China is positioned to lead Asia’s economic recovery from the coronavirus

Summary

The coronavirus pandemic applied a sudden brake to China’s growth story, as it did to most economies around the world. But there are signs that China could be ready to lead the way out of the downturn and resume its long-term growth trajectory.

Key takeaways

|

Following the slowdown triggered by the coronavirus outbreak, China’s economic recovery continues to progress as companies get back to work, quarantine measures are relaxed, and people venture outside. A resumption of “business as usual” among Chinese consumers will be essential to any recovery. Domestic demand will be needed to drive Chinese growth, particularly as demand for Chinese exports may remain subdued because of the crisis. While the daily cases of coronavirus infection in China have fallen to single digit levels, many other countries – notably those in south and south-east Asia – are still seeing hundreds and thousands of daily new infections, which is restricting economic demand.

What drives economic recovery from coronavirus?

In China and wider Asian economies, the pace of recovery from the outbreak will be determined by four key factors: the stage of the pandemic, institutional capacity to manage and contain the virus, central banks’ capacity and willingness to provide stimulus, and each economy’s openness towards external trade.

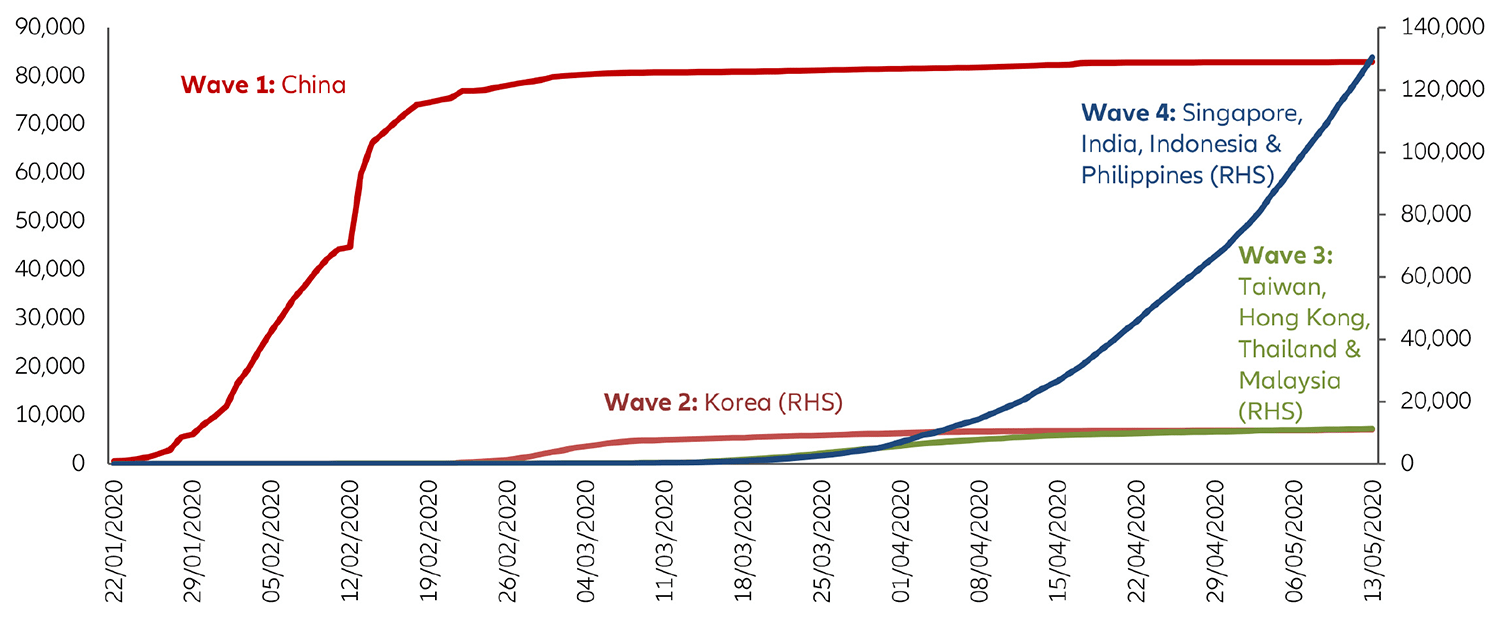

Daily confirmed infection cases in Asia

Source: Johns Hopkins University, MoH, MOPH, KCDC, Worldometers.info, AllianzGI Economics & Strategy, as of May 2020.

As the chart shows, in May the Chinese economy was already at a more advanced stage of the outbreak than any of its peers. Meanwhile, the government has been decisive in acting to bring the virus under control and looks set to continue making policy interventions to support China’s economic recovery. At the annual National People’s Congress meeting in May the Chinese government announced a widened fiscal deficit target to support the economy. In a bid to shore up employment, the government pledged RMB 4 trillion of tax exemptions for factories and retailers, waived contributions to social welfare funds, and reduced bank interest rates and utilities costs.

The government had already announced a new round of fiscal and monetary policy easing, introducing RMB 3.75 trillion of special local government debt and RMB 1 trillion of special treasury bonds. Meanwhile, the People’s Bank of China (PBoC) further lowered the reserve ratio required of banks, to provide greater liquidity and lending to the country’s small and medium sized businesses.

While supportive, these moves fell short of the expected levels of intervention, as China resists taking on too much debt as it did after 2008. However, the government has made it clear that it has further fiscal, financial and social security policies in reserve that it will roll out “without hesitation” if it considers further intervention necessary.

Beyond the coronavirus pandemic, the main risk facing China (as well as wider Asian markets and global trade) could be the resurgence of trade tensions with the US. President Trump may put China at the centre of his re-election campaign. Any heightened rhetoric or increased tariffs could be negative for market sentiment.

How will other Asian economies fare?

Looking at other Asian economies, South Korea and Taiwan are also at an advanced stage of the pandemic, with a low risk of a second wave outbreak. As such, we expect them to follow close behind China as their economies gradually recover. We expect south and south-east Asian economies – in particular India, Indonesia and the Philippines – to endure further difficulties before recovering. This is mostly due to the ongoing spread of the pandemic in those nations, which are still seeing a rising number of new infection cases. We do not think the fiscal stimulus provided by these economies will be enough to offset the drag caused by the coronavirus outbreak.

Stock markets have rebounded, but expect more volatility ahead

Equity performance within each country is likely to be influenced by the expected severity of the pandemic, along with the future likelihood of idiosyncratic risks (such as a systemic credit default), and the risk of a negative geopolitical event with the potential to derail any recovery. Again, China scores well on these metrics, along with Taiwan and South Korea.

However, equity prices within these markets have already recovered significantly since the lows of late March, so investors should exercise caution and expect volatility going forward. When it comes to fixed income investment, we see a low likelihood of restructuring among Asian public debt so would recommend investors to overweight sovereign and quasi-sovereign credit. These securities were sold off due to market concerns, causing spreads to widen above historical levels which offer good value. Again, we are more favourable on the North Asian economies – particularly China – and less so on south and south-east Asian economies.

China set to be “first in, first out” of the coronavirus

Like all economies around the world, China has been impacted by the coronavirus outbreak. However, the Chinese government has taken decisive actions to contain the outbreak, stimulated business activity, and made the necessary policy interventions to support its economic recovery.

Just as it was the first into the crisis, China appears well positioned to be the first out and continue its growth trajectory. Risks remain, but China’s continued establishment as a central hub of the world economy should see it lead the way on the long path to recovery.

AI and 5G: the positive feedback loop

Summary

When Mount Tambora erupted in 1815, the ash blacked out the sun. Temperatures fell across the globe. Food prices soared. Horses starved and were put down. There was a transportation crisis. So, Karl von Drais invented the Laufmachine. It was supposed to be faster than a trotting horse and it was at the time, an incredible innovation. Today, we call this device, the bicycle.