相關資料而作出的任何有關交易決定、傷害及其他損失均不承擔任何責任。過往紀錄不代表將來表現。

5. 資料來源:AsianInvestor,獎項是根據由獨立的第三方提供研究統計數據。基金獎項是根據2018年第四季至2020年第一季的基金表現作參考。安聯環球投資基金–安聯神州A股基金於2019年10月23日與安聯環球投資機遇基金–安聯神州A股基金合併後推出。所示於合併日期或之前的表現資料按照與本基金有關股份類別的投資目標及風險水平相同,且費用架構及投資政策大致相同的安聯環球投資機遇基金–安聯神州A股基金有關股份類別的表現模擬計算。前基金(安聯環球投資機遇基金–安聯神州A股基金)成立日期:2009年3月。

全方位涵蓋 中港美三地中資版圖

摘要

在內地上市的A股、在香港上市的中資股、在美國以預託證券形式上市的中概股,三者各有特色,與其集中在任何一個單一市場,不如以全方位策略,一次過涵蓋中國投資版圖。

-

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

Some or all the securities identified and described may represent securities purchased in client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. The securities or companies identified do not represent all of the securities purchased, sold, or recommended for advisory clients. Actual holdings will vary for each client. BAT is a widely used acronym for three large cap tech companies in China: Baidu, Alibaba and Tencent.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP (Australian Registered Body Number 160 464 200) is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.