- The Fund aims at long-term income and enhanced return by investing directly and indirectly in global interest bearing securities.

- The Fund is exposed to significant risks which include investment/general market, investing in other underlying collective investment schemes and exchange traded funds, asset allocation, sovereign debt, creditworthiness/credit rating/downgrading, counterparty, interest rate changes, valuation, volatility and liquidity, and currency.

- The Fund may invest in financial derivative instruments (“FDI”) which may expose to higher leverage, counterparty, liquidity, valuation, volatility, market and over the counter transaction risks. The Fund’s net derivative exposure may be up to 50% of the Fund’s net asset value.

- This investment may involve risks that could result in loss of part or entire amount of investors’ investment.

- In making investment decisions, investors should not rely solely on this material.

Market Insights

- Major central banks are in monetary easing mode. The inflation risks that have built up in recent years are finally easing, but longer-term inflation uncertainty remains due to three structural factors — Deglobalisation, Demographics, and Decarbonisation.

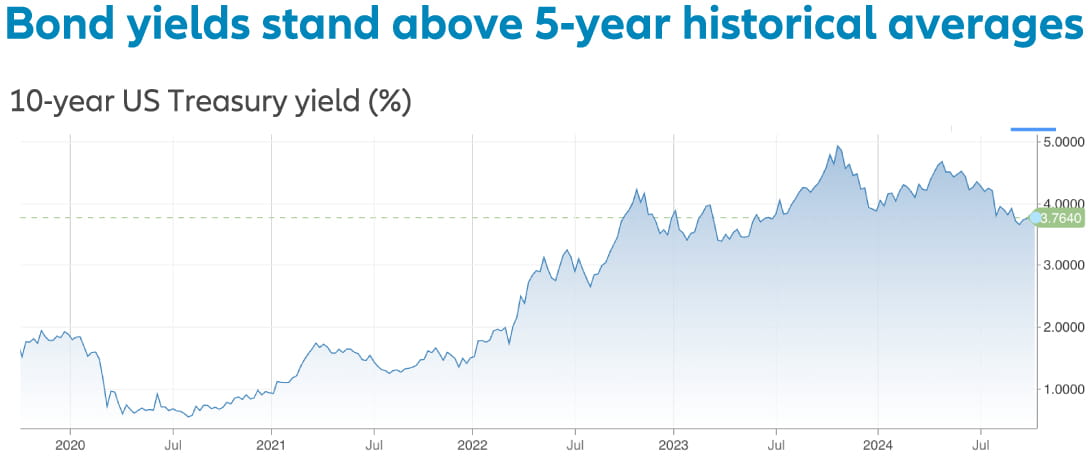

- The market has witnessed a slowdown in economic growth around the world. In the fourth quarter of 2024, with inflation pressures fading and major central banks starting the interest rate cutting cycles, the market focus has transitioned from inflation risk to growth risk.

- The prevailing soft-landing narrative will support risk assets into the fourth quarter of 2024. The US election and interest rate cuts by the Federal Reserve will also provide support for both fixed income and equity markets.

- However, we expect the market to gradually shift from a “buy the dip” to a “sell the rally” mentality as the medium-term picture becomes less clear. The uncertainty ahead warrants a prudent investment approach.

- Uncertainties surrounding economic growth, monetary policies and geopolitical developments present challenges for investors, yet also open up opportunities.

- As individual companies, sectors and economies embark on increasingly divergent growth paths, bond prices will likely develop in different directions depending on the securities’ ratings. Diversification, flexibility and active investing will therefore become increasingly important.

Fund Features

- The fund invests directly or indirectly in global interest-bearing securities and can flexibly allocate up to 5% of its NAV to global equities.

- With market expectations of ongoing monetary easing and softer macro data, sovereign bonds are expected to be supported.

- Investment grade corporate debt continues to provide a source of extra income in a context of generally strong corporate earnings, moderate default rate forecast and monetary policy easing.

- The fund is not bound by geographical limitations and can broadly invest across the markets of the United States, Europe and Asia, capturing a diverse range of income opportunities.

Source: IDS, as of 30 June 2024. The above analysis looks through the underlying fund and ETF holdings of the Allianz Yield Plus Fund.

The information above is provided for illustrative purposes only to demonstrate the Fund’s investment strategy, it should not be considered a recommendation to purchase or sell any particular security or strategy or an investment advice. There is no assurance that any securities discussed herein will remain in the Fund at the time you receive this document. Past performance is not indicative of future results. While best efforts are used in compiling the information, the company expressly assumes no warranty of any kind, actual or implied, for the accuracy, completeness and timeliness of the information.

Please refer to the offering document for further details.

- Adopting a diversified investment strategy, we invest in a range of fixed-income securities across various regions and bond types. This may include U.S. government bonds, Hong Kong government bonds, and bonds issued by listed or private companies. The portfolio maintains an average credit quality rating of AA^, which helps manage risk in navigating uncertain investment environments. Such a diversified fixed income portfolio creates potential income opportunities for investors.

- The fund may also invest in global equities (up to 5% of its NAV).

Source: Allianz Global Investors. During any given stage of the investment process, the selection criteria may vary from those shown above. The diagrams and statements above reflect the typical investment process applied to this strategy. At any given time, other criteria may affect the investment process. There is no guarantee that these investment strategies and processes will be effective under all market conditions and investors should evaluate their ability to invest for a long-term based on their individual risk profile especially during periods of downturn in the market.

- While the fund performance may be influenced by market fluctuations, its sensitivity to interest rate environment is relatively lower compared to typical long-duration bond funds, making it an alternative investment option.

- With robust experience in multi-asset management, we aim to control portfolio volatility at lower levels through active asset allocation and rigorous risk management.

¹Team data as at 1 July 2024. Multi Asset AUM include Overlay and Advisory SFDR: (EU) Sustainable Financial Disclosure Regulation. Information accurate at time of publishing.

AdMaster: 3944709

#Mox Bank Limited have teamed up with Allianz Global Investors Asia Pacific Limited (AllianzGI) to offer customers access to this fund. Mox Bank Limited is not affiliated with Allianz Global Investors Asia Pacific Limited.