Achieving Sustainability

Healthcare: how to live better

Many of us embrace the idea of living to a ripe old age. Yet the resources required to sustain longer lifespans are a growing financial burden. While provision and funding of health services varies around the world, the growing pressures on the delivery of adequate care are almost universal – as is the need for long-term investment into the sector.

Key takeaways

- Ageing populations with multiple illnesses are set to increase medical costs, with healthcare spending already close to 10% of GDP for many countries.

- Emerging health issues caused by climate impacts will add pressure to health budgets.

- Investors can contribute to the positive societal and economic outcomes of improved health by directing capital to target new solutions.

- Our ReCLAIM health model identifies the sector’s risks and investment opportunities.

Improvements in public health, nutrition and medicine in recent decades mean many of us are living longer, but are we living better? Life expectancy increased by almost six years between 2000-2019,1 but failing health in later life is driving up healthcare costs which already account for almost 10% of GDP in OECD countries.2 Ageing populations and lifestyle changes are set to add to this financial burden. Additionally, climate impacts affecting health – for example, excess temperatures and exposure to unclean flood waters – will reveal new costs.

The price of living longer

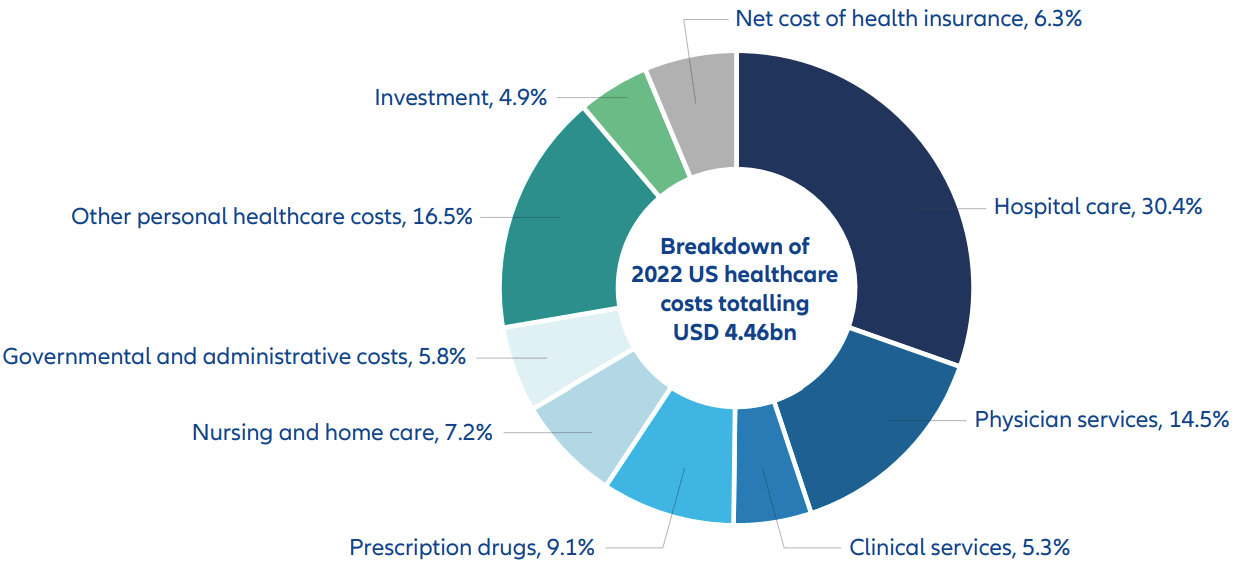

Healthcare has seen inflation pressures equivalent to those of energy and food in recent years.3 Despite pharmaceutical pricing making headlines, hospital care is the single largest cost, encompassing medical facilities, staff salaries, equipment, and patient care. Hospital resources will see greater demand for those with later life and lifestyle-related health issues. In the US – the largest single spender on health – more patients will depend on the 30% of its health budget already allocated to hospitals.

Exhibit 1: Hospital costs are draining healthcare budgets

Source: American Medical Association, Trends in health care spending | Healthcare costs in the US | AMA (ama-assn.org), April 2024

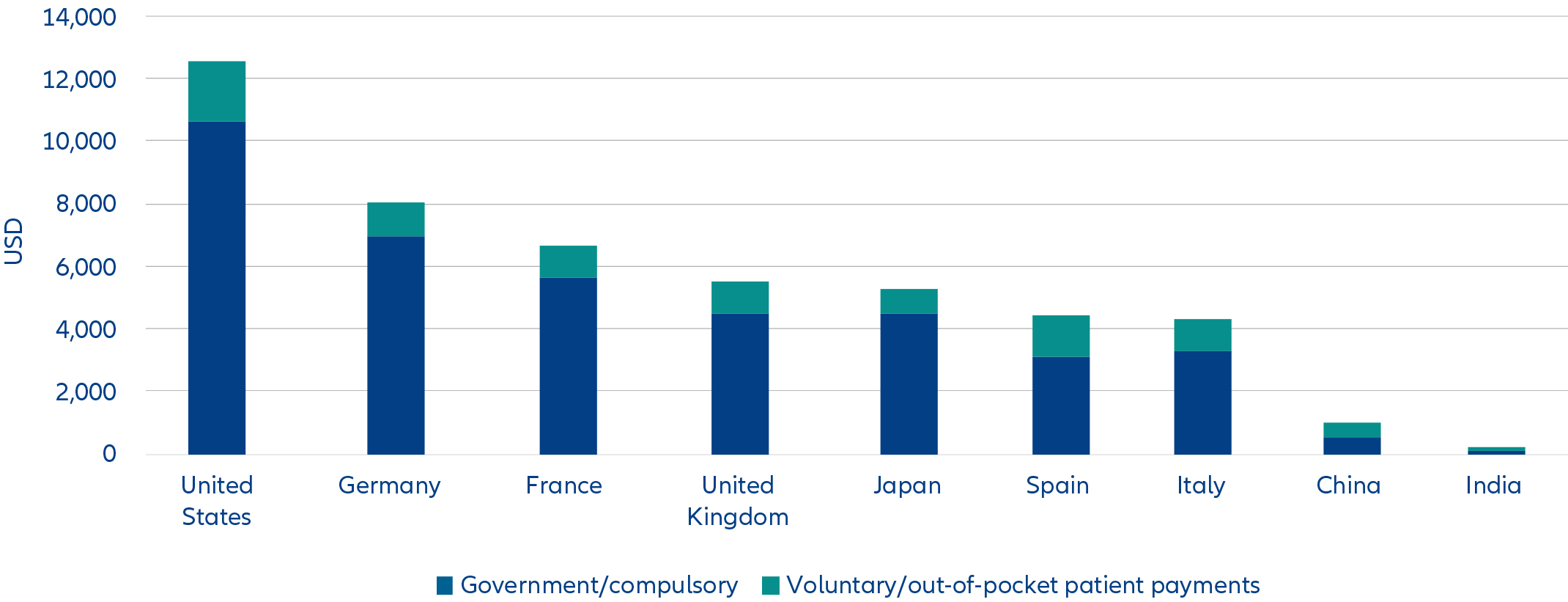

Rising costs can translate into rising additional patient payments, further increasing “catastrophic health expenditure”. This is defined as 10% of household income spent on health4 and currently applies to approximately 12% of the global population – over 800 million people. Moreover, patients face a further hike of more than 3% annually in these costs. The impact on patients of these spiralling costs varies with the differing models of medical care funding around the world. These models can be grouped into three broad categories: taxation, private health insurance, and social health insurance. Additionally, in some countries health is a pure out-of-pocket expense.

Exhibit 2: Health costs per capita by country in 2022

Source: OECD, Health at a Glance 2023, November 2023

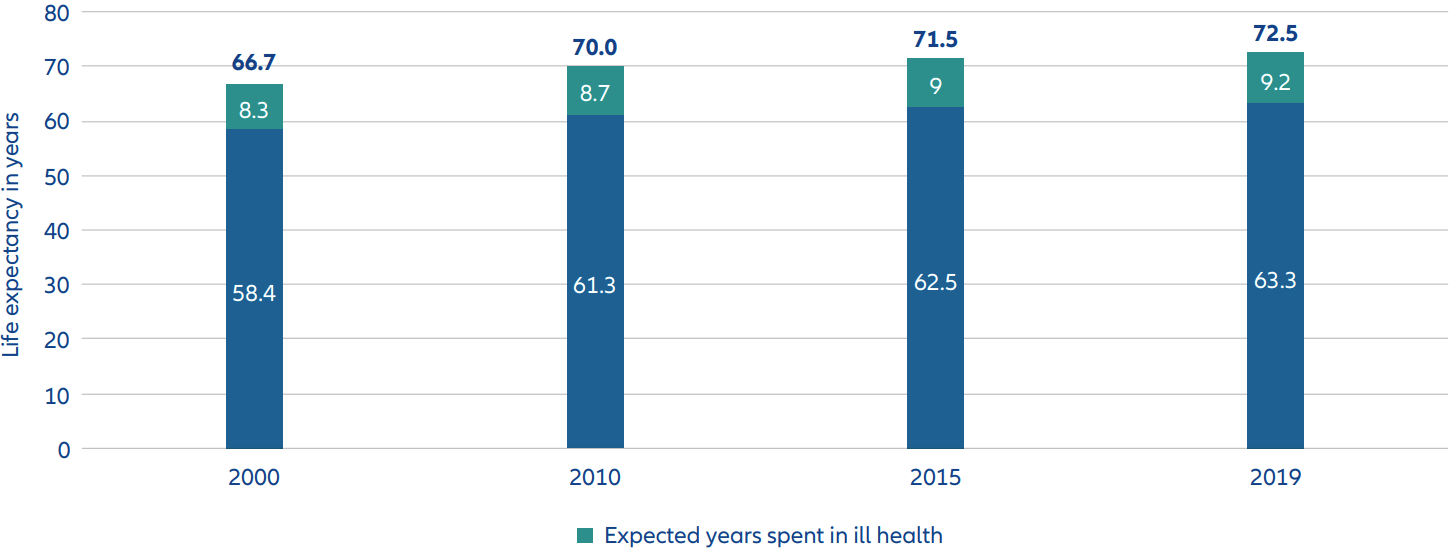

What is universally true is that health costs ramp up for end-of-life services because living longer means more years spent in ill health – see Exhibit 3. For US federal medical insurance programme, Medicare, 25% of annual spend goes to 5% of patients in the last year of their lives.5

Exhibit 3: Longer lives are increasing years of ill health

Source: WEF, Transforming Healthcare: Navigating Digital Health with a Value-Driven Approach, January 2024

Getting what you paid for?

These rising costs further contribute to the significant inequality in medical care with half of the global population lacking access to essential health services.

Additionally, strained healthcare budgets bring the challenges of limited drug choice, high patient waiting times and restricted availability of nonemergency procedures and operations.

There is also a worrying economic impact in lost productivity for workers in poor health. This reduced labour market participation and income can drive additional mental and physical health issues.6

ReCLAIMing better health

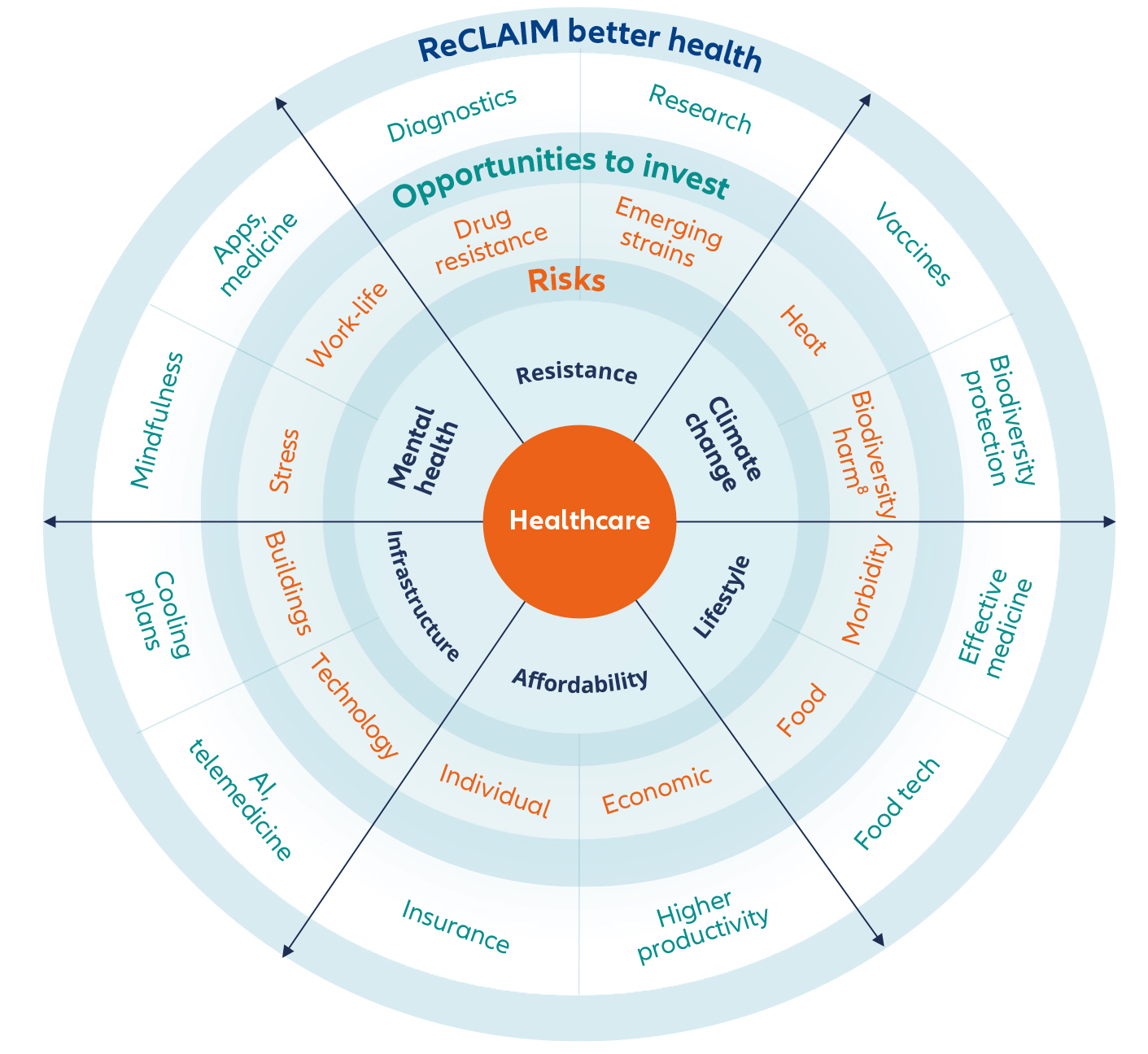

How can investment drive better health? We have developed a model to simplify the wide-ranging scope of health issues. Our ReCLAIM model7 identifies six broad areas where we see risks and outline opportunities to finance a healthier future.

Exhibit 4: Our ReCLAIM model of healthcare risks and opportunities

Source: Allianz Global Investors, May 2024

ReCLAIM model: six key health issues to address

1. Resistance

Antimicrobial resistance has emerged as a major global public health threat. It occurs when bacteria and other microorganisms evolve to evade the effects of antibiotics and other antimicrobial treatments.9 Treating infections can become difficult or even impossible and increases the risk of disease spread, severe illness, disability, and death.

In April 2024, the World Health Organization (WHO) highlighted the potential for the H5N1 strain of bird flu to spread to other species, including humans. This follows reported human infections10 and particles of the virus being found in cow’s milk sold in US stores.11 The WHO has already warned any new pandemic could be a flu virus and Covid-19 starkly highlighted the cost and time required to develop antidotes to such fast-spreading severe infections.

2. Climate change

The effects of heatwaves on the general population are already well-documented, with older age groups and those with underlying illnesses particularly at risk. The International Labor Organization also estimates that over 70% of the global workforce may be exposed to climate change-related health hazards with 1.6 billion outdoor workers continuously exposed to air pollution, extreme heat and UV radiation. These issues are linked to cardiovascular and respiratory conditions, and some cancers. Outdoor air pollution is a particular concern as hazard encapsulation12 and ventilation are not always applicable to outdoor environments giving employers and workers little or no control over sources of pollution.13 Existing occupational health and safety measures are struggling to keep pace with these escalating risks.

3. Lifestyle

Limited exercise and poor diets are increasing morbidity and burdening healthcare systems. Combined with ageing populations and an increase in long-term medical conditions means multimorbidity is set to rise.14 Multimorbidity refers to having two or more long-term medical conditions requiring more healthcare resources for complex care needs that are costly and challenging. This can mean more frequent hospital admissions, longer hospital stays and access to multiple medical specialists during a typical year.15

One example is Type 2 diabetes, which is linked to diet and weight issues and can cause blindness, heart disease and lower limb complications. This is a growing concern as approximately 1 in 8 people are considered obese, with the overweight population now surpassing the number who are underweight.

4. Affordability

Most European countries have achieved universal coverage of health care costs for a core set of services – consultations with doctors, tests and examinations, and hospital care. This gives patients some financial protection from unexpected costs.16 Nevertheless, the extent of healthcare coverage can vary and, while private insurance can accelerate access to healthcare services, additional costs often apply.

5. Infrastructure

Resilient infrastructure is needed to mitigate climate and physical health risks, to the extent that, during COP 26 in November 2021, a group of 50 countries committed to develop climate-resilient and low-carbon health systems in response to rising evidence of climate impact on health.17 Infrastructure priorities include sanitation, clean water, and energy security.

Furthermore, access to medical resources remains concentrated in urban areas where an estimated 56% of the population lives. With larger numbers expected to move out of cities public health investment in rural areas remains inadequate and a significant increase is required to support sizeable rural populations.18

6. Mental health

The Covid-19 pandemic brought greater recognition of the scale of poor mental health. This is increasingly linked to lower productivity and social care implications, with estimated costs of up to USD 14 billion annually in lost productivity, absenteeism, and employee turnover.19

Opportunities to invest in health

How does this translate into investment opportunities? We see strong potential for investment capital to drive improvements in delivery and access to better healthcare for all. There will be significant costs to mitigate these risks, but the economic benefits are also significant in terms of limiting the rise in costs relative to GDP, reducing health inequality (from both rising health costs and insurance premiums) and boosting productivity.

Preventing morbidity

Investing in research and development for innovative and effective medicine can help mitigate the healthcare burden. Such new treatments can target lifestyle-driven conditions, eg, Type 2 diabetes and morbidity, as well as cancers and mental health. This would also target environmental-change conditions like fevers and microbial infections. New curative drugs, eg, for hepatitis C are already available and gene therapies for rare diseases have been developed recently.

Tackling climate impacts

The planet is getting hotter, and heat raises the risk of new diseases and virus infections migrating to previously unaffected countries.20 This requires development of vaccines to prevent severe diseases, such as dengue and West Nile fever, migrating to northern geographic areas. In addition, respiratory solutions will be in demand as hot, humid air can increase conditions like asthma and chronic obstructive pulmonary disease.

Embracing technology

The rapid rise in artificial intelligence (AI) capabilities is helping to accelerate drug discovery, enhance product quality, and cut costs of clinical trials, by early and efficient identification of key failure points in critical stages of drug analysis.21 New solutions need to be supported by equivalent improvements in healthcare access. Telemedicine is critical in improving access to care and diagnostics applicable across borders and in rural areas where it can be more cost efficient than traditional points of access.

Improving infrastructure

Greater investment in healthcare infrastructure will be needed to adapt to higher heat and physical risks. Cooling plans, often developed by governments and municipalities, will require investment in hospitals to implement new infrastructure like improved air conditioning, while installing alternative electricity sources, eg, solar panels can mitigate energy-related physical risks.

It is clear that resetting current fractured health services must become a long-term priority for governments, investors and other stakeholders. It has famously been said that health is the greatest wealth. Preserving this wealth means directing capital towards solutions for a healthier future, supporting economic growth and driving social cohesion.

1 Source: WEF, Transforming Healthcare: Navigating Digital Health with a Value-Driven Approach, January 2024

2 Source: OECD, Health Statistics 2023

3 Source: McKinsey & Company, The gatherting storm: transformative impact of inflation on the healthcare sector, September 2022

4 Source: WHO, SDG 3.8.2 Catastrophic health spending (and related indicators), 2024

5 Source: National Library of Medicine, Medicare cost at end of life, August 2019

6 Source: OECD, Health at a glance: Europe 2016, 2016

7 ReCLAIM is an acronym of Resistance, Climate Change, Lifestyle, Affordability, Infrastructure and Mental health, developed by Allianz Global Investors’ Research team

8 An example of this is zoonoses which are diseases or infections that are naturally transmissible from vertebrate animals to humans, WHO, July 2020

9 Source: WHO, Antimicrobial resistance, November 2023

10 Source: WHO, Avian Influenza A(H5N1) – United States of America, April 2024

11 Source: CDC, Current H5N1 Bird Flu Situation in Dairy Cows, July 2024

12 Encapsulation is a remedial solution to help in the prevention of fibre release from hazardous fibrous materials

13 Source: International Labour Organization, Climate change creates a ‘cocktail’ of serious health hazards for 70 per cent of the world’s workers, April 2024

14,15 Source: National Library of Medicine, Multimorbidity: What do we know? What should we do?, February 2017

16 Source: OECD, Population coverage for health care | Health at a Glance: Europe,2020

17 Source: WHO, Countries commit to develop climate-smart health care at COP26 UN climate conference, November 2021

18 Source: World Bank, Urban Development Overview, October 2022

19 Source: Deloitte, 2023 Global Health Care Outlook, 2023

20 Source: Allianz Global Investors, Health is wealth, October 2023

21 Source: Allianz Global Investors, The healthcare industry is using AI to transform drug discovery, November 2023