The China Briefing

Leaning against tariff headwinds

US-China trade tensions, ADR delisting risks, and potential policy responses to stimulate domestic demand

Please find below our latest thoughts on China:

- With the dust starting to settle and the initial tariff shock beginning to wear off – from an equity market perspective at least – some macro and market trends are starting to emerge.

- China and the US appear locked in an unprecedented and costly standoff. Using a games analogy, it’s almost as if the Uno reverse card has been repeatedly dropped on investors as the two superpowers ratchet up the stakes.

- China’s negotiating position has hardened notably. The State Council, the highest administrative authority, put out a strongly worded statement: “Even if the US continues to impose higher tariffs, it will no longer make economic sense and will become a joke in the history of the world economy… if the US insists on continuing to substantially infringe on China’s interests, China will resolutely counterattack and fight to the end.”

- From China’s standpoint, operating under US export controls for the last five years has resulted in a meaningfully enhanced degree of self-sufficiency in critical industries. As such, US reliance on China’s industrial inputs is around three times that of China’s reliance on US components.1 It seems to us highly unlikely China will be the first to blink.

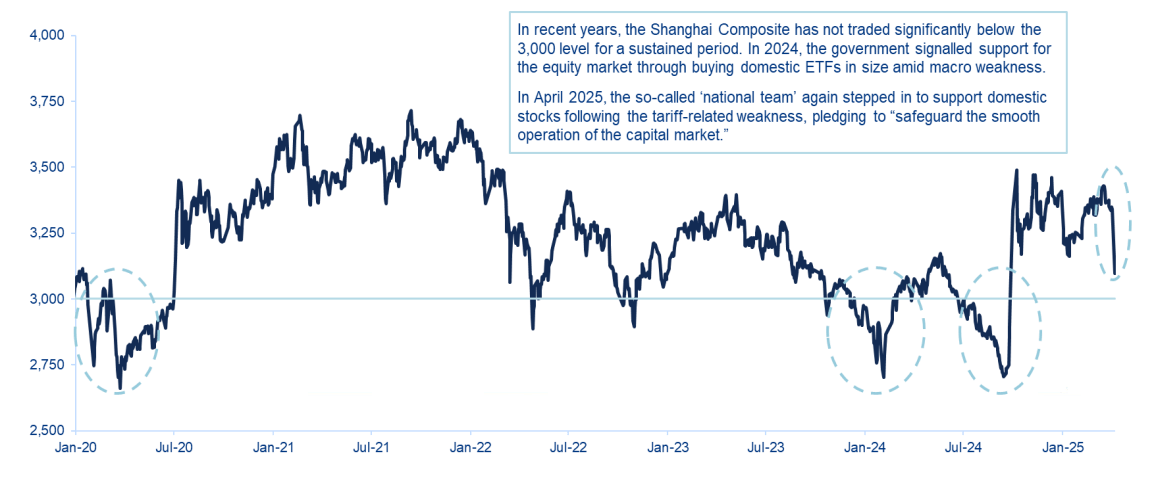

Chart 1: Shanghai Composite Index since January 2020

Source: Wind, Allianz Global Investors, as of 8 April 2025

- With ever-higher tariffs no longer having a meaningful incremental economic impact – direct China-US trade will all but evaporate at current levels – speculation will likely turn to other policy options.

- There has been recent market comment about the US forcing China companies (mainly ADRs) to delist from US stock exchanges. Or, in a more extreme scenario, a blanket restriction on US persons investing in Chinese securities.

- The talk of ADR delistings is not new. In Donald Trump’s first presidency, new regulation (the Holding Foreign Companies Accountable Act) was designed to force companies listed in the US to prove they are not controlled by a foreign government. Companies that failed to meet US auditing standards would eventually be delisted from US stock exchanges.

- Following extensive audit reviews, in practice only several smaller companies were delisted. But, more broadly, this new regulation acted as the catalyst for many China ADRs to take out secondary listings in Hong Kong.

- As a result, there are only 20 China companies listed in the US with a market cap of more than USD 1 billion that do not also have a listing in Hong Kong.2

- Over the longer term, therefore, the forced delisting of ADRs should not, in our view, have a sustained impact on markets as most investors can switch to the equivalent Hong Kong-listed stock.

- In practice, however, there would likely be additional near-term volatility both because of the impact on sentiment – a ratcheting up yet further of geopolitical tensions – and also because of the flow of funds.

- In the more extreme scenario of US persons being forced to divest all Chinese securities, it is estimated this would lead to around USD 830 billion of selling in China stocks. The split is around USD 60 billion in China A-shares and the remainder in offshore markets.3

- The average daily traded volume in China A-share markets is around USD 150 billion.4 This is one reason why, in recent days, the China A market has been more resilient than China H-shares during the periods of extreme volatility.

- There has also clearly been a coordinated effort in China to stabilise China A-share markets.

- The so-called “national team” has stepped in substantially, with domestic ETFs seeing net inflows of close to USD 30 billion month-to-date. More than 240 China A-share companies have announced share buybacks since 8 April.5 And insurance companies have been guided to increase their exposure to equities.

- The “Beijing put” has been in action several times over the last year, with the 3,000 level on the Shanghai Composite Index appearing to be the line in the sand. The current level of around 3,2506 should therefore provide some indication of the expected downside risk.

- Looking ahead, the key question, in our view, is to what extent China will lean against the tariff headwinds and the looming economic slowdown with renewed efforts to stimulate domestic demand.

- On paper, there is significant untapped potential including more than USD 20 trillion (yes, trillion) of household savings.7 But the consumption power and confidence of China consumers have been significantly hampered by the severe housing market downturn and labour market pressures in the post-Covid era.

- We think it is increasingly likely there will be decisive and forceful policy changes including the government stepping up support for asset prices, not just in equities but in the crucial housing market as well.

1 Source: Gavekal, 13 April 2025

2 Source: HSBC, 14 April 2025

3 Source: Goldman Sachs, 14 April 2025

4 Source: Bloomberg, 14 April 2025

5 Source: HSBC, 15 April 2025

6 Source: Bloomberg, 15 April 2025

7 Source: Goldman Sachs, 14 April 2025