Navigating Rates

US investment grade credit – does quality now come with yield?

With yields rising materially in line with higher interest rates, high-quality markets like US investment grade corporate bonds may offer attractive income. The asset class can also offer low correlation to other risk assets and some downside protection.

Key takeaways

- At USD 5.9 trillion, the US IG corporate bond market is one of the largest and most liquid asset classes in the world. Its size and scope may offer relative value opportunities and inefficiencies that can be captured via active portfolio management.1

- With interest rates now materially higher, investors can once again target income in this high-quality segment of fixed income.

- US IG corporates can be an effective diversification tool, having historically demonstrated low correlation to equities, US Treasuries and riskier fixed income segments.2

- The asset class can also provide some downside mitigation, having generally preserved capital better during periods of crisis than other risk assets and even US Treasuries.3

In a diversified portfolio comprising stocks, bonds, cash and alternative investments, for most investors the fixed income allocation may help protect capital in volatile periods and provide a reliable source of income over time.

For over a decade of low interest rates, balancing principal protection with the need to generate sufficient yield was a significant challenge. With interest rates having risen materially, higher-rated, lower-risk segments of fixed income such as US IG corporates are now offering higher all-in yields, meaning investors have less need to sacrifice credit quality in pursuit of returns.

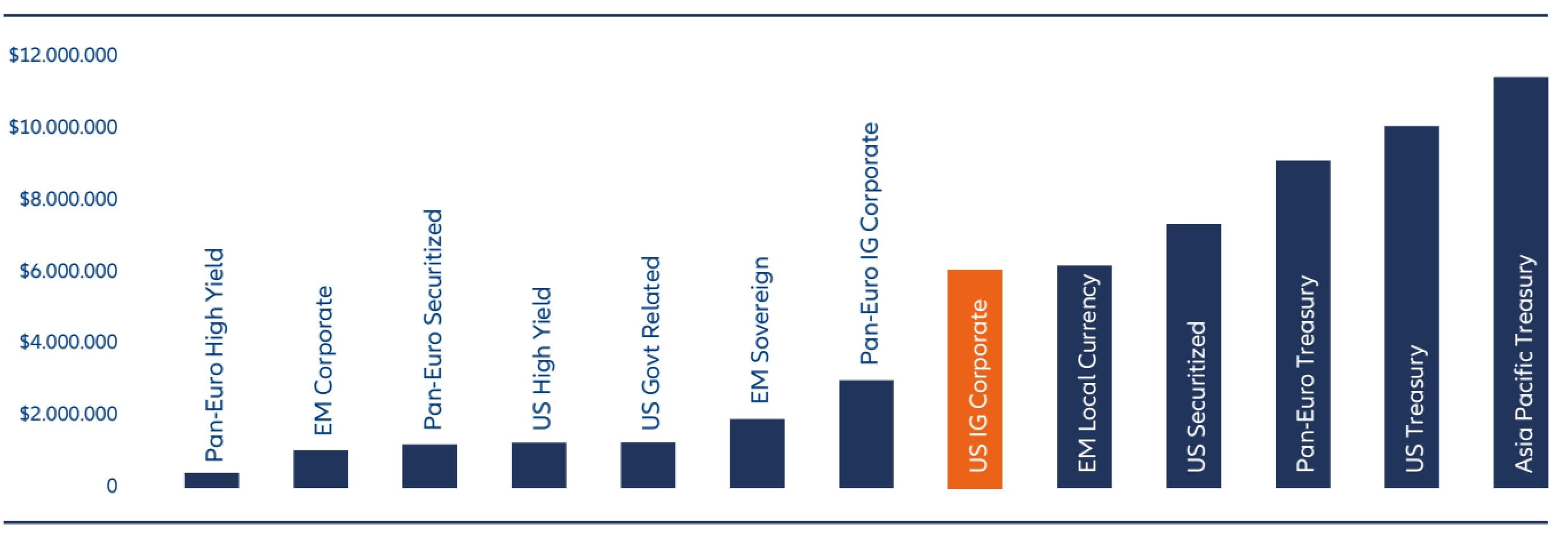

An allocation to US IG corporates also has potential diversification benefits, given the market is more than double the size of its European counterpart (see Exhibit 2) and differs in terms of both composition and duration. Technology companies, for example, make up 10.1% of the US market versus just 3.17% for Europe.4 The US market also features a much higher proportion of longer-dated bonds than its European counterpart, making its average duration 7.21 years versus 4.48 years for Europe.5

While yields have risen significantly across developed markets since early 2022, US IG corporates have historically offered more all-in yield on an unhedged basis (ie, nominal yields) than European IG corporates. This remains the case today: the average yield-to-worst on the US IG corporate index is 5.17% versus 4.22% for the Euro IG corporate index.6

Why US investment grade credit?

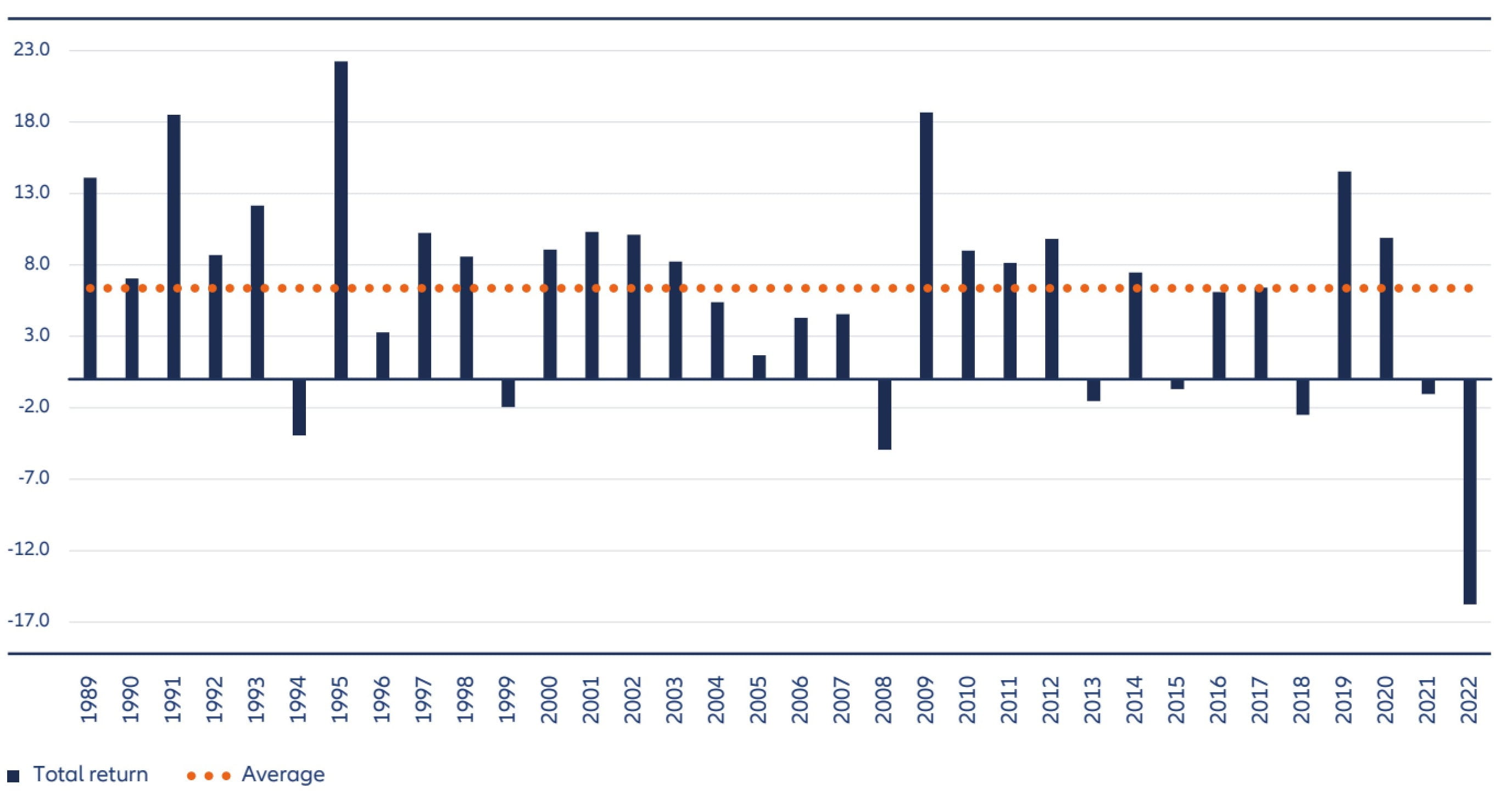

To qualify as investment grade, or IG, an issuing company must receive a credit rating of between Aaa and Baa3 from Moody's or AAA and BBB- from Standard & Poor's. As Exhibit 1 demonstrates, the relative financial stability of these companies has helped the US IG corporate segment generate long-term positive returns through multiple credit cycles.

Exhibit 1: US investment grade corporate index total return, 1989-2022

Source: Bloomberg Barclays as of 31 December 2022.

US IG corporate debt is one of the largest and most liquid markets in the world, having tripled in size since 2007 to stand at USD 5.9 trillion as of 31 December 2022.7

Exhibit 2: Size of the US investment grade corporate bond market

Source: Bloomberg, data as at 28 February 2023

The size and scope of the market may offer investors relative value opportunities and inefficiencies that may be captured via active portfolio management. We believe active management, driven by rigorous fundamental analysis and a keen awareness of how corporate management teams respond through various stages of the credit cycle, is key to exploiting these inefficiencies and generating consistent potential performance while mitigating to the downside.

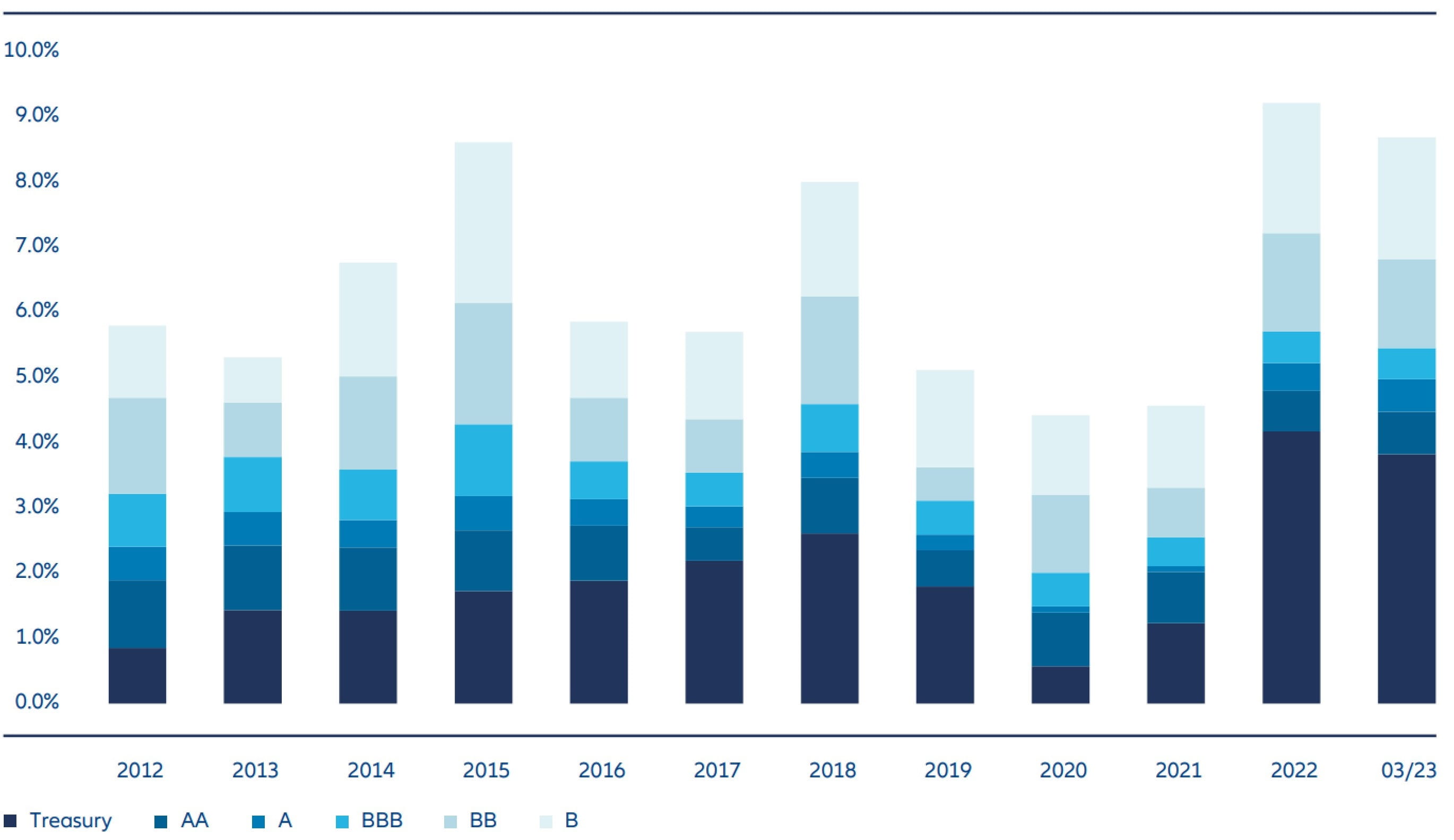

In addition, US IG corporate debt is arguably more attractively priced today than it has been for more than a decade, with all-in yields having risen sharply in line with interest rates as shown by Exhibit 3. Higher-quality, lower-risk assets like US IG corporates may help investors meet their yield requirements without needing to take undue credit risk in lower-rated segments of fixed income.

Exhibit 3: US bond yields by rating, 2012-2023

Source: Bloomberg Index Services Limited and Voya Investment Management. Treasuries represented by the Bloomberg US Treasury Index. Yields by credit quality represented by the Bloomberg US Corporate Aa, A and Baa subindices and the Bloomberg US High Yield Corporate 2% Issuer Cap Ba and B subindices.

While the breadth of the market and the yields available can look compelling, US IG corporates possess several features that may help investors mitigate their portfolios to the downside.

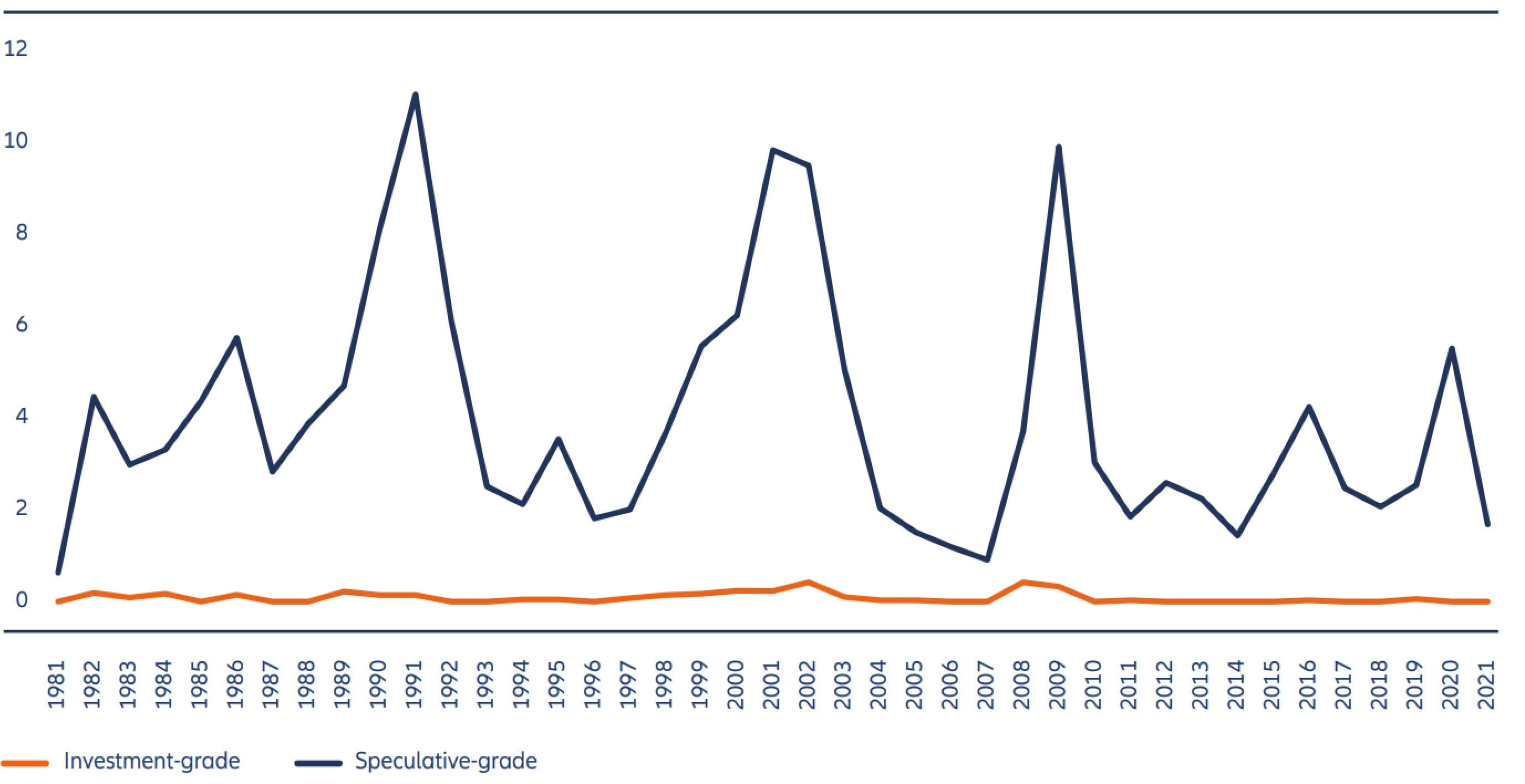

First, US IG corporate bonds have generally been a relatively safe asset class over time. As Exhibit 4 shows, corporate defaults within US IG credit have been infrequent and minimal over time compared to other credit-sensitive asset classes.

Exhibit 4: US corporate default rates, 1981-2021

Source: S&P Global Ratings Research and S&P Global Market Intelligence's CreditPro®, data as at end-2021.

Given the minimal and infrequent default risk over time, one key risk in the IG corporate market is idiosyncratic downgrade risk. While companies being downgraded to below investment grade – so-called “fallen angels” – is a relatively rare occurrence, a passive approach to investing in the IG corporate market may expose investors to this unnecessary additional downgrade risk, which is a key driver of spread volatility. Active managers aim to manage downgrade risk through credit selection, meaning that unlike passive strategies they may be able to avoid the downgrades that do occur.

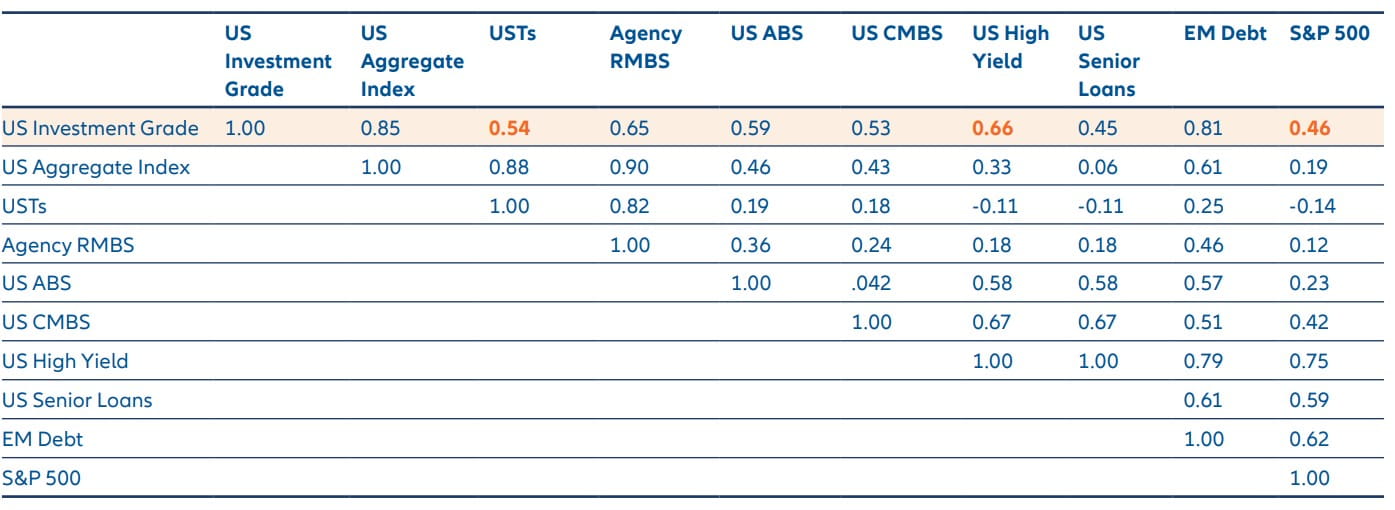

Second, a dedicated US IG corporate sleeve can serve as an effective diversification tool. As Exhibit 5 shows, the asset class has historically demonstrated low correlation to both equities and US Treasuries, as well as riskier segments of the fixed income market like emerging market debt, high yield bonds and leveraged loans.

Exhibit 5: US IG corporates’ correlation to selected asset classes

Source: Bloomberg, data as at 31 March 2023. Based on monthly returns from 31 January 2007 to 31 March 2023.

Third, as shown by Exhibit 6 below, US IG corporate bonds have historically delivered compelling downside mitigation during periods of significant market stress.

Looking at market returns in crisis periods over the last 20-plus years, the US IG corporate market outperformed senior bank loans and US stocks during the dot-com crash, the 2008 financial crisis, the European sovereign debt crisis, the 2015 energy crisis, the US Federal Reserve’s 2018 hiking cycle and the Covid-19 pandemic. Even allowing for a rebound year following each crisis, total returns for the US IG corporate market through all the combined crisis and rebound years exceeded those of the aforementioned markets.

US IG corporates did underperform US high-yield bonds in four of the five crisis-and-recovery periods, but the underperformance across all periods was a modest 7% and when accounting for the significantly lower volatility profile (a standard deviation of 1.74% vs. 2.70%), the underperformance versus high yield does not look too drastic.

Exhibit 6: Relative US IG corporate performance during crisis periods

(see below for accumulated)

Source: Bloomberg and Voya Investment Management, 31 December 2022

Perhaps even more surprising is that, as Exhibit 6 shows, over the same periods of crisis and recovery, US IG corporate bonds have typically delivered a better outcome than US Treasuries, a typical safe haven during volatile periods when investors are looking to conserve capital.

Is the yield back in US IG?

We believe that in current markets, US investment grade corporate bonds may be an appealing asset class.

Years of low interest rates may have tempted many investors into lower-rated parts of fixed income in pursuit of yield, but with rates having risen materially, US IG corporate debt is arguably more attractively priced today than it has been for more than a decade. With the economic outlook still uncertain, we see the potential diversification and downside protection characteristics of the asset class as additional positives.

In our view, US IG corporate bonds can provide strong, long-term risk-adjusted returns and diversification in investors’ fixed income portfolios.

1 See Exhibit 2.

2 See Exhibit 5.

3 See Exhibit 6.

4 Bloomberg Indices, data as at 31 March 2023.

5 Bloomberg Indices, data as at 31 March 2023. Note that we believe “pure” investment grade credit investing is about managing credit risk rather than duration risk, and there may be better ways for investors to manage interest-rate sensitivity in their portfolios, such as using interest-rate derivatives or allocating to more dedicated short-duration bond strategies.

6 Bloomberg Indices, data as at 31 March 2023. Currency-hedging costs can eat into nominal yields, particularly at a time of exchangerate volatility. Investors may consider potentially cost-efficient ways of managing exchange-rate moves cost such as through derivativesbased hedging strategies.

7 Bloomberg Indices, data as at 31 December 2022.