Embracing Disruption

What the rise of generative AI means for investors

What are the implications of the evolvement of generative AI like ChatGPT and DALL-E 2 for investors?

Key takeaways

- ChatGPT and DALL-E 2 have brought generative AI to the forefront

- Underlying GPT technology is growing rapidly and has practical use cases across sectors and industries

- We expect this to be a disruptive innovation, but over time

“Generative AI is at a transition point, and we are crossing a chasm. This is the first time where the broader population sees the magic happening. I am extremely bullish on this concept…. When everybody said AI is out (of favour), it is all about blockchain and crypto, [it] turned out that AI accelerated, and the others had a meltdown instead. I think that we’re going to see very exciting things coming up in the next few years.1”

Danny Lange, Senior Vice President of AI at Unity

THE NEWS: Microsoft is planning to make a multibillion-dollar investment in OpenAI, the startup behind ChatGPT, at an approximate USD 29 billion valuation.

Although Microsoft’s additional investment in OpenAI was the latest artificial intelligence (AI) related headline, other generative AI applications have been capturing people’s attention. What is different now are the many immediate applications of the technology and the broad implications for investors.

What is generative AI?

Generative AI is an umbrella term for a form of machine learning (ML) called “deep learning”. This form of AI uses machines trained on sets of data to perform certain tasks and/or make predictions without human direction – and recently, they made a big technological leap in how they learn. Most initial ML models involved supervised learning, in which humans were needed to classify data – for example, identifying an image as a “dog” or a social media post as “political.” Recent developments in generative AI involved unsupervised learning, in which the model makes its own predictions and calculations based on the massive amounts of data fed into it.

And now, the machine has moved from being able to identify the dog in an image to creating an image of the dog. A technology called DALL-E creates paintings based on descriptive words, and Chat Generative Pre-trained Transformer (ChatGPT) can write economic commentary or even computer code based on a few prompts. To be sure, although the ChatGPT and DALL-E functionality and user interfaces are remarkable, the underlying technology is already several years old but improving rapidly. Private and open source advanced GPT models have been created by Meta Platforms, Microsoft, Google and more since 2018.

Why it matters for investors

ChatGPT is an example of a large language model (LLM) – essentially, software trained on immense sets of text data to execute specific tasks, such as finishing a sentence or completing a line of code. LLMs have billions of variables (parameters) that they can change as they learn – and as a result, as their accuracy rate increases, so do the business use cases. For example, an AI-driven chatbot might be able to answer 90% of questions from banking customers, freeing up employees to spend more time selling services or provide a better in-person experience to the bank’s highest-value clients.

Imagine all the scenarios for this type of technology. A company requiring any written materials – ranging from simple product descriptions to technical manuals to answers to “Why did my insurance rate go up?” – will be able to do it faster and cheaper than any human being can. On the coding side, generative AI technologies will free up programmers to engage in more-important and higher-value-added programming tasks rather than basic, boilerplate coding, which is extremely time-consuming.

Generative AI can be used to generate other outputs beyond text, including images, voice and movies. This tool could aid or even replace time-intensive human tasks, such as designing logos, illustrating scenes and designing products. These models will be integral to the next generation of augmented and visual reality–related technology in gaming; visual interactive entertainment; and business simulations, such as “digital twins”. We could even soon witness a famous actress licence her image to a production company, which then uses a generative AI model to do the actual acting in an advertisement.

Ethical and regulatory questions

ChatGPT and all AI-related technologies raise important ethical questions and issues, such as copyright and licensing issues for AI-created images. ChatGPT can also produce incorrect, inconsistent or even inappropriate answers – a result of using the entire Internet as its training set. For companies using the technology on specific use cases, this will be less of an issue, and they can further train the machine with more-specific data sets and fine-tuning. But for social media companies in particular, these are serious issues.

As we have seen numerous times with the advent of a new technology, the applications and uses are introduced first, and then regulation has to catch up. OpenAI is hoping that by initially opening ChatGPT for broad public use, it can better help train the model with real-time feedback from users. More than 1 million users signed up to use OpenAI’s ChatGPT tool in the first five days after release in November 20222.

How AllianzGI is positioned

While iterations of generative AI technology have existed for decades, applications such as ChatGPT and DALL-E are milestones, especially in the area of unsupervised ML and deep learning applications. Within the theme of this type of AI-driven transformation, the Allianz Global Artificial Intelligence strategy seeks broad and diversified exposure to generative AI across AI infrastructure, AI applications and AI-enabled industries.

Conclusion

The future of generative AI will likely evolve rapidly. We expect to see improvements in the quality and diversity of generated content; new types of generative models; and broader application in a variety of industries, such as healthcare, finance and transportation. Additionally, AI should become more accessible to a wider range of users through user-friendly interfaces and tools. The precise future of generative AI is hard to predict, but we are optimistic it will be a key piece of AI-driven transformation and innovation.

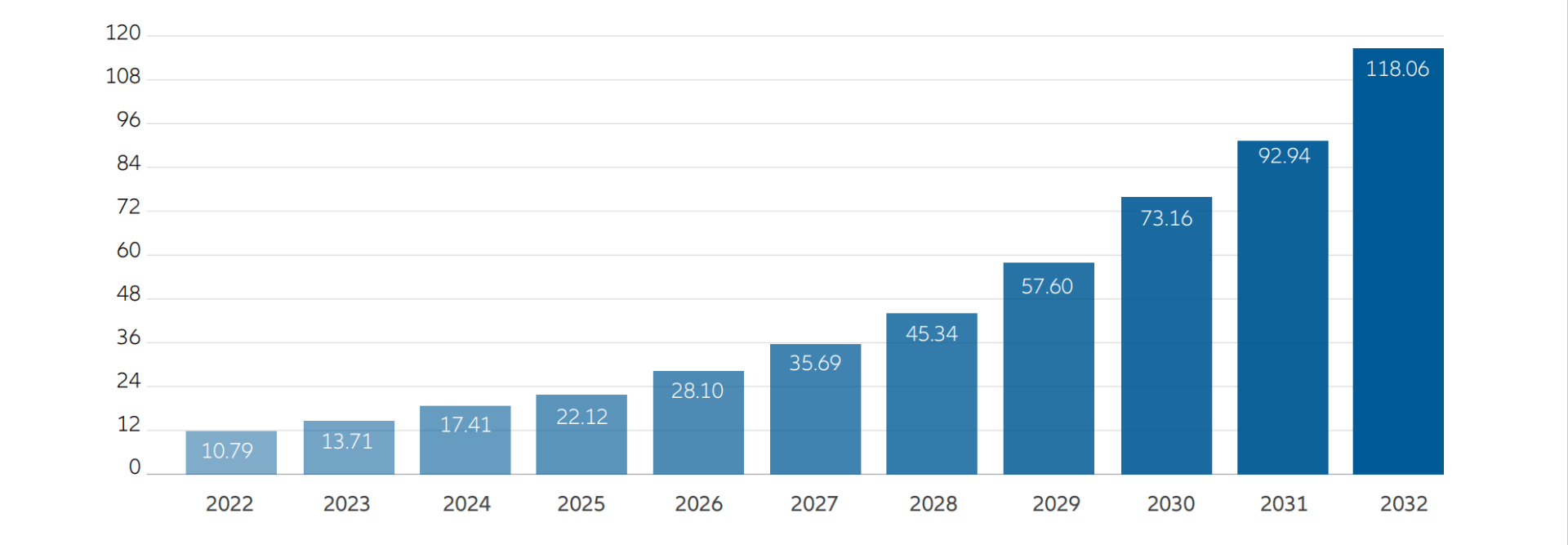

Chart of the day: generative AI market could grow 27% annually over 10 years

Source: Precedence Research, December 2022. Compound annual growth rate = 27.02% from 2023-2032.

1 Unity’s AI Chief on Generative AI, Metaverse and Gaming, aibusiness.com, December 20, 2022.

2 “What is Generative AI”, McKinsey and Company, 19 January 2023