Achieving Sustainability

Water in 2023 – is history repeating or just rhyming?

Dry weather patterns and historic low water levels showcase the urgency to ramp up investments in providers of water resiliency solutions.

Key takeaways

- The current winter droughts and overall dry weather patterns across Europe and beyond showcase the urgency in tackling water scarcity, water quality and water availability issues.

- Governments globally will be forced to address and mitigate the effects of climate change on water availability and accessibility to maintain their nations’ standards of living.

- Solving this puzzle will require joining forces with the private sector, creating a supportive business environment for the solution provers.

2022, an eventful year for the Water theme

Record droughts across Europe, floods in Australia, record high temperatures in India in April and forest fires around the world. Monsoon floods submerging one-third of Pakistan, devastating the agriculture sector, and displacing 8 million people. A third consecutive year of a La Niña weather pattern for the Horn of Africa, bringing parts of Somalia to the verge of famine for the second time this century.1

These have all been harbingers of a fundamental change in the world’s climate, the consequence of global warming – with farreaching implications for the global economy as well which seems not well-prepared for the challenges to come.

The implications can take their effect in unforeseen places. Low water levels on rivers have thus halted traffic and driven up shipping costs. Shortages in fresh water might affect the farming industry which with 70% of water use2 represents the largest consumer of water globally, putting further pressure on already high food prices. Low water levels might also lead to lower contribution from nuclear power stations and hydropower plants pressuring energy prices.

During the winter of 2022-2023, Europe and several other regions in the world faced severe drought conditions, quite an unusual phenomenon for the wintertime. Europe’s major waterways like the Po and the Rhine experienced record-low water levels already in midwinter. Countries such as Spain, Portugal, Italy, and Turkey experienced low levels of rainfall, leading to decreased water supply for agriculture and urban use. The drought also affected hydropower production, contributing to increased electricity prices and the need for alternative energy sources. The lack of snowfall in the Alps will lead to lower snow smelting in spring and summer for countries like France, Switzerland, and Italy. Here, the Snow Water Equivalent (SWE, a measure that indicates how much liquid water is stored in the snow), as of end of January 2023 showed a deficit of 35% compared to the average SWE of the past ten years.3 Considering that around 60% of the water flowing in Italian rivers derives from melted snow, low snow levels can be harbingers of an impending new drought season.

Examples of countries and regions where droughts were severe or ongoing and are causinghavoc and creating further pressure:

France:

Italy:

Spain:

Regional focus: Catalonia

Since the beginning of March 2023, nearly 6 million Catalans in 224 municipalities have been affected by severe water restrictions imposed by the Government of Catalonia due to dramatically fallen water supplies.14

These new water-saving measures comprise:

- A reduction of 40% for agricultural water uses

- A cutback of 15% for industrial water uses

- A limitation of 230 liters per day for inhabitants

- The prohibition of watering of parks and gardens (both public and private) unless watering is done by drop irrigation or with watering cans.

Turkey:

Reports have shown that Turkey is experiencing one of its driest winters on record, with many regions receiving only a fraction of their usual rainfall. This has led to concerns about potential droughts and water shortages, particularly for farmers who rely on irrigation to grow their crops.15 The government is taking measures to address the situation, including promoting water-saving techniques and investing in infrastructure to improve water management16. However, experts warn that more needs to be done in order to ensure long-term water security, such as reducing water waste and improving efficiency in agriculture. The urgency of such measures becomes apparent when one considers that 43.6% of the overall water input volume is considered Non-Revenue Water (NRW), i.e., water that is produced and lost due to e.g., leaks, broken pipes, inaccurate water metering or illegal tapping.17

Horn of Africa:

The Horn of Africa is facing drought trends worse than those witnessed during the 2011 famine, during which hundreds of thousands of people died18. Most affected are Ethiopia, Kenya, Somalia, and Uganda. The Horn of Africa is home to the so-called water tower of Africa, located in the Ethiopian highlands. This region also contains the Grand Ethiopian Renaissance Dam (GERD), Africa´s biggest infrastructure project and, with 6,000 MW, the largest hydroelectric power station in Africa19.

This hydropower project on the Blue Nile River has let to recurrent tensions between Ethiopia and its down-river neighbor Egypt, which relies on the Nile’s water flow for agriculture and energy production. While Ethiopia claims the dam to be an existential necessity, Egypt considers GERD to be an existential threat to its water security. Current drought patterns in the region may exacerbate the geopolitical tensions existing between the two nations, and be a portent for future conflicts around water.

Increasing need for water-related investment spending

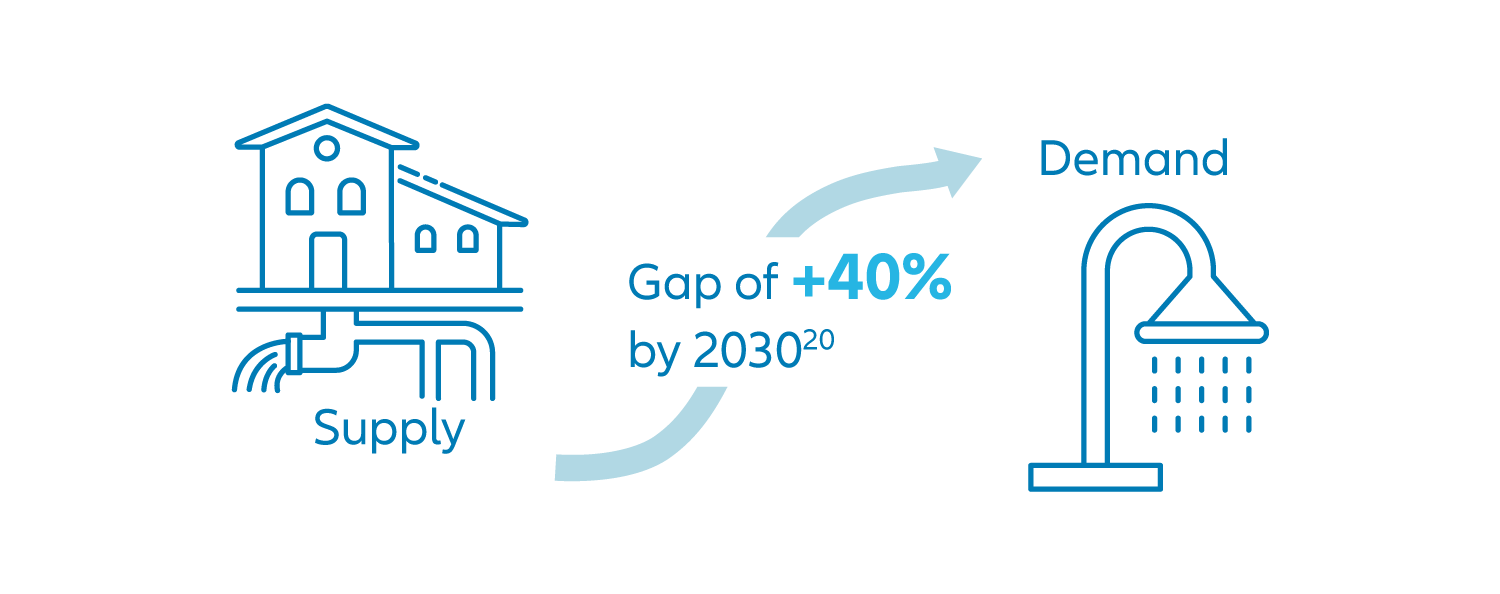

Water-related issues continue to make headlines as the mild but dry European winter turns to spring. Investments in water-related infrastructure have come back into investors’ focus and are rising on political agendas. We therefore believe that water remains a secular growth opportunity for investors. To maintain our living standards and deal with the challenges of climate change, it is crucial to consider and increase targeted investments along the entire value chain of the water industry, as the imbalance between supply and demand continues to grow from current levels.

The good news is that water spending is on the rise globally, and governments, corporations and farmers alike have begun to realize the need for urgent capital expenditure. Another good news is that quick wins like fixing leakages or reducing water waste are feasible everywhere, with comparatively little effort. The companies which deliver the required solutions for such resiliency issues are in many cases well-known. One of the largest producers for farming equipment reported strong increases over their first quarter which can be viewed as a bellwether indicator for the entire farming equipment sector.

Given the sound fundamentals of the companies in the water sector, and more interesting valuation levels, the overall outlook for water investments is quite compelling in our view. Recent M&A activity in the sector is another indicator for sound business expectations over the mid-term. Individual corporate profits will play a particularly important role over the months to come, are likely to create a favourable scenario for active managers. Overall, we believe that market participants will increasingly differentiate between “winners” and “losers” at the stock, sector, and country level and that an active theme and stock picking approach will be useful. At the same time, many market valuations are much more attractive than a year ago.

We therefore see opportunities for investors in companies that actively provide quality and resiliency solutions to water scarcity and water quality issues, and which help to improve the sustainability of water resources.

1. UNHCR Impact of Drought on Protection in Somalia, October 2022

2. https://www.oecd.org/agriculture/topics/water-and-agriculture/

3. https://www.rinnovabili.it/ambiente/cambiamenti-climatici/livelli-nivologici-alpi/

4. https://www.ifw-kiel.de/fileadmin/Dateiverwaltung/IfW-Publications/Saskia_Moesle/KWP_2155_low_water_econ_activity.pdf

5. https://www.destatis.de/EN/Press/2022/08/PE22_N053_463.html

6. https://www.cleanenergywire.org/news/catastrophic-winter-drought-france-bodes-ill-europes-power-production-2023

7. Ibd.

8. https://www.euronews.com/2023/02/25/macron-says-it-is-the-end-of-water-abundance-as-he-opens-french-agricultural-show

9. https://www.connexionfrance.com/article/Practical/Environment/Water-management-expert-throws-doubt-on-French-minister-s-drought-plan

10. Ibd.

11. https://www.europarl.europa.eu/doceo/document/P-9-2022-002655_EN.pdf

12. https://www.lamoncloa.gob.es/lang/en/gobierno/councilministers/Paginas/2023/20230124_council.aspx

13. https://newseu.cgtn.com/news/2023-02-10/Water-scarcity-Spain-s-new-drought-measures-threaten-mass-job-losses-1hjwF1AeZTa/index.html

14. https://elpais.com/espana/catalunya/2023-02-28/cataluna-amplia-las-restricciones-de-agua-a-seis-millones-de-personas-ante-la-peor-sequiadel-siglo.html

15. https://www.dailysabah.com/turkiye/turkiye-fears-droughts-amid-lowest-rainfall-this-year/news

16. Ibd.

17. https://www.researchgate.net/publication/309486811_Urban_Water_Losses_Management_in_Turkey_The_Legislation_and_Challenges

18. https://www.aljazeera.com/news/2023/2/22/drought-in-horn-of-africa-worse-than-in-2011-famine-experts

19. htttps://www.amacad.org/sites/default/files/publication/downloads/Daedalus_Fa21_09_Verhoeven.pdf

20. https://www.weforum.org/impact/sustainable-water-management/