How China can achieve its ambitious decarbonisation plan

Summary

China’s pledge to achieve net-zero by 2060 appears ambitious, but it is central to the country’s broader strategic interests and the pathway to realising its goal could provide new opportunities for investors.

Key takeaways

|

When China’s President Xi Jinping announced an ambitious set of decarbonisation goals to the UN General Assembly in 2020, some wondered what the real motives could be. China would aim for peak CO2 emissions by 2030, he stated, and for carbon neutrality by 2060.

Today, the answer is becoming increasingly clear; with approximately one fifth of the world’s population and a vast land mass, it is natural that China would take a long-term strategic interest in limiting climate change and its destabilising effects.

But China’s decarbonisation targets go beyond the country becoming more responsible as a global citizen; carbon neutrality also serves China’s long-term strategic interests on other fronts. For instance, leading in the race for net zero could bolster technological leadership, while home-grown renewable energy should secure energy supplies in a country that relies heavily on imported crude oil and natural gas.

It is important to note, however, that China’s path towards net zero will not be linear. Progress towards the end goal needs to be balanced by economic stability and energy security, and the journey will not be smooth.

Three levers of progress

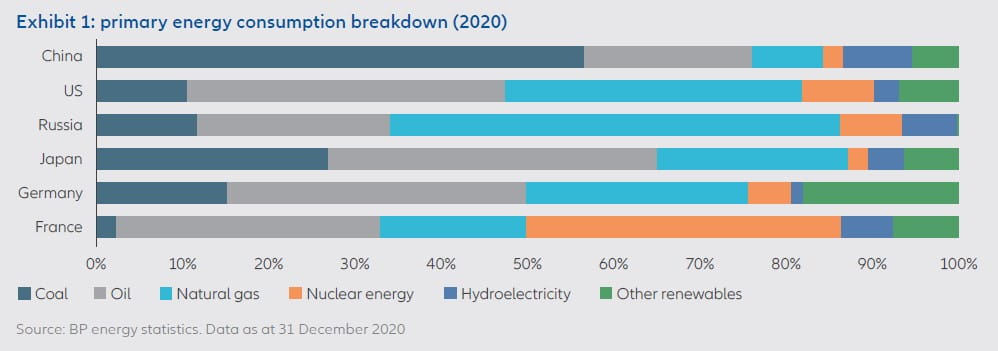

The task facing China is huge. The country is currently responsible for around a third of the world’s CO2 emissions – more than the US, Europe and Japan combined. Further, with gross domestic product (GDP) per capita still lagging mature economies, emissions are a long way from naturally peaking. And, as Exhibit 1 shows, the country still relies on coal – the most polluting fuel – for half of its energy:

Even so, China seems committed to achieving net zero and will pursue it using a number of different “levers”. The three key levers which each bring possible investment opportunities are:

Energy efficiency improvement through enhanced technologies, improving the power generation mix and transforming the national power supply system, and the long-term decarbonisation of heavy manufacturers.

According to Tsinghua University, one of China’s leading climate change faculties, energy efficiency improvements will likely have the most immediate part to play in decarbonisation. Temperature-proof building materials, automated production processes, smart route planning and industrial recycling are some examples of the ways China could achieve these efficiency improvements.

The electrification of transportation is another key factor. China accounted for around half of global sales of electric vehicles (EVs) during 2021 and it hosts six of the top 10 battery manufacturers globally (see Exhibit 2). The country is also electrifying buses and railways. Semiconductors and the software powering advanced driving systems are just two of the opportunities that electrification could provide for investors.

Outside of energy efficiency, improving the energy mix will be essential. The International Energy Agency estimates that by 2060, around 74% of China’s primary energy consumption should come from wind, solar, hydro or other renewables.1 Advances in this area have already been swift: in 2021 China represented about a third of wind and solar installation globally. This means China’s domestic market has a mature supply chain. It is already competitive internationally and is exporting wind turbines to southeast Asian and European markets

Within China, though, there is a natural mismatch between renewable energy generation and consumption. Wind and solar power are generated mainly in the north and west of the country, but chiefly used in the eastern coastal cities. Also, the peak time for solar generation is around lunch, while peak usage is in the evening. In order to overcome this imbalance and match generation with usage, China will need ultra-high-voltage power transmission, an intelligent national power grid system, an abundant energy storage system and a well-designed market mechanism to allocate energy in the most efficient way, all of which should create further investment opportunities.

The third lever is likely to also be the most difficult – decarbonising heavy manufacturing. Technological breakthroughs in areas such as carbon capture and hydrogen steel will be key to reducing emissions in the most polluting areas, such as steel, cement and aluminium, which underpin the economically critical property and infrastructure sectors. China’s state-owned enterprises are leading the way in this area but, in reality, we are unlikely to see practical benefits in terms of meaningfully lower carbon emissions in the near term.

Room for improvement in corporate targets

China’s path towards carbon neutrality by 2060 has been charted and progress is being made. Even so, despite the government’s commitment, individual companies have been slower than those elsewhere to formalise climate policies and set quantitative carbon reduction targets. There is a perceived lack of the specialist skills, tools and science-based framework required but it should be remembered that China is only two years into this journey, and that many companies are still ramping up for the long-term change required.

We expect companies in China to follow the government’s lead. Corporate frameworks should follow soon, and with them the transparency that investors increasingly seek. Such change will give further evidence of China’s accelerating drive for decarbonisation – and the investment opportunities it is yielding

1 Source: An Energy Sector Roadmap to Carbon Neutrality in China, International Energy Agency, September 2021

Information herein is based on sources we believe to be accurate and reliable as at the date it was made. We reserve the right to revise any information herein at any time without notice. No offer or solicitation to buy or sell securities and no investment advice or recommendation is made herein. In making investment decisions, investors should not rely solely on this material but should seek independent professional advice. However, if you choose not to seek professional advice, you should consider the suitability of the product for yourself. Investment involves risks including the possible loss of principal amount invested and risks associated with investment in emerging and less developed markets. Past performance of the fund manager(s), or any prediction, projection or forecast, is not indicative of future performance. This material has not been reviewed by any regulatory authorities.

Switching the energy transition to sustainable gears

Summary

Emerging markets have had a tricky year so far, but we don’t expect a broader crisis for EM debt, and there are reasons for optimism about a recovery.

Key takeaways

|