Two-Minute Tech

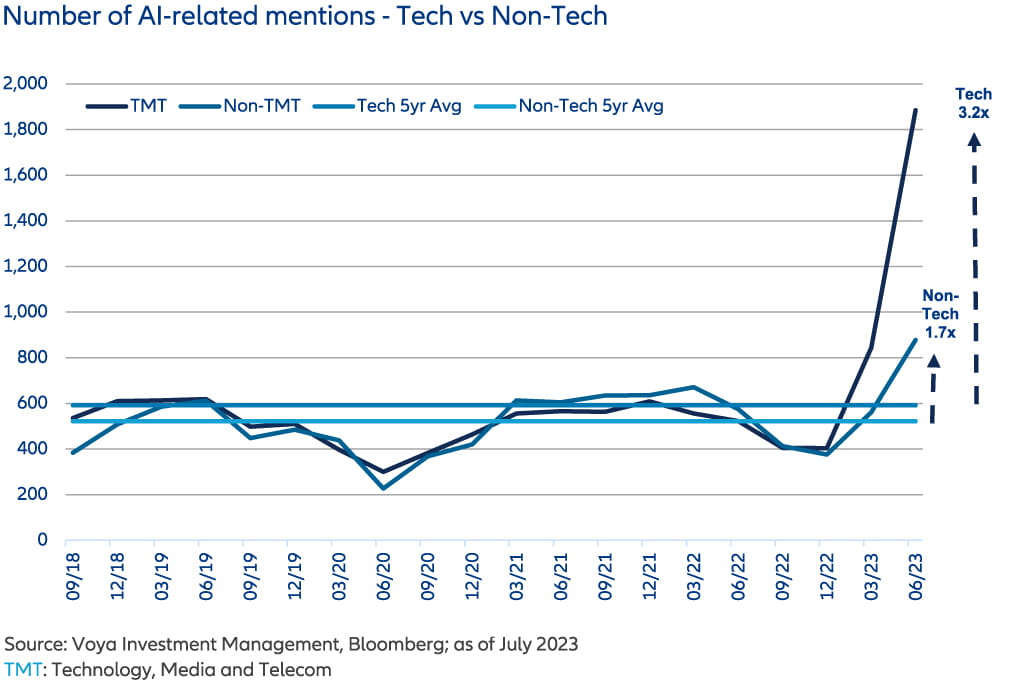

Company mentions of artificial intelligence and related topics on quarterly earnings calls has inflected following the public release of OpenAI’s ChatGPT large language model at the end of 2022.

Key takeaways

- A massive increase in mentions of Artificial Intelligence (AI) and related topics on quarterly earnings calls since the public release of OpenAI’s ChatGPT large language model at the end of 2022 reflects the fast-paced advancement of Generative AI systems and their growing cross-sector relevance

- While, thus far, companies driving the AI conversation are well-established technology leaders, it is expected to steadily expand also among non-tech industries

- Longer term, the conversation around AI is expected to continue at an elevated level with management teams providing more details regarding their plans to integrate AI in their operations and launching new AI-enabled products

Merits a mention: AI conversation at an inflection point

Company mentions of artificial intelligence and related topics on quarterly earnings calls has inflected following the public release of OpenAI’s ChatGPT large language model at the end of 2022. Through the three months ended 30 June 2023, which include the calendar first quarter earnings release period, total company mentions of AI-related topics increased nearly 2.5x from the five-year average.

Who is talking about AI and what are they saying?

Understandably, the companies driving the conversation are well-established technology leaders the likes of NVIDIA, Microsoft, and Adobe. These companies’ management teams have made bold pronouncements and predictions related to the impact of AI advancements on their businesses and society:

“A trillion dollars of installed global data center infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process” – Jensen Huang, NVIDIA CEO 1

"Next generation of AI will unlock a new wave of productivity growth, with powerful copilots designed to remove the drudgery from our daily tasks and jobs, freeing us to rediscover the joy of creation” – Satya Nadella, Microsoft CEO 2

“Generative AI in the creative space is going to augment human ingenuity…the winning companies are those who recognize that there’s a complete workflow associated with it” – Shantanu Narayen, Adobe CEO 3

Thus far, technology companies have been more vocal regarding their views on the latest in AI developments with mentions on quarterly conference calls increasing 3.2x from the five-year average. Meanwhile, non-technology companies have also increased their mentions of AI though not at the same level as their tech counterparts.

We expect the AI conversation to steadily expand among non-tech industries as these companies explore and adopt the latest developments in the space, particularly those around Generative AI. Executives from sector leaders such as JPMorgan and Eli Lilly have articulated their views on how Generative AI and other AI technologies could impact their respective industries.

“AI is real. This is a technology which is staggering…we’re already using them to do risk, fraud, marketing, prospecting and it’s the tip of the iceberg.” – Jamie Dimon, JPMorgan CEO4

“We’re using generative AI to help our scientists identify new molecules that could lead to new medicines…discovering different ideas than typically appear to the human mind” – Dave Ricks, Eli Lilly CEO5

What’s next in the AI discussion?

We expect the conversation around AI to continue at an elevated level and we look for management teams to provide more details regarding their activities in that space. We anticipate companies will highlight their plans to integrate AI in their operations as well as launching new AI-enabled products.

For instance, Microsoft will soon expand the availability of their Generative AI-enabled 365 Copilot which automates activities in the Office 365 suite. We believe the 365 Copilot will be the first of many such products launched with the potential to accelerate growth and productivity across sectors.

Longer-term, we expect investments by non-technology companies in the latest AI tools such as large-language models and Generative AI to yield significant productivity enhancements. The breadth of applicability and transformational potential will necessitate coordination between private and public entities to ensure the safety and reliability of these new tools, in our view.