Sector ideas for the “re-opening” phase of the coronavirus crisis

Summary

Around the world, lockdowns and quarantines are slowly lifting, but consumers and business activity remain fragile. We believe investors should play both offence and defence during this new “re-opening” phase. On offence, the tech sector will likely remain a leader, but select high-yield bonds and cyclical sectors (parts of energy and financials) could also outperform. On defence, consider consumer staples and healthcare, which are well-positioned for a post-coronavirus world.

|

Key takeaways

|

Where to look for opportunities in the next phase of the economic cycle

As the world battles the coronavirus and tries to return to something closer to “normal”, many countries are now undergoing the tentative process of re-opening their economies. Faced with this uncertainty, investors may find it helpful to take a historical look at how market sectors have responded to various economic phases – particularly those sectors that have done well when the economy stabilises after a downturn.

As the chart below shows, more economically sensitive (or cyclical) sectors – such as financials, energy, and parts of technology and consumer discretionary – have outperformed when economies stabilise and return to growth. In the fixed-income space, high-yield bonds and even “fallen angels” (investment-grade companies that have been downgraded) have historically been attractive during these times.

The coronavirus pandemic pushed the US economy into one of the fastest, steepest downturns in history – but it may be stabilising

| EARLY Growth rebounds |

MID/LATE Growth stabilises and peaks |

RECESSION Growth contracts |

|

|---|---|---|---|

| Stage in economic cycle | Cyclical areas tend to shine as the economy returns to growth. Defensive areas take a back seat. | Steady growth sectors tend to do well during mid-cycle, while defensive sectors lag until the downturn is in sight. | The most defensive. Income streams for these sectors tend to be the most secure. |

| Equities: outperforming sectors | • Financials • Industrials • Technology |

• Communication • Consumer discretionary • Energy/materials • Technology |

• Consumer staples • Healthcare • Real estate • Utilities |

| Fixed income strategies | Rotation into select high yield, which tend to outperform as the economy grows. Selective “fallen angel” strategies may do well as downgraded assets improve their credit profiles over time. Convertible bonds can do well thanks to upside from their equity options. | Basket of investment-grade and high-yield assets. Gradually reduce risk profile as signs of downturn become clear. | Up-in-quality investment-grade bonds, as well as sovereign/Treasury bonds and cash equivalents. Help preserve capital and avoid defaults |

Source: Allianz Global Investors. Past performance is no guarantee of future results.

During this coronavirus crisis, we have observed a market cycle similar to the one above, though the time scale has been fairly compressed. From December through mid-March, as the crisis hit globally and markets anticipated the pandemic pushing the US into recession, utilities and real estate – the defensive “bond proxy” sectors – performed best.

Since then, new sector leadership has emerged – namely technology and healthcare – as investors quickly and astutely began to position their portfolios in sectors that could prosper in this changed world. Indeed, certain business models have thrived during this pandemic and could continue to do so in the post-coronavirus world, including:

- The technology that powers a stay-at-home world (such as cloud computing, cybersecurity, remote access and gaming)

- The healthcare services and products (including possible therapies and vaccines) that are fighting covid-19

- The businesses that efficiently provide online retail and food delivery for consumers

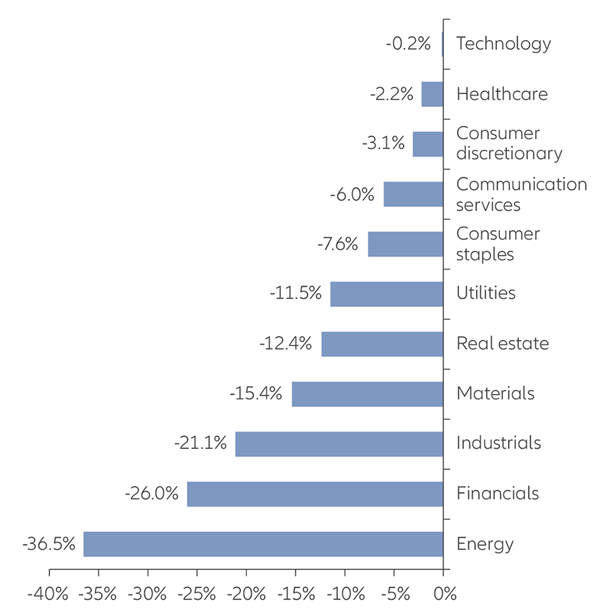

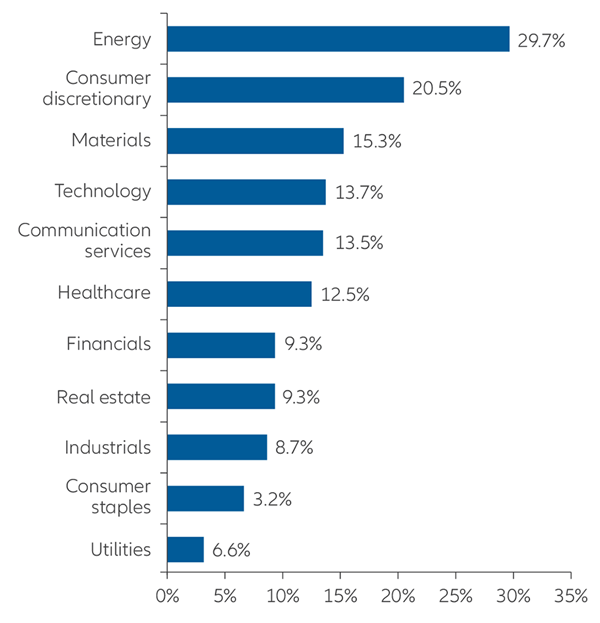

Market performance has already started to reflect these trends. On a year-to-date basis, technology, healthcare and consumer discretionary have substantially outperformed other sectors (see chart below), while cyclical areas such as energy have shown early signs of leadership.

Tech, healthcare and consumer discretionary have led the markets, with energy making a late surge

January-April S&P 500 sector performance

(31/12/19 - 30/4/20)

April S&P 500 sector performance

(31/3/20 - 30/4/20)

Source: Bloomberg, Allianz Global Investors. Data as at 30 April 2020.

What comes next? Portfolio positioning for a “re-opening” of the economy

With the US and major global markets potentially entering a new phase in the coronavirus crisis – the “re-opening” – much uncertainty remains about what lies on the other side of this process. So we believe investors should consider positioning portfolios with both offence and defence, perhaps with the following investment themes in mind.

The tech sector could continue to be a market leader

Before the coronavirus pandemic hit, the technology sector had driven much of the market’s strong performance. It continues to do well during this crisis, and there are several reasons it may remain a leader even once economic growth returns (though we would suggest building exposure tactically):

- Tech is likely to be in a secular uptrend in a post-coronavirus world, as consumers globally continue to use more stay-at-home and work-from-home technology, both software and hardware.

- We believe the world will remain in a low-interest-rate, slow-growth environment for some time to come, so investors may be more likely to hunt for potential growth sectors (like tech) that have historically done well with lower discount rates.

- Many tech giants have strong balance sheets, which can help them weather downturns or periods of prolonged slow growth.

Fallen angels in fixed income could offer opportunity

In the US, select parts of the high-yield market could present interesting return opportunities as the economy stabilises. There is a tremendous amount of BBB rated investment-grade debt – more than USD 900 billion – that could be downgraded to high yield because of the economic environment. These “fallen angels” notably could have the opportunity to improve their credit profiles and become investment-grade assets once again. In addition, the Federal Reserve has included fallen angels in its corporate bond-buying programme, which helps support this asset class.

Start thinking about the laggards

Cyclical sectors (parts of energy, financials, and the travel and leisure complex) have been suffering during this crisis, but many companies will survive and eventually thrive – and they offer some of the most compelling risk-reward opportunities today. Some examples include areas such as renewable energy, diversified financials and private equity players, and select airlines.

Markets are generally forward-looking, and returns tend to improve when investors believe the worst has passed. For example, the energy sector was the top performer in April, despite the oil-price collapse in mid-April (see chart above). This suggests that if optimism about the economic re-opening becomes more widespread, we could see a broader rotation into cyclical sectors, which have so far been the biggest laggards of the crisis.

Maintain some defences

We believe consumer staples and healthcare should remain a part of investors’ portfolios. While these have traditionally been considered defensive sectors, we believe they offer long-term, secular growth opportunities in a post-covid-19 world. As we gradually resume activity, both staples and healthcare will be essential – from basic food and necessities, to anti-bacterial and face-mask solutions, to medical therapies and vaccinations.

Active bets may make sense

Financial markets during times of crises lend themselves better to active strategies, in our view, and this pandemic is no exception. Markets today are being driven by sector-specific performance rather than the broad market returns (beta) that passive investors relied on in recent years. Moreover, passive and index investments – which are useful in certain environments – could now expose investors to potential underperformers or even defaults. There will be winners and losers as we re-emerge from the coronavirus crisis, and we believe it’s essential to take select active bets in portfolios today.

China is positioned to lead Asia’s economic recovery from the coronavirus

Summary

The coronavirus pandemic applied a sudden brake to China’s growth story, as it did to most economies around the world. But there are signs that China could be ready to lead the way out of the downturn and resume its long-term growth trajectory.

Key takeaways

|