It is also important to consider what, in general, are the key features of the various investment funds that are available to you. To what extent are they likely to provide capital growth or income? What are the main factors that drive their performance? How risky are they relative to other kinds of funds?

4 Steps to Investment

| Step 1 - Understanding Yourself as an Investor | Step 2 - Understanding Investment Choices |

| Step 3 - Choosing the Suitable Fund Mix | Step 4 - Regular Review |

Step 1 - Understanding Yourself as an Investor

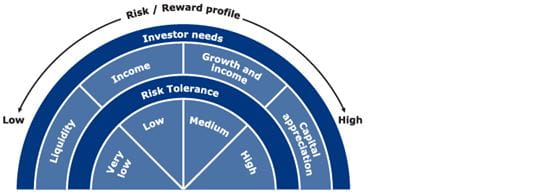

Before you start investing, it is important to understand what you want to achieve. What is your investment objective? Are you looking to achieve mainly capital growth or income or capital preservation? What is your investment horizon? Are you looking to invest for one year, three years, five years or over a longer period? What is your risk tolerance? To what extent are you prepared to endure capital losses or erosion of real wealth through inflation?

Learn more about...

Step 2 - Understanding Investment Choices

Step 3 - Choosing the Suitable Fund Mix

A successful investment strategy requires the right mix of funds. The selected fund options should match your main investment objectives and investor profile. Often the better outcome will involve several types of investment funds. By investing in a combination of different funds, you may reduce the overall level of risk through diversification: as one investment is performing badly, another investment may be performing well. The gains and losses are offset under normal circumstances, thereby reducing the risk.

Please click the image to view the enlarged version.

Generally, if an investor requires a higher potential return he must be prepared to expose himself to a higher level of risk.

Step 4 - Regular Review

Your investment needs may change over time and you should regularly review your financial situation and consider whether you need to change your strategy and fund investments. You might need to reassess your investment objective and your risk-taking level each time before choosing the investment strategy that meets your investment needs and then make changes to reflect your modified financial situation.