Asian fixed income: an antidote to global slowdown?

With global economic prospects diverging, investors may look to defend their portfolios from increased market volatility by gaining exposure to those economies set to drive growth in the next few years. With solid fundamentals and attractive valuations, it may be time to look at Asian fixed income.

Key Takeaways

- In our view, gaining exposure to Asian fixed income through broad emerging market indices looks increasingly limited and outdated.

- With Asia outgrowing other regions over the last decade, Asian credit has developed into a high-quality universe featuring USD 1 trillion of bonds from over 500 issuers.1

- Asian investment grade bonds have shown greater resilience than US and global counterparts during recent market downturns and could offer some stability to portfolios amid the global slowdown.

- While Chinese property bonds will likely remain volatile, we see attractive investment opportunities in other areas of the Asian high yield bond market on a selective basis.

As the global economy emerges from the dual shocks of Covid-19 and the war in Ukraine, we are seeing growth prospects between “advanced” and “developing” economies diverge. Growth figures for 2023 will be sluggish in the US (1.6%), the eurozone (0.8%) and the UK (–0.3%), according to the International Monetary Fund, compared to 5.2% for China and 5.9% for India.2

With advanced economies facing growth headwinds and sticky inflation, and with market volatility picking up, now could be the time for investors to consider Asian fixed income. With solid fundamentals and attractive valuations relative to other regions – including emerging markets – we think a separate allocation to Asian bonds could be an effective antidote to broader market volatility and the global slowdown.

Asia is more than EM, and more than just China

Historically, global investors have tended to gain exposure to Asian fixed income through emerging markets (EM) indices. But as Asia has outgrown other regions economically over the last two decades, this approach has looked increasingly outdated.

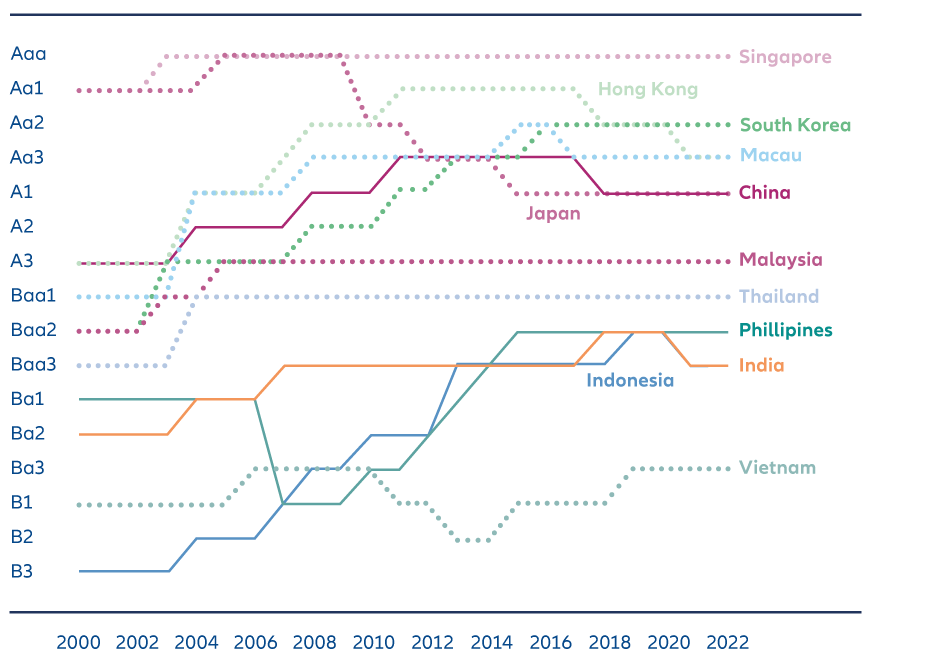

Asia features a combination of developed and emerging markets, including Singapore, South Korea, Hong Kong and Macau which boast AAA and AA ratings, the highest two notches on the credit rating scale. The region’s strong growth has also helped many so-called emerging markets improve their sovereign credit ratings, as Exhibit 1 shows. A good example is Indonesia, whose rating from Moody’s has risen from B3 to Baa2 over the last two decades.

Exhibit 1: Asian sovereign ratings on the rise

Source: Bloomberg, Moody’s, AllianzGI, as at March 2023.

Asia’s growth has been mirrored by its bond markets, which in our view have shaken off their EM label to become an established standalone asset class.

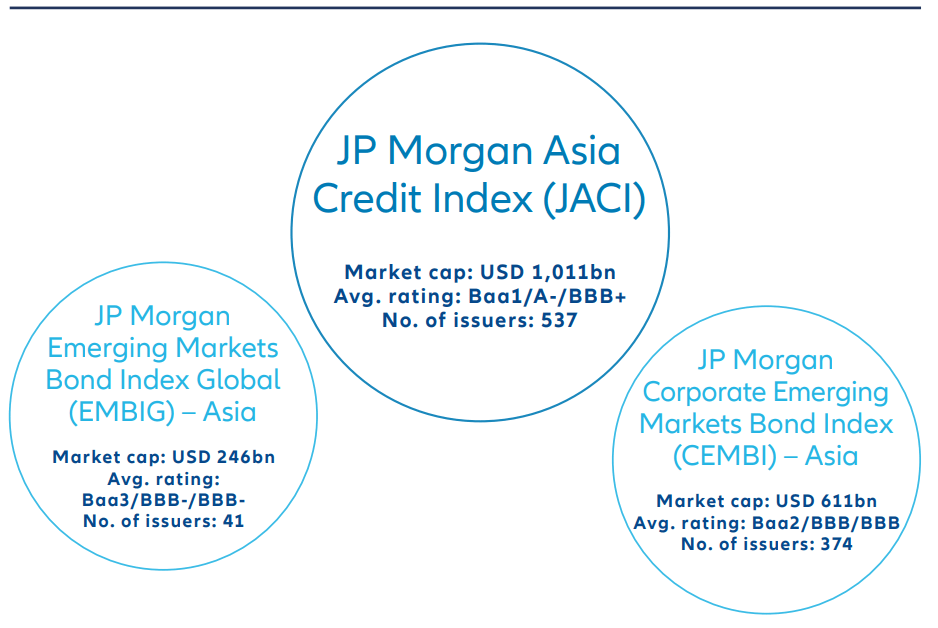

For example, the JP Morgan Asia Credit Index (JACI) – a popular index of USD-denominated Asian sovereign, quasi-sovereign and corporate bonds – has now reached a USD 1 trillion market capitalisation and features bonds from over 500 issuers. With an average rating of Afrom S&P and 85% of the index rated investment grade, it is a high-quality investment universe.3

As Exhibit 2 demonstrates, the size and depth of the Asian market can offer investors much broader and more diversified exposure to Asian issuers than popular EM bond indices such as the JP Morgan Emerging Market Broad Index (EMBIG) and the JP Morgan Corporate Emerging Exhibit 1: Asian sovereign ratings on the rise Source: Bloomberg, Moody’s, AllianzGI, as at March 2023. Market Broad Index (CEMBI). It is also worth noting that Asia is more than just China, with non-Chinese issuers accounting for 60% of the JACI based on market value.4

Exhibit 2: Asian fixed income is a standalone asset class

Source: JP Morgan, AllianzGI, as at 31 March 2023.

Why Asian fixed income?

In our view, Asian fixed income is under-owned and under-appreciated by global investors – partly because as mentioned they have traditionally relied on EM indices for Asian exposure.

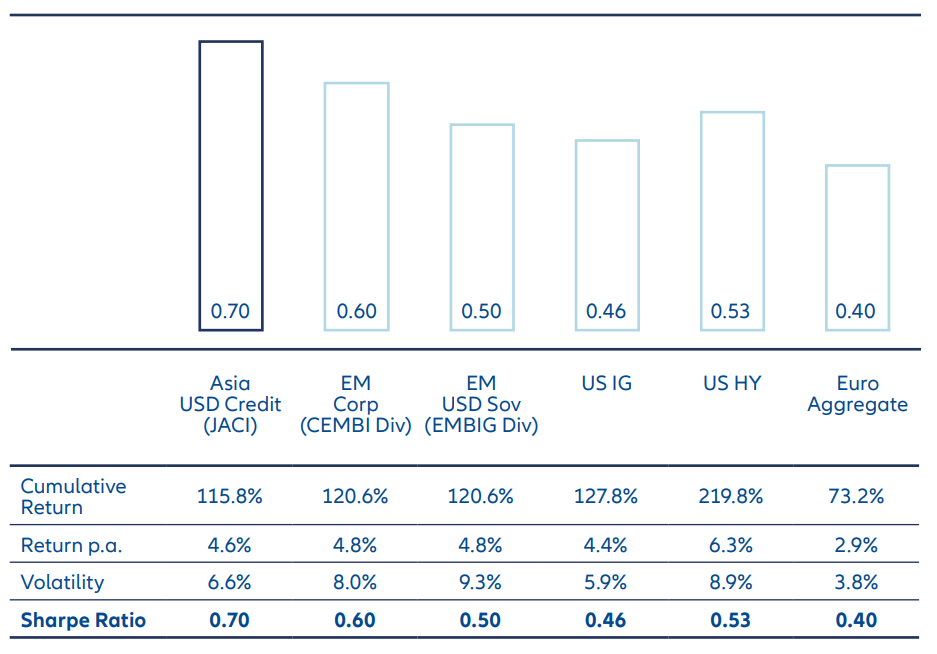

Yet as Exhibit 3 shows, Asian USD credit (as represented by the JACI) has historically demonstrated a superior risk-adjusted return vs other major developed and emerging economy bond markets.

Exhibit 3: Asian credit has historically offered superior risk-adjusted return

Source: Bloomberg, JP Morgan, AllianzGI as at 31 March 2023. Return figures are shown in USD. Calculation based on monthly data from 2006-2022.

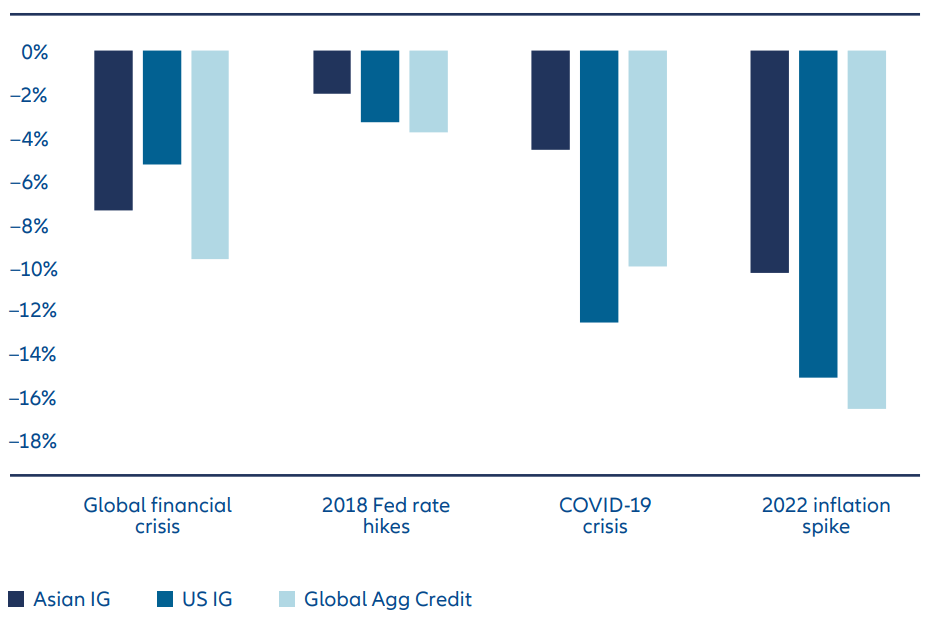

Asian investment grade (IG) bonds in particular have shown greater resilience than their US and global counterparts, with lower drawdowns during recent market crises (as shown by Exhibit 4).

Exhibit 4: Asian IG has shown lower drawdowns during crises

Source: Bloomberg, AllianzGI, as of 31 March 2023. Asian IG is based on the JPM Asia Credit – Investment Grade Index, US IG is based on the Bloomberg US Corporate Total Return and Glbl Agg Credit is based on the Bloomberg Global Aggregate Credit Total Return. GFC/Lehman Crisis (16/09/2008-09/03/2009), 2018 Fed Rate Hikes (02/01/2018 – 08/11/2018), Covid-19 Pandemic (19/02/2020 – 23/03/2020), 2022 Global Monetary Tightening (03/01/2022 – 30/12/2022).

Asian IG corporates demonstrate solid credit fundamentals, with low leverage (an average net debt/ EBITDA5 ratio of 1.8) and healthy liquidity (an average cash/short term debt ratio of 114%).6 With the major developed economies looking unlikely to avoid recession, markets could be volatile in the coming months and the resilience of Asian IG could offer some stability to investors’ portfolios.

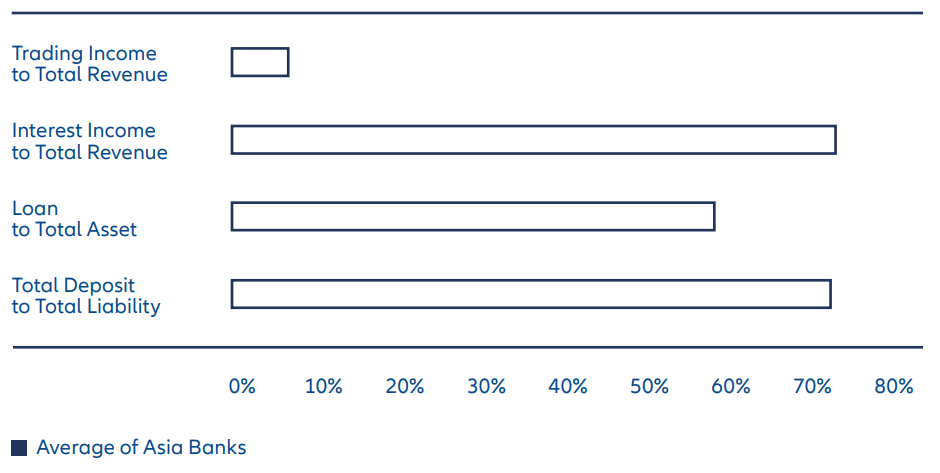

We also regard Asian banks as well capitalised institutions with strong liquidity. The Asian banking sector’s average liquidity coverage ratio (LCR)7 is 168%,8 for example, compared to around 150% for the largest European banks and around 120% for the largest US banks.9 Asian banks’ relatively low trading income as a proportion of total revenue, and relatively high proportion of deposits to liabilities (as shown by Exhibit 5), also compare favourably, and in our view reflect their historically more conservative model of deposit-taking and lending when compared to many Western banks.

Exhibit 5: Asian banks show solid fundamentals

Source: BofA Global Research, AllianzGI as at 31 March 2023.

Is Asian high yield still investable?

In addition to its large investment grade offering, Asian fixed income is also home to high yield (HY) bonds, with USD 156 billion of the USD 1 trillion JACI index mentioned above being rated HY.10

However, the Asian HY market has experienced two extremely challenging years due to widespread defaults among Chinese property developers – many of whom were HY bond issuers.

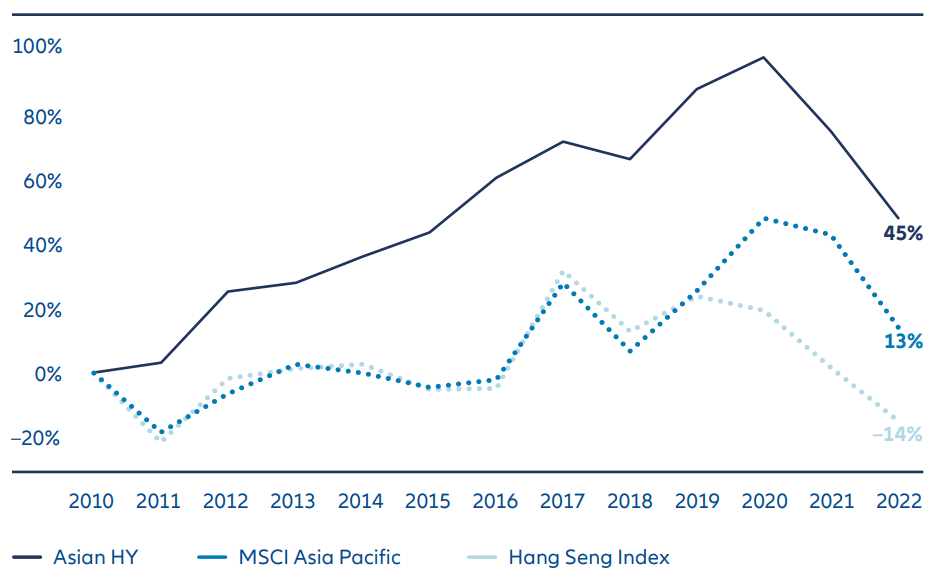

For years China, in our view, has been overly reliant on real estate for growth, with property and related industries accounting for some 25–30% percent of its economic output.11 Light regulation meant property developers were able to keep borrowing and expanding, supported by seemingly ever-rising property prices. That was until the Chinese authorities clamped down on the over-leveraged sector, sparking a severe downturn in the Chinese property sector. This heightened volatility eventually spilled into the broader market, and as such Asian HY saw a sharp drawdown after several years of strong returns which had outpaced even regional equity markets (see Exhibit 6).

Exhibit 6: Asian HY has outperformed regional equity markets since 2012

Source: Bloomberg, AllianzGI as of 31 March 2023.

Before this long overdue correction, Chinese property bonds had delivered double-digit annual returns and virtually zero defaults – an unsustainable situation that also gave investors very little information on potential restructuring outcomes or recovery values.

Now the sector has experienced its first “real” credit cycle we think the market is pricing in default risk more accurately, and with better visibility on potential outcomes we also think investors can analyse credits more effectively. However, we anticipate further defaults in the sector and expect volatility will remain high.

When it comes to ex-China Asian HY bonds, we have a more positive view. We expect corporate earnings to be largely robust out of South-East Asian corporates, for example, and the default rate remains low in this space.

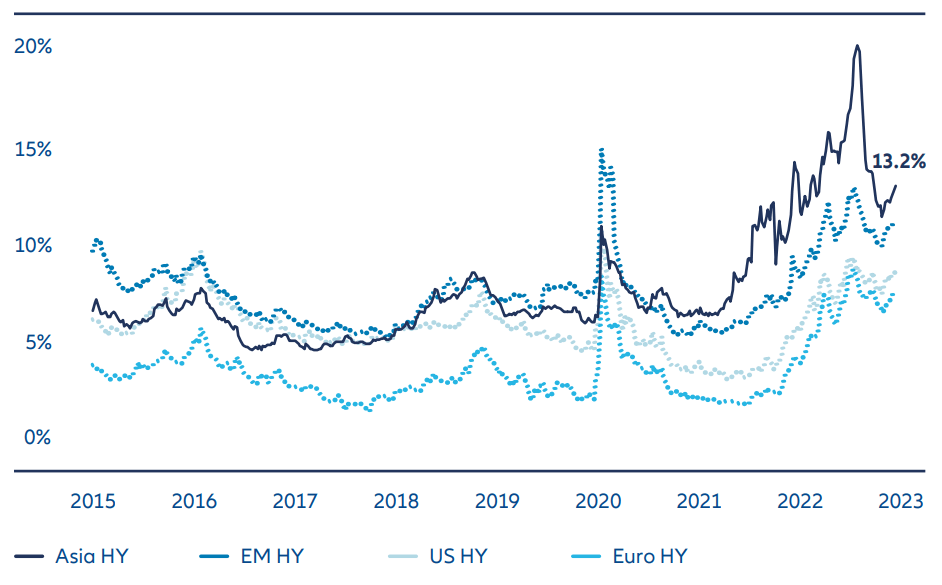

As Exhibit 7 shows, Asia is the highest-yielding HY market globally. Its 13.2% yield far outstrips developed markets such as US and European HY, but more notably it offers a healthy premium over EM HY – a premium that first emerged alongside the problems in China’s property sector.

Exhibit 7: Yields in Asian HY look attractive

Source: Bloomberg, AllianzGI as at 31 March 2023. Asia HY = JP Morgan Asia Credit Index (nonIG), EM HY = Bloomberg EM USD Aggregate High Yield Index, US HY = Bloomberg US Corporate High Yield Index, Euro HY = Bloomberg Pan-European High Yield (USD) Index.

Overall, given the lack of investor conviction on global macro prospects over the next six to nine months, we think a defensive and selective approach is appropriate in Asian HY with a focus on diversification and credit quality.

However, the long-term risk-reward ratio of Asian HY looks compelling to us, and with market valuations looking cheap on a historical basis we think the asset class may present opportunities for spread compression and attractive carry.

1 JP Morgan Asia Credit Index (JACI) as at 31 March 2023

2 World Economic Outlook, April 2023: A Rocky Recovery (imf.org).

3 JP Morgan Asia Credit Index (JACI) as at 31 March 2023.

4 JP Morgan Asia Credit Index (JACI) as at 31 March 2023.

5 EBITDA – earnings before interest, taxes, depreciation, and amortisation – is a widely used measure of cash profit derived from a firm’s core

operations.

6 JP Morgan, AllianzGI as at 31 March 2023.

7 The Liquidity Coverage Ratio (LCR) is a measure of banks’ short-term liquidity which measures a bank’s unencumbered high quality liquid assets

relative to the net cash outflows it could encounter under a severe 30-day stress scenario.

8 Moody’s as at 31 March 2023.

9 Fitch Ratings as at 31 December 2022.

10 JP Morgan, AllianzGI as at 31 March 2023.

11 China’s looming property crisis threatens economic stability | PIIE