3 There is no guarantee that these investment strategies and processes will be effective under all market conditions and investors should evaluate their ability to invest for a long-term based on their individual risk profile especially during periods of downturn in the market.

We provide strategic asset allocation solutions tailored to each client’s unique investment situation, as well as identify ways to seek improved portfolio outcomes through a portfolio construction of best-fit investment products customised to your objectives.

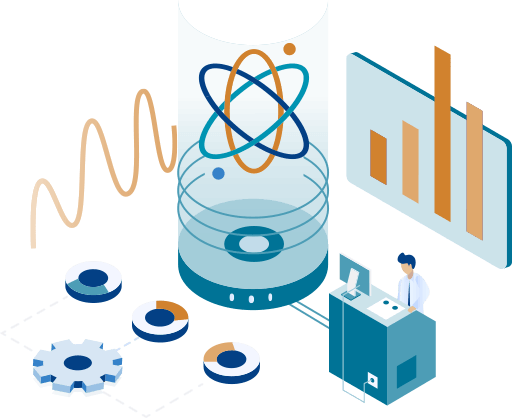

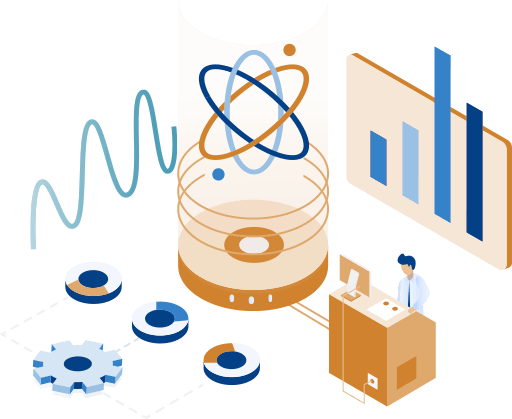

Asset Allocation Advisory Process: Our asset allocation capabilities follow a clear and transparent process, leveraging a global academic network and quantitative models and methods.

We support with all strategic decisions along the investment process.

Investment Objectives

Market Assumptions

Investment Strategy

For guidance only.

Investment Objectives: We tailor the process to our clients’ needs

- Return target

- Liquidity requirements

- Investment restrictions

- Risk budget

- Investment horizon

- Asset class universe

Capital Market Assumptions: Our long-term Capital Market Assumptions are derived based on our proprietary Capital Market Model (CMM)

Asset Allocation and Portfolio Optimisation: Our optimisation methodology results in an efficient portfolio allocation aligned with your defined investment objectives. The subsequent evaluation measures your portfolio characteristics from a holistic perspective.

Optimiser

- Reduces parameter uncertainty through robust optimisation

- Also applicable in LDI context

For illustrative purpose only. LDI: Liability-driven investing; SAA: Strategic asset allocation. The above does not reflect any actual data or show any actual performance and are not indicative of future results.

Portfolio Construction: Robust portfolio construction is critical for a prudent implementation

For illustrative purposes only.

Liability-driven Investing (LDI)

- Our LDI strategy is customised to the client’s liability profile. The design always starts with the analysis of the liabilities.

- We minimise mismatch risks by addressing relevant risk factors and continuously realigning the portfolio to changes in the liability profile and the capital markets.

- Our LDI strategy allows to flexibly adjust the hedge ratio for each risk factor. This allows to opportunistically increase/decrease the hedge.

- The LDI strategy can be implemented as a close replication portfolio or as an active mandate with higher alpha aspirations.

- Ongoing support from risklab‘s analytical tools and capabilities.

” are trademarks which are registered in the United States of America (USA), the European Union (EU), Hong Kong and various other jurisdictions. Legal owner of the aforementioned trademarks is Allianz Global Investors GmbH, a German capital management company (Kapitalverwaltungsgesellschaft) registered with Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) under the German Capital Management Act (KAGB) which is also licensed as a provider of financial services in Germany.

” are trademarks which are registered in the United States of America (USA), the European Union (EU), Hong Kong and various other jurisdictions. Legal owner of the aforementioned trademarks is Allianz Global Investors GmbH, a German capital management company (Kapitalverwaltungsgesellschaft) registered with Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) under the German Capital Management Act (KAGB) which is also licensed as a provider of financial services in Germany.