China A-shares: Is now an opportune time to invest?

Summary

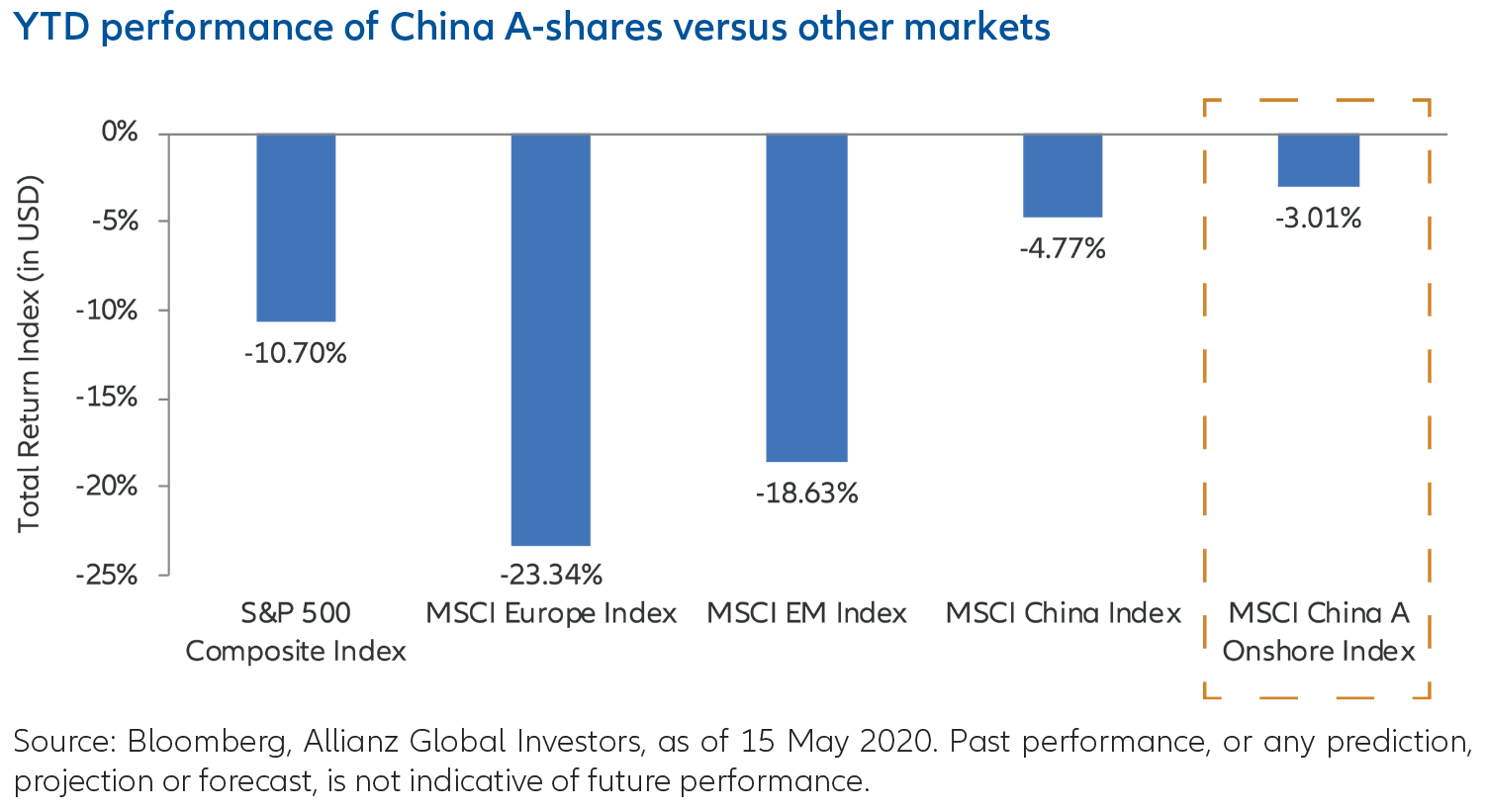

Which country’s stock market was more resilient than others during the COVID-19 pandemic? The answer may surprise many investors. As of 15 May 2020, the MSCI China A Onshore Index (USD) fell 3% year-to-date (YTD), outperforming China’s offshore indices as well as the European and US stock markets. Mr Anthony Wong, Allianz Global Investors’ co-lead manager for Allianz China A-Shares, explains the global stock market turbulence as primarily caused by the pandemic and the plunge in oil prices, but both have relatively limited negative impact on China’s A-shares market.

Foreign capital flows into A-shares despite COVID-19

While China was the first to face the COVID-19 outbreak, it was also the fastest to contain the disease, this has no doubt contributed to its stock market’s resurgence. As for oil prices, China is a crude oil importer, the oil and gas industry accounts for a minimal proportion in the A-shares market.Hence, the hammered energy sector had limited negative impact on the A-shares market.

More importantly, the A-shares market is dominated by individual retail investors, who are very sensitive to the Chinese government’s policies. Hence, when the state released economic stimulus measures, retail investors responded positively, contributing to the A-shares’ better YTD performance than other countries’ stock markets.

Moreover, the COVID-19 pandemic has not interrupted the trend of international capital inflow into A-shares through Stock Connect programmes. China is the world’s second-largest economy, but China’s A-shares makes up less than 1% in the MSCI World Index and merely 4% in the MSCI Emerging Market Index. As the A-shares’ weight in global indices is set to rise, it will become international investors’ go-to option for long-term asset allocation.

The recent stock market crash highlights the importance of risk diversification. Retail investors, who account for 80% of the A-shares market’s trading volume, invest differently from international institutional investors. Therefore, the A-shares market has a relatively low correlation with the foreign stock markets, making it a functional device for risk diversification.

Mr Wong noted that as the A-shares market gradually opens up, its correlation with other stock markets will increase gradually, but the process will be prolonged. He believes the A-shares market will remain relatively independent in the coming three years.

A-shares gained 40% since Donald Trump’s inauguration in January 2017

Going forward, Mr Wong believes the escalating US-China tensions will have minimal impact on the A-shares market. This is because the US institutional investors’ A-shares holdings account for only 1%1 of the A-shares’ total market value. In fact, the repercussion of the US-China relations on China equities has been overblown. From the beginning of Donald Trump’s presidential term on 20 January 2017 to April 2020, the MSCI China Index has accumulated a 42%2 gain, outperforming the US S&P 500 Index’s 37%2. Also, as China strives to reduce reliance on imported technology and electronic parts, it prioritizes homegrown research and development (R&D) and innovation. This benefits companies that with relevant technologies, providing investors with brand new investing opportunities.

Capturing opportunities in a diverse new economy

Mr Wong added, the COVID-19 pandemic has brought transformative changes to the mainland Chinese economic structure. In the past few years, there were still residents who were not used to online shopping or accessing electronic services. But during the nation-wide lockdown, many consumers have embraced digital technology and developed a habit of ordering daily necessities online. This has expanded the e-commerce industries’ customer base and offers potential opportunities for investors.

When compared to the Hong Kong stock market, the A-shares market features more diverse new economy sectors, such as 5G equipment, healthcare, biotechnology, industrial automation, new energy, and travel and entertainment, from which investors can capture enhanced returns from China’s economic restructuring.

Allianz China A-Shares:

• Allianz China A-Shares (the “Fund”) aims at long-term capital growth by investing in the China A-Shares markets of the PRC.

• The Fund is exposed to significant risks of investment/general market, country and region, emerging market, company-specific and currency (in particular RMB). The Fund invests in China A-Shares via the RQFII regime and the Stock Connect and thus is also exposed to the associated risks including quota limitation, change in rule and regulations, repatriation of the Fund’s monies, trade restrictions, volatility and stability of China markets, potential clearing and/or settlement difficulties, change in economic, social and political policy in PRC and Mainland China tax risks.

• The Fund may invest in financial derivative instruments (“FDI”) which may expose to higher leverage, counterparty, liquidity, valuation, volatility, market and over the counter transaction risks. The Fund’s net derivative exposure may be up to 50% of the Fund’s net asset value.

• Investment involves risks that could result in loss of part or entire amount of investors’ investment.

• In making investment decisions, investors should not rely solely on this material.

Note: Dividend payments may, at the sole discretion of the Investment Manager, be made out of the Fund’s capital or effectively out of the Fund’s capital which represents a return or withdrawal of part of the amount investors originally invested and/or capital gains attributable to the original investment. This may result in an immediate decrease in the NAV per share and the capital of the Fund available for investment in the future and capital growth may be reduced, in particular for hedged share classes for which the distribution amount and NAV of any hedged share classes (HSC) may be adversely affected by differences in the interests rates of the reference currency of the HSC and the base currency of the Fund.

1. Source: Goldman Sachs Global Investment Research, Wind, CEIC, US Department of Treasury, Bloomberg, as of 18 May 2020. The US holdings of China A-shares and HK-listed stocks are estimated based data disclosed by the US Treasury. The US ownership of US-listed Chinese stocks is calculated as the total US institutional holdings divided by the total listed market based on stock-level data from Bloomberg. 2. Source: ThomsonReuters DataStream, Allianz Global Investors, as of April 30, 2020. Performance data based on MSCI China Index and S&P 500 Index starts from 20 January 2017 to 30 April 2020. Past performance is not a reliable indicator of future results. 3. Source: Morningstar, as at 30/04/2020. Copyright © 2020 Morningstar Asia Limited (“Morningstar”). All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. 4. Source: AsianInvestor, the award is based on statistical data provided by independent third parties. The award is based on the performance of the Fund from Q4 2018 to Q1 2020. Allianz Global Investors Fund – Allianz China A-Shares was launched on 23 October 2019 upon the merger of Allianz Global Investors Opportunities – Allianz China A-Shares into the Fund. The performance information shown on or before the date of the merger has been simulated based on the performance of the relevant share class of Allianz Global Investors Opportunities – Allianz China A-Shares with the same investment objectives, risk profiles, and materially the same fee structures and investment policies of the relevant share class of the Fund. Predecessor fund (Allianz Global Investors Opportunities – Allianz China A-Shares) inception date: March 2009.

Information herein is based on sources we believe to be accurate and reliable as at the date it was made. We reserve the right to revise any information herein at any time without notice. No offer or solicitation to buy or sell securities and no investment advice or recommendation is made herein. In making investment decisions, investors should not rely solely on this material but should seek independent professional advice. Investment involves risks, in particular, risks associated with investment in emerging and less developed markets. Past performance is not indicative of future performance. Investors should read the offering documents for further details, including the risk factors, before investing. This material and website have not been reviewed by the Securities and Futures Commission of Hong Kong. Issued by Allianz Global Investors Asia Pacific Limited.