In the Year of the Rat, think even longer term

Summary

This Chinese New Year, more than a billion people globally will celebrate the Year of the Rat. We believe investors everywhere can also find reason to celebrate China as a source of continued economic growth. Even if US-China tensions linger, China’s heavy investment in advanced manufacturing and regional partnerships should strengthen its position as a global economic powerhouse in the years ahead.

Key takeaways

|

China is still on track to become the world’s largest economy

In the 12 years since the last Year of the Rat, China doubled its GDP and delivered an average annual growth rate of 7%. A slowdown seems all but inevitable, especially given China’s rapid accumulation of debt since the 2009 global financial crisis. But even if China’s 2020 growth dips to the 5.9% level predicted by the World Bank, it will still easily beat slow-growing Europe, Japan and the US. In the medium term, growth of around 4% per year would still represent great progress for China and its citizens.

Longer term, President Xi Jinping is successfully executing a strategy that aims to make China the world’s largest economy by 2049 – the 100-year anniversary of the Communist Party taking power. Investors would be wise to assume that Mr Xi will continue making the right decisions to help China reach its goal.

What to watch in the Year of the Rat

Made in China 2025: Chinese manufacturing is moving up the value chain

The “Made in China 2025” initiative is designed to ensure China can compete with the US and other developed nations in higher value-adding, advanced-manufacturing sectors such as robotics and aviation. This should help China avoid falling into the middle-income trap that has beset other emerging economies that still focus on apparel, consumer electronics and other lower-value products.

Trade and investment: US-China tensions will likely continue

China’s entry into the World Trade Organization in 2001 was widely welcomed – including by the US. But more recently, US policies have led to trade wars that slowed growth globally. Fortunately, there have been signs that US-China trade hostilities may be winding down. The US reversed its decision to label China as a currency manipulator, and the US and China signed the first phase of a deal that suspends planned US tariffs in exchange for China agreeing to purchase more US goods. These New Year’s gifts will surely be welcomed in Beijing, but we don’t expect an end to overall tensions between the two countries. The US-China “tech cold war” continues as each country develops its own tech ecosystem. And China will keep trying to form new trading relationships with other nations, especially since its growth depends on oil, gas, coal and other commodities. China’s “belt and road” initiative of regional investment should provide it with long-lasting supply routes – and perhaps make other countries less reliant on the US as they form stronger ties with China.

Technological development: China’s transformation is driven by innovation

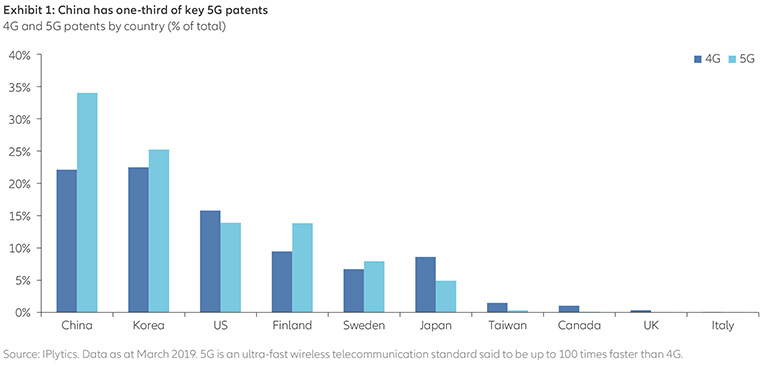

As China moves away from exports and trade, its high-tech sector is growing rapidly. As the following chart from IPlytics shows, China already holds one-third of key 5G patents. And according to the World Intellectual Property Organization (WIPO), almost half (46%) of the 3.3 million patent filings around the world are in China. The majority of patent applications come from private companies, which points to the strength of China’s private sector.

Moreover, Asia as a whole is benefiting from an influx of private-sector capital, receiving 41% of global venture-capital funding in 2018, according to WIPO. China also has its own mega-cap tech giants, the BATs (Baidu, Alibaba and Tencent)*, whose influence is growing across the region.

Monetary policy and deleveraging: China is on a difficult but more effective path

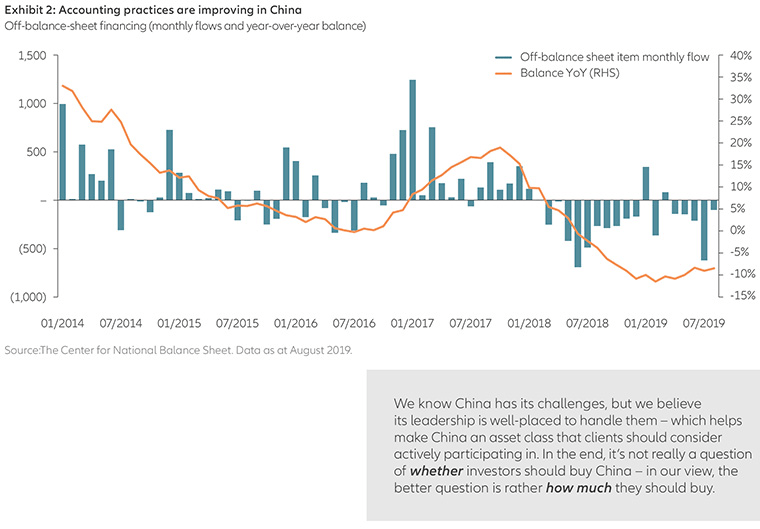

The People’s Bank of China (PBoC) is intent on improving the country’s savings and investment habits while reducing its debt levels, which soared from 141% of GDP in 2008 to 244% in 2017, according to the Center for National Balance Sheet. Since then, debt levels have stabilised and moved up only slightly, reaching 250% by mid-2019. Moreover, as the next chart shows, accounting practices are improving: fewer companies are obscuring their liabilities with off-balance sheet financing. Overall, the PBoC’s commitment to allowing defaults to rise and weak banks to close is clearly different to Western central banks’ focus on providing ultra-low rates and more monetary stimulus. Moreover, we believe the PBoC’s approach will be more effective in supporting the country’s long-term economic growth and structural reforms.

Sustainability: China knows the importance of reducing its environmental footprint

We expect China will begin addressing in earnest the environmental downside of its remarkable economic growth. If government investment in renewable energy and a reduction in carbon emissions are coupled with continued economic growth and rising wages, the result will be a tangible improvement in the quality of life for China’s 1.4 billion citizens.

Demographics and urbanisation: China is lifting restrictions to improve the quality of life

Like many countries with top-performing economies, China has an ageing population – exacerbated by its previous “one-child” policy. But the birth rate is rising somewhat and China is intent on spending more on education for younger generations than on public welfare for the elderly. Moreover, China is attempting to boost migration to fast-growing cities by lifting restrictions on where citizens can work or own property. We expect to see enormous growth in dense city-clusters around Beijing, Shanghai, Shenzhen and other cities. This will create huge infrastructure demands, but it could also free up more land for agriculture – and perhaps make China less susceptible to global economic trends or trade friction.

Investment implications

The combined effect of these initiatives and trends could make the Year of the Rat a positive one for investors. And beyond this coming year, China seems set to enjoy a prolonged period of continued economic growth. As we’ve said for some time, it’s not a question of whether investors should buy China – in our view, the better question is rather how much they should own. With that in mind, here are some of our top investment ideas for the Year of the Rat and beyond:

- China’s policies should continue supporting China A-shares – companies listed on stock exchanges in Shanghai or Shenzhen.

- As China’s advanced manufacturing sector grows, high-tech areas such as robotics and electric vehicles could benefit.

- Urbanisation will require vast infrastructure investment in rail, water, power, education, health care and housing.

- If the PBoC is successful keeping China’s currency stable, it should support purchasing power and help China “rebalance” its economy towards domestic consumption rather than exports and trade. The domestic services, property, retail and e-commerce industries could benefit.

* BAT is an acronym widely used on Wall Street and among many investors that stands for three large-cap tech companies in China: Baidu, Alibaba and Tencent.

In the Year of the Rat, think even longer term

Summary

This Chinese New Year, more than a billion people globally will celebrate the Year of the Rat. We believe investors everywhere can also find reason to celebrate China as a source of continued economic growth. Even if US-China tensions linger, China’s heavy investment in advanced manufacturing and regional partnerships should strengthen its position as a global economic powerhouse in the years ahead.

Key takeaways

|