It is also important to consider what, in general, are the key features of the various investment funds that are available to you. To what extent are they likely to provide capital growth or income? What are the main factors that drive their performance? How risky are they relative to other kinds of funds?

investment-basics

4 Steps to Investment

| Step 1 - Understanding Yourself as an Investor | Step 2 - Understanding Investment Choices |

| Step 3 - Choosing the Suitable Fund Mix | Step 4 - Regular Review |

Step 1 - Understanding Yourself as an Investor

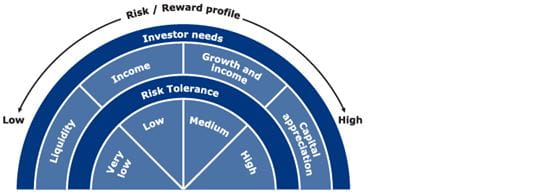

Before you start investing, it is important to understand what you want to achieve. What is your investment objective? Are you looking to achieve mainly capital growth or income or capital preservation? What is your investment horizon? Are you looking to invest for one year, three years, five years or over a longer period? What is your risk tolerance? To what extent are you prepared to endure capital losses or erosion of real wealth through inflation?

Learn more about...

Step 2 - Understanding Investment Choices

Step 3 - Choosing the Suitable Fund Mix

A successful investment strategy requires the right mix of funds. The selected fund options should match your main investment objectives and investor profile. Often the better outcome will involve several types of investment funds. By investing in a combination of different funds, you may reduce the overall level of risk through diversification: as one investment is performing badly, another investment may be performing well. The gains and losses are offset under normal circumstances, thereby reducing the risk.

Please click the image to view the enlarged version.

Generally, if an investor requires a higher potential return he must be prepared to expose himself to a higher level of risk.

Step 4 - Regular Review

Your investment needs may change over time and you should regularly review your financial situation and consider whether you need to change your strategy and fund investments. You might need to reassess your investment objective and your risk-taking level each time before choosing the investment strategy that meets your investment needs and then make changes to reflect your modified financial situation.

Dollar Cost Averaging

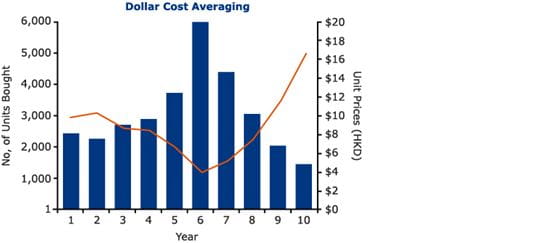

Dollar cost averaging is a technique designed to reduce market risk through regular investments at predetermined intervals and set amounts over time. By buying a fixed dollar amount of a particular investment on a regular schedule, regardless of the share price, investors can purchase more shares when prices are low and fewer shares when prices are high. Consequently, the impact of short-term market fluctuations on an investment can be mitigated and the costs of units purchased are averaged out.

This chart shows that if you invest HKD2,000 per month for 10 years, you buy more units when the price is low and fewer units when the price is high.

Hypothetical Example (Please click the image to view the enlarged version)

| Dollar Cost Averaging | Lump Sum Investment | |

| Rate of Return (per annum) |

8% | 5% |

| Monthly Contribution | $2,000 | - |

| Total Investment | $240,000 | $240,000 |

| Average Unit Cost |

$7.83 |

$10 |

| Total Investment Value at Period End | 30,645 | 24,000 |

| Total Investment Value at Period End | $520,965 | $408,000 |

According to the table, at the end of the period, the value of the total number of units bought is HKD520,965. This represents an annual rate of return of 8%, which amounts to returns almost 48% higher over the full 10 years when compared with a lump sum investment at the start of the period.

The above information used is for illustrative purposes only and are not indicative of any fund performance and the actual returns likely to be achieved by the investor.

Frequently Asked Questions

Q1. How do mutual funds work?

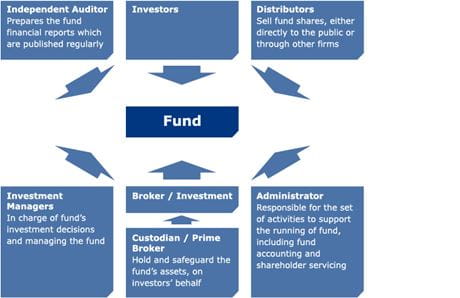

Answer: A mutual fund pools money of many individual investors and a professional fund manager invests this pool of money in a wide range of investment instruments. Investors hold shares or "units" in the fund. The number of units an investor holds is based on the amount of money he or she invests. Fund unit is priced according to the value of the fund's investment at the close of the previous day.

Q2. What are the common investment instruments mutual funds invest in?

Answer: The most common investment instruments a mutual fund can invest in are - stocks, bonds and cash (e.g. bank deposits) all over the world. Some funds may also invest in derivative markets, such as futures and options markets.

Q3. How does investing in mutual funds benefit me?

Answer: It makes investing easy for you - once you decide which funds to invest in, you leave the day-to-day investment decisions to the professional managers. They not only take care of the complex and demanding tasks of market and investment instrument research but also the time-consuming administration work, like stock settlements. You can achieve asset diversification and benefit from high growth potential, as professional fund managers work for you to identify the best investment opportunities worldwide. A unit trust or fund generally invests in 50 to 100 different securities, often covering several different asset classes and/or individual national markets at once. This diversifies your investment a lot more efficiently than you can on your own.

Q4. Does investing in mutual funds mean that I give up control of my money?

Answer: No. You always have control of your investment. Firstly, it is your decision to invest in a specific fund and you make that decision based on your investment objectives. Secondly, you can always sell your units or switch to other funds on any dealing day.

Q5. Are there any mechanisms for mutual funds to control risks?

Answer: Basically, managing risk can be achieved in two ways – asset allocation and diversification. Different asset classes do not perform in the same way under different economic circumstances and mutual funds allow you to invest in different asset classes at once. For instance, high quality bonds might do well when stock markets are falling. Investing across shares, bonds and cash reduces portfolio risks and affords high potential return and relative stability. Other than diversifying across asset classes, a mutual fund also achieves diversification by investing in many different securities (usually 50 to 100) and different geographic markets. In this case, poor performance in one securities and one market does not do as much damage to the fund as it would if the entire portfolio is comprised of only a few securities from the same market.

Q6. What criteria should I consider when choosing a fund management company?

Answer: We believe a good fund management company should have the following qualities: market recognition, extensive global investment resources, proven performance track record, and strong customer focus with products and services tailored to clients' needs.

Q7. When is a good time to invest?

Answer: We believe the best way to invest is to start early and to take a long term and disciplined bottom-up investment approach with the focuses on earning growth and corporate fundamentals. In this sense, any time is a good time to start investing. The earlier you start, the earlier you benefit from the power of compounding effect. Remember, short-term volatilities in the market are hard if not impossible to predict.

Fund Investment Basics

Mutual Funds

Mutual funds, or unit trusts, are a pool of money from a number of investors. You are essentially able to buy a small stake in the mutual fund's underlying assets. By investing as a group with other investors, you may access a larger and more diversified pool of assets than you would as an individual.

Because the various expenses of investing (such as brokerage commissions, custodian's fees etc.) are spread over a larger pool of assets and effectively shared with all the other investors, mutual funds may provide you with a cost effective investment solution.

Another key benefit of mutual funds is that it is professionally managed. You have access to the same expertise as a large institutional investor. Your minimum investable money need only be a few thousand dollars, or even less.

Equity Funds

These focus mainly or exclusively on stock market investments, looking to achieve capital appreciation over the long term. Most equity funds seek to achieve defined capital growth objective in particular ways. Some focus on one particular stock market – such as Hong Kong. Others will invest in stock markets throughout a particular region of the world – such as the Asia Pacific – or worldwide.

Sometimes equity funds will be defined by the sort of companies that they invest in, rather than the part of the world that they are focusing on. Growth stocks, for instance, are investments in companies whose businesses and earnings are likely to expand at a relatively rapid rate. Value stocks, by contrast, are investments in companies that may pay attractive potential dividends and in turn appear to be cheap in terms of the valuations.

Bond Funds

Bond funds tend to focus mainly on fixed income investments, looking for long term capital appreciation and income. Many bond funds can and do provide some capital growth, and they are normally less risky than equity funds.

Bond funds are usually defined by the part of the world in which they invest, or the type of bonds in which they invest in. For instance, they may focus on government bonds. Alternatively, they may invest in corporate bonds, which are issued by large companies.

Most bonds are assessed for riskiness by major ratings agencies such as Standard & Poor’s or Moody's. Some bonds are seen by the agencies as being sufficiently risky that they are "below investment grade". Such bonds usually include high yield bonds and emerging markets debt.

Multi-asset Funds

Multi-asset funds combine a stock component, a bond component and, sometimes, a money market component, in a single portfolio. They look for a mixture of potential income and modest capital appreciation.

Cash or Liquidity Funds

Cash or liquidity funds are the least volatile of mutual funds. They invest in bank deposits and, sometimes, short-term bonds of very high quality. They usually carry no risk of capital losses, but offer no prospect of capital gain. Returns to investors come entirely from interest income.

Cash or liquidity funds are often attractive to investors who are very risk averse. Whilst they can also be useful as a place to park spare cash for a short period, it is not same as placing monies on deposit with a bank or deposit-taking company.

Diversification

Investing in funds provide you with the ability to build an enormous variety of portfolios. It is possible to spread your investments across stocks, bonds or cash or liquidity – or across a number of countries/locations, industries and sectors.

This diversification may reduce risk level, reduce volatility and increase the likelihood that your investments may produce a steady potential return over time.

By using mutual funds, you can build an investment portfolio that matches your investment objectives, risk tolerance and personal financial situation.

Fund Structure

Please click the image to view the enlarged version.

* It may vary from fund to fund.