fixed-income-corner

Bond Basics

Simply put, a bond is a debt instrument. The issuer needs to pay interest to the bond holder at a pre-set rate on a regular basis and repay the invested principal on a specific date.

In other words, when an investor purchases a bond, he is effectively lending money to the issuer, which is typically a government, a private company, a supranational organisation or another type of agency. The issuer must promise, in the terms of the issuance, that it will pay interest at the pre-determined rate (i.e. coupon rate) during the lifespan of the bond, and repay the face value of the bond, which means the sum originally invested, on maturity.

The term of a bond, defined at the time of issuance, is referred to as tenor or maturity. In general, the longer the maturity, the higher the coupon rate will be. Short-dated bonds usually have a maturity of up to two years, while for medium-term bonds it is 2 to 10 years; bonds with maturity longer than 10 years are defined as long-term bonds.

Bond Duration

Longer duration implies higher interest rate risk

Duration of a bond indicates the extent to which its price will move in response to interest rate changes. Duration is expressed in number of years and is shorter than the term of the bond. In general, the longer the duration of a bond, the more sensitive it is to interest rate changes. In other words, duration can also be used as a measure of interest rate risk. A longer-term bond typically has a longer duration.

Risks vary with different interest rates

Duration is also the weighted average of the present value of the cash flows. Its calculation takes into account the fixed coupon payment during a bond’s life and the face value paid at the maturity date. Duration can be used as a measure to compare the interest rate risks of bonds with different maturities, face values and coupon rates. When faced with the same decline in interest rate, the price of a bond with a longer duration will be more volatile than one with a shorter duration.

Investors with higher risk tolerance may consider bonds with a longer duration if they perceive that the interest rate is trending down. Conversely, when the interest rate goes up, bond prices will go down. Investors holding bonds with longer duration may suffer a greater loss due to the more severe drop in prices.

Bond Portfolio

Defensive characteristic

Bonds are referred to as “fixed income securities” due to the fact that most are able to pay a “fixed” income according to a pre-determined schedule.

In addition, bond investments offer the benefit of diversification. The risk equities are exposed to, because of market volatility, is higher than bonds. However, the performance of bond and equity markets is usually uncorrelated. If an investor holds both equities and bonds in his portfolio, during market downturn, the stability of bond investments can provide a buffer against potential loss from equities.

Bonds can also act as a hedge against economic slowdown. When growth is losing steam, corporate earnings and equity income are bound to be weaker. Investing in “fixed income securities” can ensure a fixed income. In a deflationary environment, income from bond investments can be even more attractive as the fixed income does not change even when prices fall.

Bond funds as the cornerstone of investment portfolios

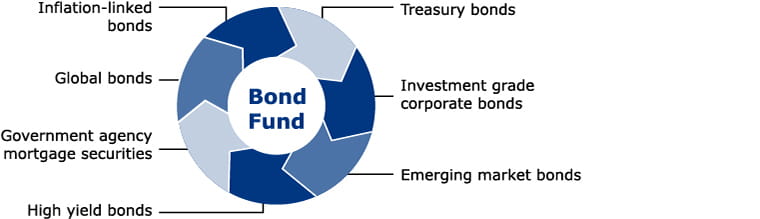

In terms of asset allocation, investors should consider making bonds with defensive characteristics the “cornerstone” of the portfolio. A multi bond fund will be suitable for investors looking for an investment tool that covers a wide range of bonds. A diversified bond portfolio invests in various types of bonds and the manager has the flexibility to adjust the weightings in tune with changing market conditions which allows the fund to capture gains under all circumstances.

“Do not put all eggs in one basket” – an appropriate approach is to have a multi bond fund as the cornerstone of an investment portfolio.

Bond Price and Interest Rate

Difference between coupon and yield

The coupon is expressed as a percentage of a bond’s par value (or face value). While coupons are generally fixed, they can also be floating, or even set at zero. Although zero-coupon bonds do not pay out any interest, these are issued at a discount to par value.

Yield refers to the returns on bonds which are based on both the bond’s price and the interest, or coupon payment received.

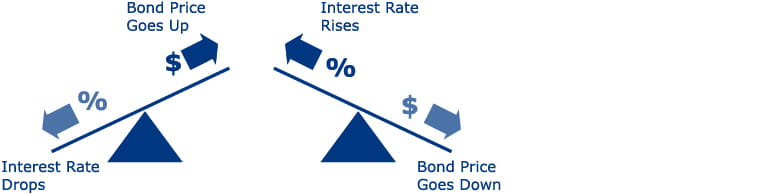

Inverse relationship between bond price and interest rate

In general, bond purchasers would hold the bonds to maturity. Even if a bond is not traded prior to its maturity, its price still fluctuates in the meantime due to its intimate relationship with interest rate movements. Bond prices are inversely related to interest rates. When the interest rate goes up, the price of bonds falls; conversely, when the interest rate falls, the price of bonds goes up.

Take the following hypothetical example. Suppose the current interest rate in the market is 5% p.a. and Mr. Chan decides to buy a 30-year bond with a par value of HKD10,000 at a coupon of 5% p.a.. Subsequently Mr. Chan wishes to sell his bond holding but the prevailing market rate at the time has gone up to 7% p.a.. As the coupon offered is less than the market rate, Mr. Chan has to attract investor interest with a price below its HKD10,000 par value in order to sell his investment.

The above information used is for illustrative purposes only and are not indicative of the actual returns likely to be achieved by the investor.

Bonds and Bond Funds

A bond fund is a portfolio constructed by a fund house, which invests in bonds or debt securities with different maturities issued by a range of issuers. Just like an equity fund, the manager of a bond fund selects bonds or debt securities according to the established investment objectives and management policy.

Through an active management approach, these funds invest in a wide range of bonds to diversify risks and adapt the asset allocation to the changing market conditions, in order to capture gains.

In addition, the entry barrier for bond funds is generally lower compared to direct investments in bonds, which allows access to a diversified bond portfolio at a lower cost.

The difference between bond funds and bonds

Different types of bond funds invest in different bonds and debt securities. The underlying assets may include more direct investments such as government or corporate bonds as well as more complicated investments such as asset backed securities (ABS).

An “all-in-one” bond fund

The return on bond funds depends on the interest payment and changes in market value of the underlying bonds and securities. In direct investments, an investor can receive regular coupon payment and the principal at maturity. However, bond funds have no maturity date and principal repayment. Any interest payout is subject to the distribution policy. Re-investing the dividend provides the opportunity to add value and hence increase the potential return.

Bond Yield

Various factors affecting bond yields

The yield of a bond represents its rate of return, which changes with the coupon rate and bond price. Whilst the coupon rate is often fixed, the price fluctuates in response to changes in interest rate, market supply and demand, the remaining time to maturity and credit quality of the bond. Therefore, upon issuance, a bond usually trades at a premium or discount in the market. Bond yield is commonly classified into current yield and yield to maturity.

Current yield

It is the annualised rate of return calculated by dividing the current annual coupon of a bond by its price. If a bond is purchased at par value, then its current yield will equal the coupon rate. However, if the bond is bought at a discount to par value, its current yield will be higher than the coupon rate. Conversely, when the bond is bought at a premium, current yield will be lower than the coupon rate.

Yield to maturity

It is the total return an investor can receive from a bond held to maturity. It is expressed as an annualised rate of return, which includes potential interest gain or loss incurred from the time of purchase, up to maturity and the capital of the bond, taking into account any movements in price. Yield to maturity is a better measure of return compared to current yield due to the fact that it reflects the expected total return on a bond if it is held to maturity.