Achieving Sustainability

Back on track for a sustainable future

Transport represents a significant – and growing – contributor to global carbon emissions, accounting for over 20% of the global total in 2022.1 Decarbonizing transport is thus a priority in terms of the energy transition, and we are seeing a greater number of policy initiatives – such as the EU’s “Green Deal” and the Inflation Reduction Act in the US – that address this issue directly.

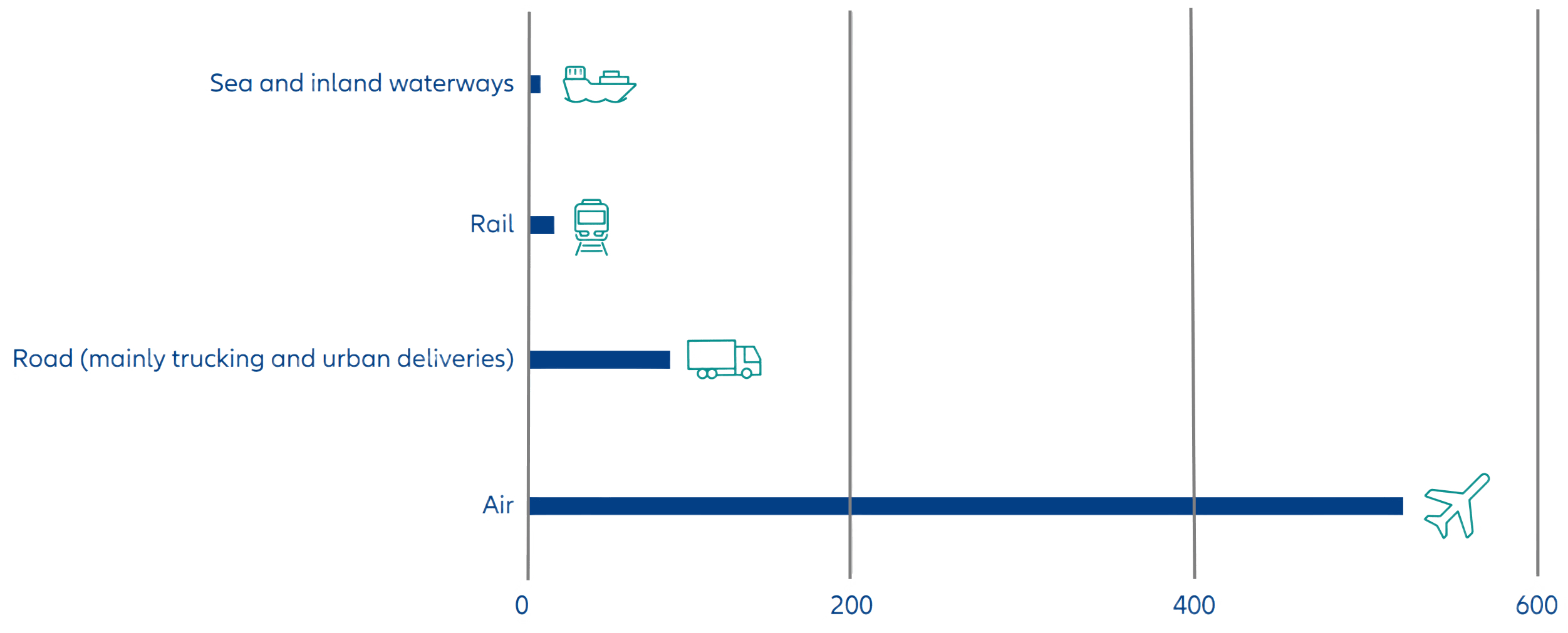

Global freight carbon emission intensity (kg) per billion-tonne kilometre in 2020

Source: MIT Climate Portal, June 2024

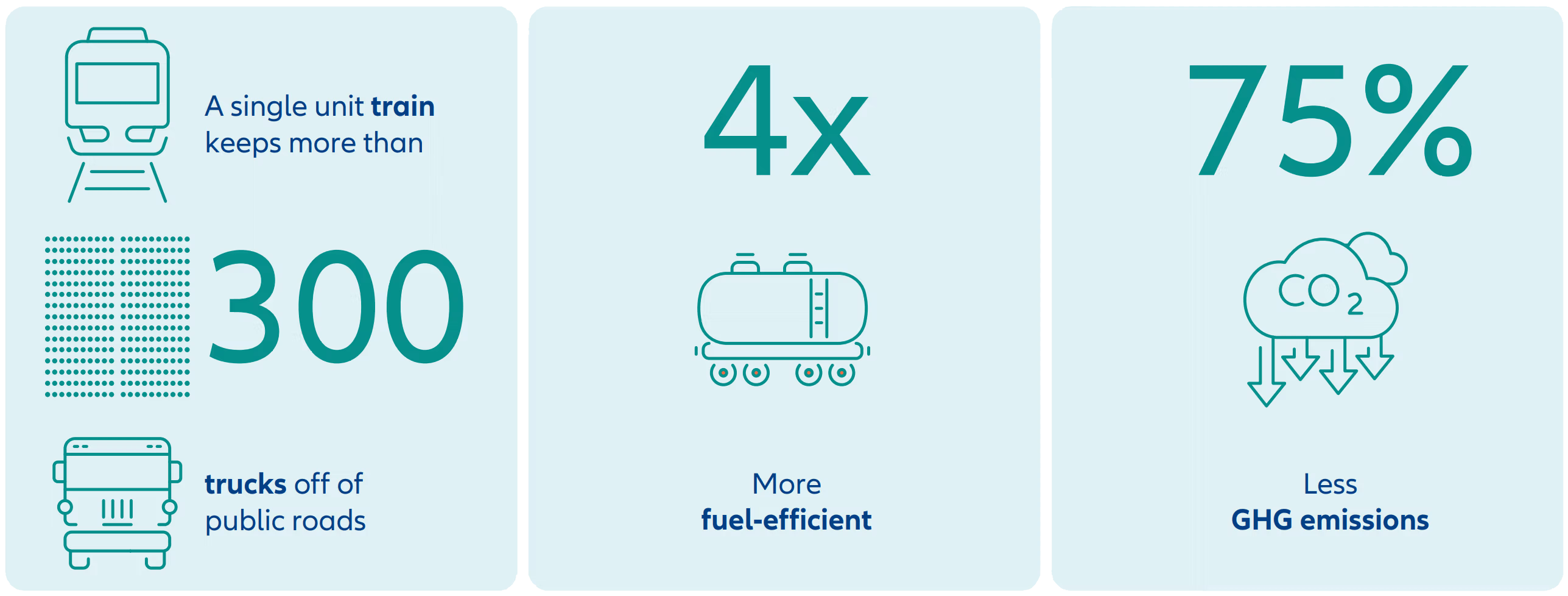

The superiority of rail (and water) over road (and air) here is clear, in terms of both emissions and costs per kilometre. Indeed, rail’s tonnage costs have also increased more slowly than road’s during the recent bout of high inflation. Yet its sustainability advantages go beyond purely cost and environmental factors. In the US, the railway industry provides employment to over 160,000 people – in skilled, unionised positions, earning over 50% more than the average US employee. And railroad employment also outperforms in a safety context, with employees far less likely to receive work-related injuries than in other transport

Rail vs. trucking

Source: MIT Climate Portal, June 2024

An investment perspective

Freight volumes alone are set to grow by 50% by 2050 in the US alone, and this figure is likely to be much higher in less economically developed markets. Given this growth and the environmental imperative to ensure that as much of this increase as possible takes place on rail as opposed to road, as well national governments’ legal obligations in terms of meeting climate targets, rail transportation clearly represents a sector of interest to us as investors with a sustainable approach. Indeed, alongside the ESG factors mentioned above, rail is well positioned to take advantage of other megatrends such as reshoring and putative “deglobalisation”.

We thus see this sector as benefiting from notable tailwinds, and this is reflected by developments on the ground. For instance, we recently saw the merger of two large North American players to form Canadian Pacific Kansas City (CPKC), the first – and, so far, only – transnational rail network joining Canada, the US, and Mexico, and stretching over 20,000 miles.3 Going forward, strategic assets such as this network will be crucial for the efficient transportation of goods across large landmasses – which is why this company is part of our current investment portfolio. Freight volumes in the US are currently dominated by road, with trucking taking over 40% of volumes and with rail lagging on around 30% – given current policy positions with regards to energy transition, it is clear the potential for growth, in terms of transitioning freight onto the railways, is huge.

This North American railway giant also provides an example of how sustainable equity investing benefits from a bottom up, active approach. On the surface, the company certainly fits the bill in terms of its growth potential and its role in mitigating carbon emissions. And beyond rail representing a much better alternative to road in terms of carbon, this advantage is potentially set to increase, with the development of hydrogen locomotives progressing apace. The provider in question has been experimenting in this area for some time, and recently purchased 18 hydrogen locomotives to accelerate its development of alternative traction.

Yet, we also see that this firm has best-in-class sustainability credentials in its own right, with a strong history of ESG disclosures, a strong improvement in fuel efficiency over the last decade, and a leader in safety, tying management compensation to relevant safety benchmarks.

This example thus shows how considering the broader picture – in terms of the metrics that will make a company a success in the long run – forms a crucial part of our philosophy of successful sustainable equity investing.

1 https://www.statista.com/statistics/1129656/global-share-of-co2-emissions-from-fossil-fuel-and-cement/

2 https://www.aar.org/data-center/#data-fact-sheets

3 A security mentioned as example above will not necessarily be comprised in the portfolio by the time this document is disclosed or at any other subsequent date