Five key themes in China A-shares

Summary

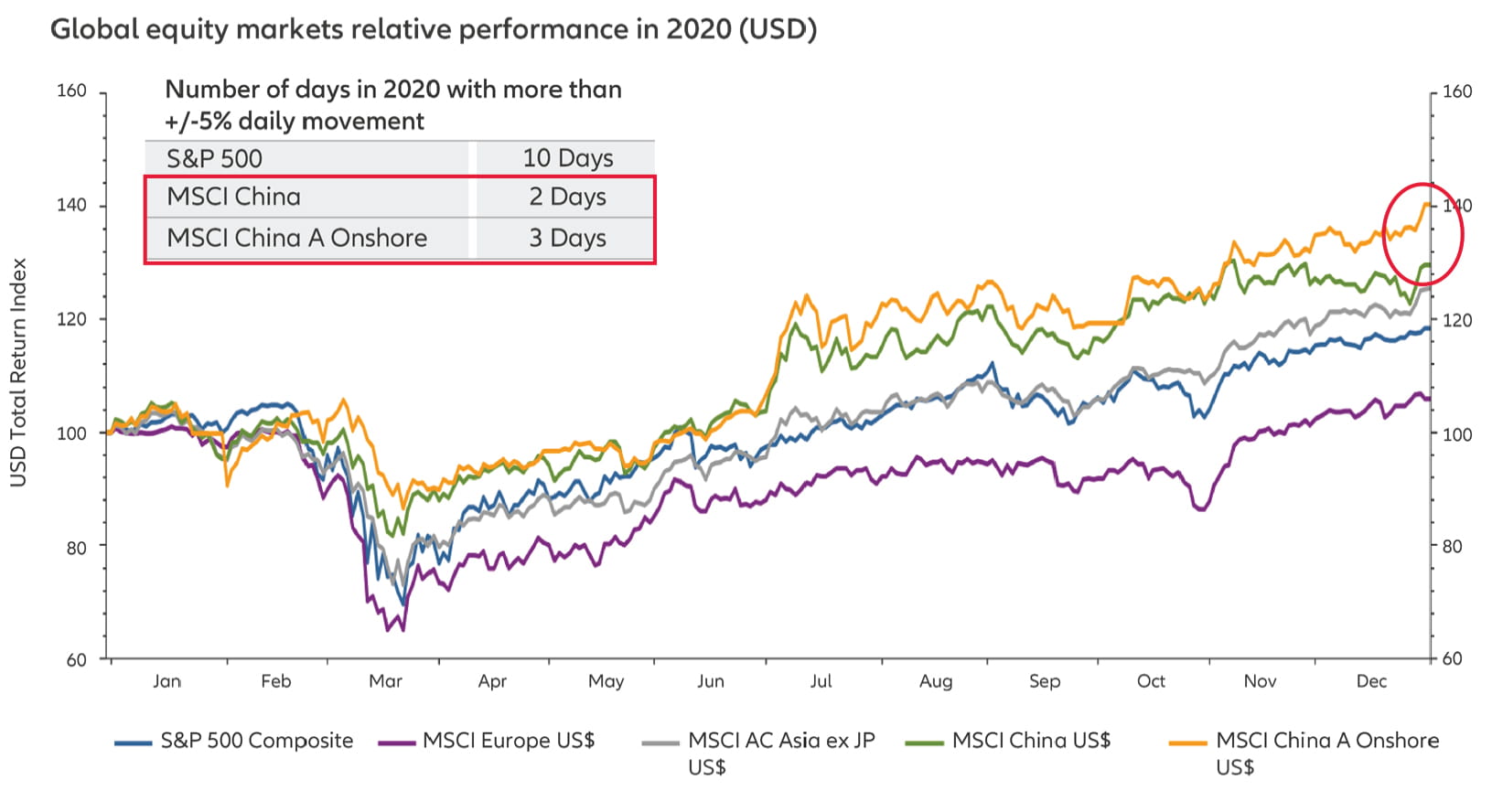

Chinese equities caught investors by pleasant surprise last year. Compared with other global markets, China remained resilient despite the pandemic hit at the beginning of the year. It even showed significant growth in the subsequent rebound, outperforming equities in Europe and the U.S. for the whole year.

Looking ahead to 2021, we’re expecting high single-digit growth in China’s GDP as most economic activity has resumed, which will also contribute to the recovery in corporate earnings. Under this backdrop, the five key themes below are worthy of investors’ attention.

-

While the pandemic situation is still severe in other parts of the world, China has been doing a better job in the fight against the pandemic. The difficulties and hurdles for people in China to travel abroad actually benefits local tourism, which favours duty-free shops and hotels.

-

Infrastructure projects continue to support economic growth and drive demand for machinery in China. Furthermore, under the policy of “internal circulation,” the market share of local component manufacturers is expected to increase.

-

As the population ages, healthcare expenditure will continue to increase. We believe the prospect for the medical and biotechnology sectors is attractive, especially in offshore markets such as Hong Kong.

-

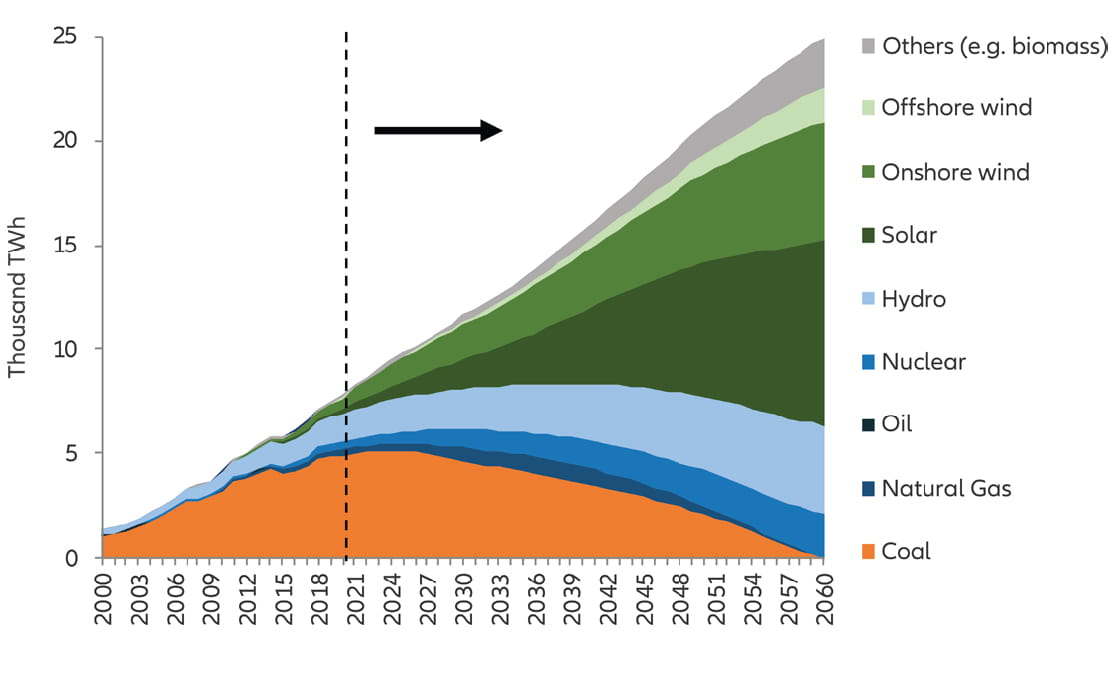

The Chinese government is committed to carbon neutrality by 2060 by promoting the development of new energy sources. As the cost of solar energy declines gradually, it is expected to reach grid parity this year, which greatly enhances the competitiveness of the sector. The new energy and electric vehicle sectors will outstrip the traditional fossil fuel-related industries becoming the winners in the sustainability theme.

-

Last but not least, China’s latest five-year plan focuses on “internal circulation” and technology, therefore technological innovation sectors such as semiconductors, 5G and new energy industries will be in favour.

After the market rally last year, the P/E forecast for the MSCI A-share index is now around 17 or 181, which is one standard deviation higher than the historical average (14). Has the factor of economic recovery been reflected in the equity market? Undoubtedly, the price of A-shares will remain high in the short term, but investors do not need to be overly worried about the valuation, because the market is supported by corporate earnings. Also, China’s economy continues to show stable growth, which will be able to support higher valuations.

In addition to the A-share market, investors may also expand their investment landscape to seize other opportunities across the whole array of Chinese equities, meaning they could consider investing in China A-shares, as well as Chinese ADRs listed in the U.S. and stocks listed in Hong Kong in one shot. As global liquidity remains abundant and the valuation of H-shares is slightly lower than that of A-shares, Chinese capital has been flowing into Hong Kong shares in recent months and become a new driving force in local financial markets.

In short, the Chinese stock market has shown its strength with greater resilience and lower volatility last year as compared to other global markets. With China effectively controlling the pandemic, the economy continues to improve, which stimulates corporate earnings to grow continuously and creates more investment opportunities. However, due to the fast-paced sector rotation in the A-shares market, leading industries may fall behind rapidly. Therefore, it is important to employ active management and be nimble in capturing the opportunities and managing risks.

Information herein is based on sources we believe to be accurate and reliable as at the date it was made. We reserve the right to revise any information herein at any time without notice. No offer or solicitation to buy or sell securities and no investment advice or recommendation is made herein. In making investment decisions, investors should not rely solely on this material but should seek independent professional advice. Investment involves risks, in particular, risks associated with investment in emerging and less developed markets. Past performance, or any prediction, projection or forecast, is not indicative of future performance. Investors should read the offering documents for further details, including the risk factors, before investing. This material and website have not been reviewed by the Securities and Futures Commission of Hong Kong. Issued by Allianz Global Investors Asia Pacific Limited.

10 things to know about China equities

Summary

Once largely out of reach to foreign investors, China’s equity markets have opened up as the country’s economy transforms. From Shenzhen and Hong Kong listings to the Nasdaq-like STAR board, Chinese companies are attracting significant investor capital. Here’s what you need to know.