1. This fund has offered the best return over the past six months. Should I switch my retirement investment to this fund?

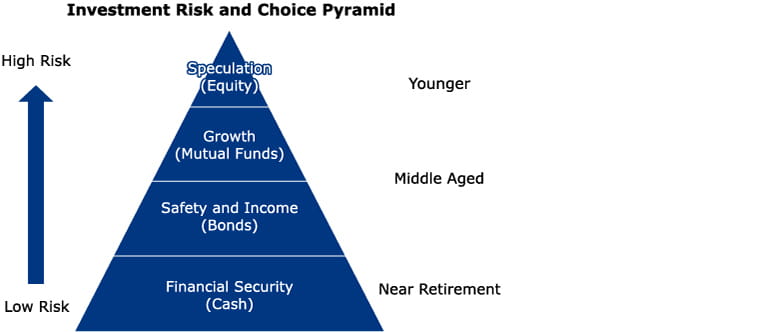

Answer: As investors, we are sometimes attracted to investment funds based on the investment return over a short period of time. Nevertheless, the choice of an investment fund should be based on personal factors, including one's risk tolerance level, age and time horizon. Frivolous investing is especially dangerous for retirement investors who in general have a longer time horizon and should be looking at long-term performance rather than short-term volatility.

2. Do I need to rebalance my portfolio frequently in order to capture as much of the stock market's gain as possible?

Answer: Market timing, or buying low and selling high, is very difficult, even for professional investors. Although as retirement investors we should monitor our portfolios regularly, we should bear in mind that retirement investing is essentially a long-term activity. Other key factors such as risk tolerance level, age and time horizon should be taken into account.

3. Should I put all my retirement savings into cash so that I will not be affected by volatile investment markets?

Answer: Cash instruments, which generate interest returns only, are not an effective tool to protect wealth in the presence of inflation. The purchasing power of our savings deteriorates over time if the investment grows more slowly than the inflation rate. There are many retirement fund choices to suit different individuals' needs and we should conduct a full review of the fund options available.

4. Why should I review my retirement savings portfolio regularly?

Answer: Each time you reach a milestone in life – such as buying a home, getting married, having children or retiring - it is important to take a look at your portfolio to ensure it stays in line with your retirement goals and your changing life circumstances. In general, it is advisable to review your retirement plan every six months even though adjustment is not always necessary.

5. I know nothing about investing. Can I simply follow what my friend, spouse or colleague does?

Answer: Feeling as if we do not have time to plan our investment strategy is not a reason to follow someone else's. Having an individual focus is of paramount importance when it comes to choosing the right funds. We need retirement plans that fit our individual needs. Even members of the same family may have different circumstances and situations to consider.