Growth. The China Way.

China: taking the long view

Summary

China’s regulatory crackdown on “big tech” does not alter its strategic goals. It will continue opening up and global investors will likely keep increasing their China allocations. What long-term lessons can investors take away from this period?

Key takeaways

|

When China passed a strict data privacy law in August 2021, it was just the latest sign of an intensifying crackdown on “big tech”. Before this effort to address social concerns such as safe-guarding citizens’ data privacy, the government made many other market-moving proclamations. In fact, since November 2020, when the Ant Group IPO was pulled just before listing, the government has made approximately 50 announcements that impacted the share prices of China’s offshore companies listed in New York, many of them the big internet and ecommerce companies.

While unsettling for international investors, we do not believe this correction is a game-changer that means investors should reconsider their view of China. The recent regulatory blitz is a reaction to emerging social problems like the low birth rate and social inequality, the growing influence of big tech during the pandemic, and ongoing tensions with the US. But in our view, it does not lessen the country’s commitment to opening up to the foreign investment that will be critical to its growth ambitions.

Big tech in China: from hero to zero

The Chinese government’s overriding policy goals – stated in its 14th Five-Year Plan (2021-2025) – remain to foster high-quality growth, innovate in science and technology, and uplift its citizens’ livelihoods. What’s changed is that rather than viewing the internet and other new economy sectors as national champions of innovation, policymakers increasingly view big tech as a source of social problems, and the root of many financial and security risks.

To judge what’s likely to happen from here, it’s best to view the situation through the lens of the Chinese government:

- Policymakers want to encourage capital markets to invest less in consumer internet services and more into high-tech manufacturing. This reflects an ongoing policy focus on self-sufficiency, industrial upgrades and carbon neutrality.

- More broadly, China is engaged in an ongoing effort to reduce reliance on Western economies, especially the United States. It is no coincidence that resources are being poured into research and development across areas including artificial intelligence (AI), semiconductors, robotics, energy storage, gene sequencing and blockchain.

But China still needs foreign capital to fuel its industrial growth. So although access to capital through US listings seems likely to stop – at least for future listings – the domestic capital markets are set to become more important than ever. This indicates that the government will want to reduce volatility in local equity and bond markets, which leads us to expect that the tone and intensity of the regulatory intervention will soften.

The US and EU were already focused on regulating big tech

Investors may also find some reassurance in the fact that China is not the first country to try to rein in big tech. Regulators in the US and EU were already focused on tech giants’ size, alleged anti-competitive practices, control of consumer data and so on. The big difference is that China’s political and governance system allows it to act faster.

In fact, to some extent, Chinese regulators were behind the curve before the crackdown started with the suspension of Ant’s IPO. Ant’s fintech model, for example, was regulated in an extremely light-touch way in comparison to the traditional banking system. China’s recent changes, therefore, are partly about catching up.

Unlike the West, however, China frames its tech crackdown as an effort to preserve financial and social stability. The official slogan – “prevent the disorderly expansion of capital” – was first used in December 2020 and has become a key policy priority. The government is concerned about tech companies growing so influential that they distort market outcomes. Officials are also worried about the wealth and power accumulated by the billionaire founders of these tech firms.

Beyond big tech, China is focused on addressing social issues

China has also been taking action to address social problems at home – as have policymakers in the US and EU. But China’s recent efforts to reform its education sector have been quite forceful, given the extent of the social issues China is trying to address:

- For years, China’s education system has been almost entirely dependent on the results of standardised tests, creating a culture of almost endless homework and test preparation in schools – including widespread use of paid tutoring outside school to achieve an edge.

- China has also been turning out legions of students capable of rote memorisation, rather than the creative minds needed to achieve global leadership.

- This has made it harder for children of poorer families to compete academically with richer ones, contributing to longer-term problems with economic inequality.

With so many social issues at stake, the writing was on the wall in March 2021 when President Xi Jinping called the tutoring sector “a chronic disease that is very difficult to cure”. As such, it wasn’t a total surprise to see the government crack down on after-school education companies. But we do not see this as part of a broader attack on the private sector or on capitalism, per se. Rather, it comes in the context of education being seen as a public good given China’s social challenges. So although class is over for many of China’s tutoring firms, and there is still potential for reforms in other sectors, these seem unlikely to challenge the viability of whole business models.

US-China tensions are having little impact on China’s domestic capital markets

Despite the fact that regulators in the US and China are addressing some similar problems, the countries still have major differences. In fact, poor US-China relations are bringing US capital raisings to an end. The Chinese government has announced that it will review the use of Variable Interest Entity (VIE) structures, which Chinese companies commonly use to raise money from foreign investors. We believe that China will block VIE listings in the US, but we think it’s unlikely that they would be outlawed for existing companies. Further, it’s probable that VIE listings will continue in Hong Kong H-shares, given China’s need for foreign capital to meet its strategic objectives.

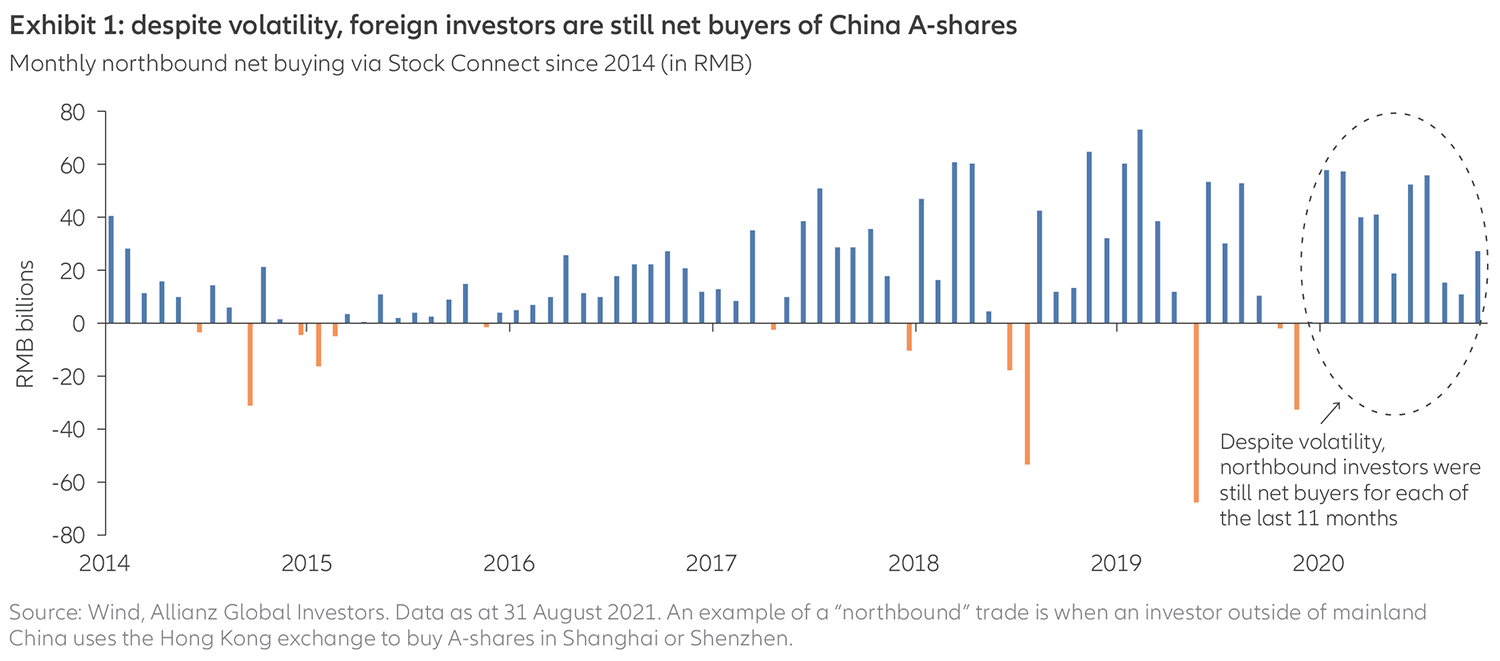

Despite the negative news flow, global investors have continued to add to China A-shares (see Exhibit 1 on next page). In July, foreign investors bought a net USD 1.6 billion of China A-shares through the Stock Connect scheme. At the time of writing, flows into China A-shares were also positive in August 2021. This is the ninth consecutive month of positive flows, as buyers raise their structural asset allocation to China. Although down on previous months, it suggests a “buy the dip” mentality.

What’s more, the currency and fixed-income markets have been stable in contrast to other periods of uncertainty. The renminbi and domestic bond markets have even trended higher at certain points.

Reflecting that the focus of the government’s new regulations is quite narrow, there has been a contrast between the stability of China A-shares and sharp falls of offshore companies listed in Hong Kong and the US – typically internet, ecommerce and education stocks. Notably, the MSCI China is down about 14% year to date, through the end of August 2021. However, the onshore A-shares market is up slightly, returning around 1% during the same time period. This indicates that the volatility has been largely confined to big tech and education.

Looking forward, we believe that the domestic A-share market stands to benefit from the challenges facing the offshore market, especially Chinese companies listed in the US. It will be an even more important source of funding for the country’s long-term economic development, and will become more diverse, with greater liquidity. Indeed, it was noticeable how state-owned media recently posted supportive comments about mainland equities after bouts of weakness in A-shares.

Our perspective: investors should take the long view on China

Looking to the longer term, we do not believe that the current crackdown will lead to a structural de-rating of Chinese equities due to a rising risk premium. The internet sector is a big part of offshore equities, so weakness in this sector will inevitably have some impact on the overall market valuation. But the domestic A-shares market has continued to be resilient – as shown by the strong foreign investor flows previously discussed.

In our view, international investors should continue to consider increasing their structural allocation to Chinese equities. We also suggest viewing China as a standalone allocation, rather than part of an existing emerging markets investment. Look at it this way: the Chinese economy accounts for 16% of global GDP and its domestic A-share market represents more than a fifth of global equities trading. By contrast, the MSCI All Country World Index (ACWI) gives only a 5% weighting to China. That’s a big gap to close.Furthermore, many companies in the regulators’ sights are large corporations with significant, profitable businesses, and they are likely to continue to grow successfully over the longer term.

In the assets we manage on behalf of our clients, our approach to China has largely remained unchanged throughout this volatility. In fact, we have taken the opportunity of market weakness to initiate several new positions. Yet key themes in our portfolios remain in line with where we see sustained growth potential and continued government policy backing. This includes sectors linked to China’s need for self-sufficiency (semiconductors), industrial upgrades (robotics) and lower carbon emissions (renewable energy and electric vehicle supply chains).

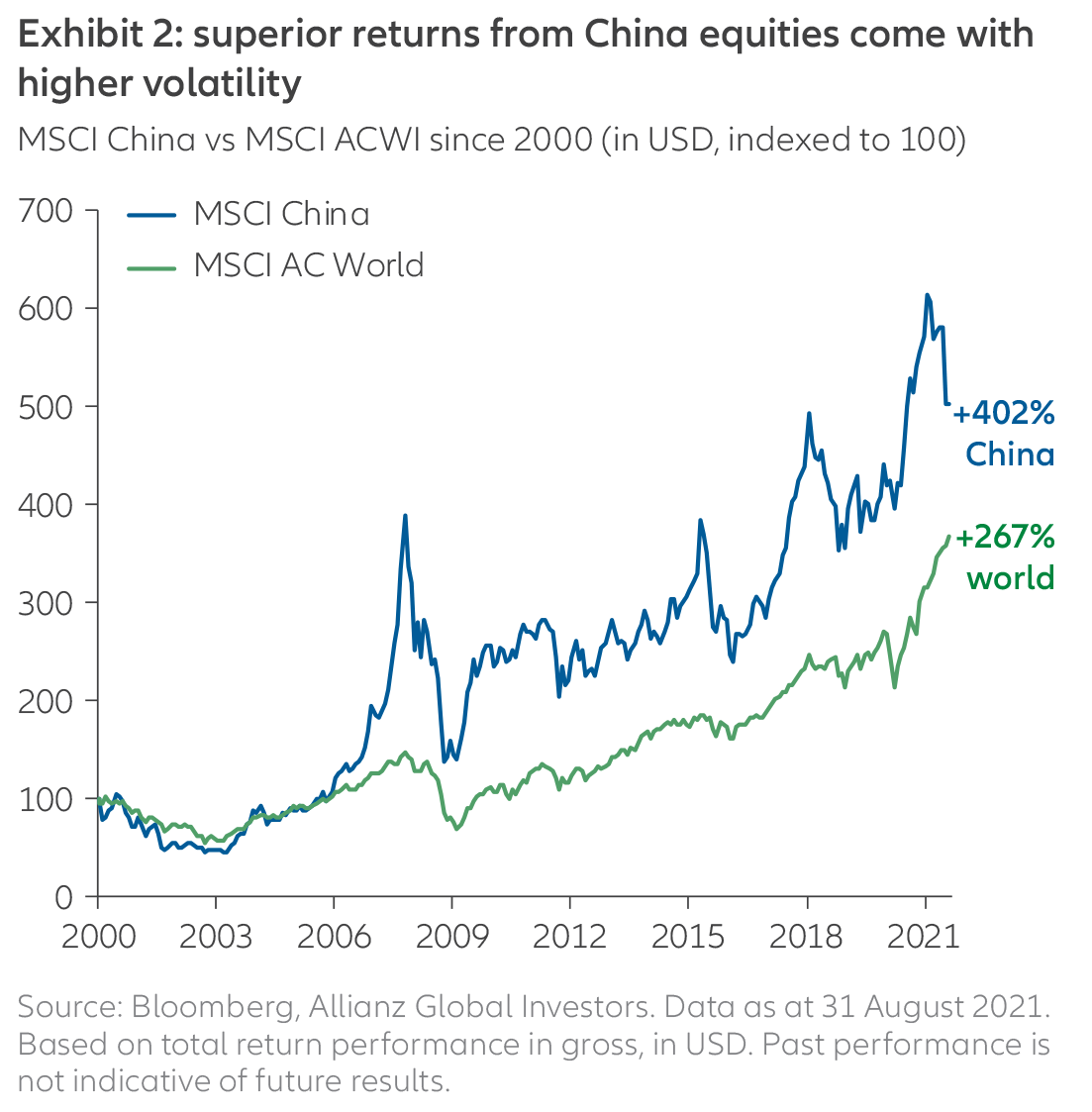

Overall, our perspective is that investing in China brings different risks and greater unpredictability compared with Western markets, but investors have historically been rewarded with long-term outperformance. Indeed, as Exhibit 2 shows, a 20-year investment in China equities to the end of August would have generated a 402% return, against 267% for global equities. In the past, moments of volatility like this have proved to be buying opportunities.

MSCI All Country World Index (ACWI) is an unmanaged index designed to represent performanc e of large- and mid-cap stocks across 23 developed and 24 emerging markets. MSCI China Index is an unmanaged index that captures large- and mid-cap representation across approximately 85% of the China equity universe. Investors cannot invest directly in an index.

7 reasons to stay invested in China equities

Summary

Although recent news out of China has understandably unsettled the markets, we don’t think it changes the long-term investment case. Volatility goes hand in hand with China’s higher long-term return potential. Understanding the dynamics at play can help make these changes easier to take in stride.