2021 mid-year outlook

Summary

The economic outlook is positive at the mid-year point, thanks in large part to the significant economic stimulus packages over the past year, but all this growth may come at a price.

Investing in the Pet Economy Poised to be the Next Big Thing

Summary

Having pets at home is common. For the physical and mental health of their companion animals, pet owners are splashing money on the best food and the best medical care. Their level of attention and care committed is no different from that of bringing up their own children. It turns out that the pet market has become a trillion-dollar business, giving rise to a brand new "pet economics" and unique opportunities for investors.

What’s ahead for the rest of 2021?

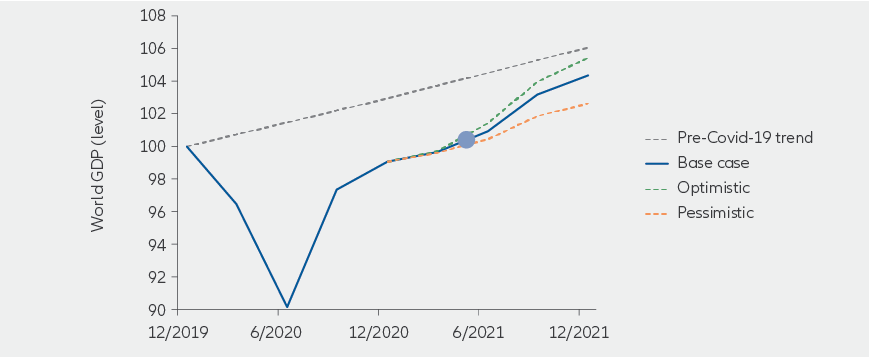

Overall, economic growth has returned forcefully after last year’s severe pandemic-related slowdown, bringing a boost to capital markets – though growth will likely remain below the pre-pandemic growth trend for years (see chart). While the Covid-19 crisis isn’t over, vaccines are helping some parts of the world turn the corner and the hope is that pandemic risks will decrease as the year progresses. This boom in the economy and markets comes at a potential price – not least a rise in inflation. Investors will also need to navigate uneven levels of economic growth across countries and sectors. And with diverging amounts of fiscal and monetary stimulus around the world, policymakers are responding in a way that investors will want to factor into their strategies.

Investment implications

- A spike in inflation this year – and potentially beyond – makes it important to preserve purchasing power with additional sources of return.

- The recent jump in inflation was a major factor behind the US Federal Reserve’s decision to implement small rate hikes in 2023. The market has also been expecting the Fed to start “tapering” its bond-buying, probably in 2022. Both these moves could trigger some volatility depending on how they are managed by the Fed.

- We still have a bias for risk assets – albeit with some caution. As such, we don’t think investors should “de-risk” their portfolios, but rather consider a more neutral position along the risk/return spectrum – at least for the short term.

GDP forecast (2020-2021)

Source: Bloomberg, Allianz Global Investors. Data as at May 2021.

Our 2021 mid-year regional outlooks

Multiple factors have boosted the economy and corporate earnings – including the successful vaccine rollout, a decline in Covid-19 cases, low interest rates and ongoing fiscal stimulus. But rising inflationary pressures and potential tax increases could turn into headwinds in the second half of the year.

Although financial markets have done well in 2021, we expect bouts of volatility throughout the year. The markets could have an ongoing bias towards value and cyclical sectors. Financials could benefit from a higher yield/steeper yield-curve environment, while energy and commodities should continue to perform as the global economy reopens. Parts of infrastructure, clean energy and 5G are all supported by President Joe Biden’s policy agenda.

Given strong growth and rising inflation, yields may continue to grind higher. This may put more downward pressure on long-duration assets/sectors, including investment-grade corporate bonds and sectors such as growth and technology.

After a weak start to the year, economic activity has moved up a gear. A strong and broad-based rebound is possible once virus-containment measures are eased more markedly and private consumption picks up. Inflation looks set to peak in 2021 before moderating in 2022. Any economic recovery will continue to depend on economic policy support, and the European Central Bank’s monetary policy remains accommodative overall.

Amid continued pandemic-inspired uncertainty, accelerating growth should help corporate earnings – which will likely be the main driver of equity returns in 2021. Although we expect longer-term government bond yields to rise moderately, led by the US, rising inflation may be temporary and the overall low-yield environment should remain intact.

We expect the economy to continue to rebound thanks to a swift vaccine rollout and the broader reopening. This will enable a catch-up in consumer spending – unleashing the high levels of household savings accumulated during the pandemic. Fiscal policy should remain supportive even as post-pandemic stimulus fades towards the end of the year. Inflation is expected to rise during the second half, but underlying cost pressures are mounting only gradually.

Post-Brexit trade frictions (particularly non-tariff barriers) continue to weigh on exports, despite the EU trade deal agreed at the end of 2020. There is little definitive evidence yet that the slump in trade with the EU will be offset by stronger trade with the rest of the world.

Thanks to effective containment of Covid-19, China’s economy has largely returned to its trend growth rate. Fiscal and monetary policy support have begun to normalise, which could be less helpful for risky assets, but China’s authorities will remain vigilant to prevent any issues from arising. Strained relations with the US may yet have an impact on the outlook for China’s trade and finances.

The recent pullback in China’s equity markets should be viewed as a healthy development, bringing valuations to more attractive levels. China’s fixed-income markets also offer investors the kind of yields that are hard to find in other major economies, where rates could remain lower for even longer. Still, China’s markets are volatile, so investors should keep a long-term perspective.

Despite a recent rise in new Covid-19 cases, Japan has begun its vaccination programme and the delayed Olympic games are scheduled to take place in Tokyo this summer. Against this backdrop, we expect domestic demand to recover gradually during the second half. Meanwhile, Japan’s external demand (the sum of exports minus imports) looks set to remain firm thanks to a continued recovery in global capital expenditures.

Price pressures remain muted despite an improved growth outlook, so the Bank of Japan has sought to make its monetary policy framework more sustainable.

The global economic recovery and modestly weaker US dollar are helpful conditions for most emerging markets. Some EM central banks have already begun to tighten – including in Turkey, Brazil and Russia -- and the expected increase in inflation may lead even more to do the same.

The threat of a renewed pickup in Covid-19 infections is particularly acute in emerging markets. While their progress in tackling the pandemic continues to lag developed markets, they are set to make more progress on this score towards the end of 2021. We continue to expect the recovery in emerging markets to be both fragile and unevenly spread. Generally, those countries that have been most successful in containing the pandemic – such as South Korea and Singapore – look to be best positioned.

-

12022: The growth opportunity of the century, PwC