The China Briefing

Market vs Macro

Please find below our latest thoughts on China:

- China equities have shown few signs of pausing for breath in recent months, even in the face of weaker-than expected macro data.

- The last three months have seen significant rotation though, with China A-shares making up lost ground from earlier in the year.

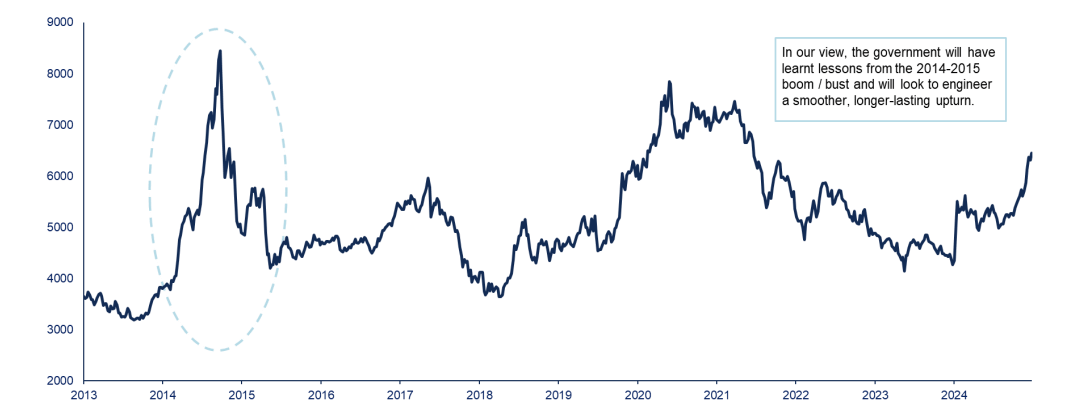

- The pace of the recent rally has triggered concerns that the huge 2014-2015 boom and bust scenario is being

repeated. We think this is unlikely as the macro context is quite different now.

Chart 1: Performance of MSCI China A Onshore Index

Source: Bloomberg, Allianz Global Investors, as of 12 September 2025.

- Nonetheless, in our view the government will have learnt lessons and will be looking to engineer a smoother, longerterm upturn rather than stoking animal spirits too aggressively.

- Overall, with the MSCI China A Onshore Index still trading around 20% below the highs of early 2021, we see room for further upside.1

- More broadly, we think a number of factors are supporting China equities, which have been in place for most of the last year and remain in place today.

- Key to markets finding their initial support levels was a pivot in government policy towards a more pro-growth stance. This has recently been reinforced with the focus on “anti-involution”, an attempt to tackle over capacity and associated deflationary pressures.

- One feature of government policy has been an explicit objective of stabilising asset prices. So far this has been more successful with equity markets than the property sector.

- Indeed recent macro data suggests some weakening of domestic demand which, if the trend continues, could put at risk the all-important 5% GDP growth target.

- We expect a mini stimulus package in coming months, similar to what was seen in both the fourth quarters of 2023 and 2024.

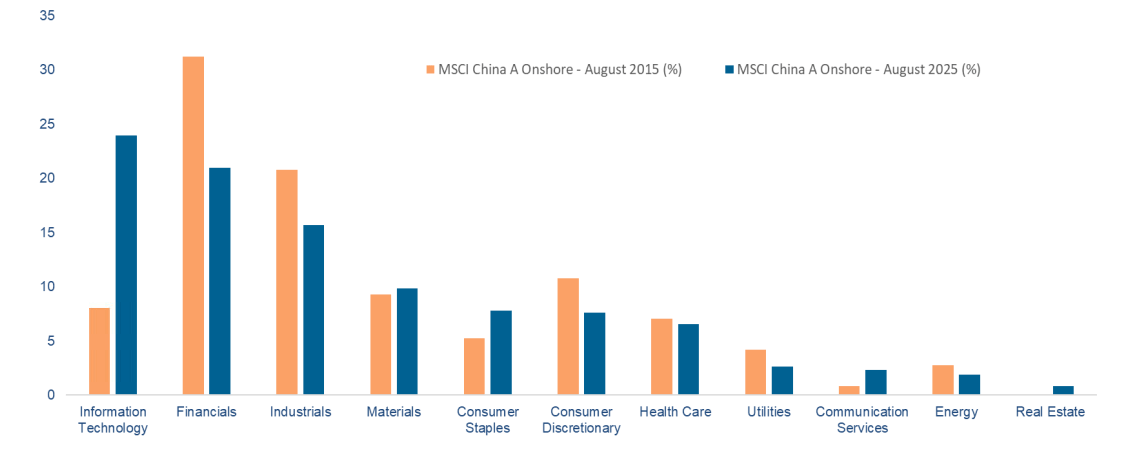

Chart 2: MSCI China A Onshore Index – sector weightings 2015 vs 2025

Source: IDS, Allianz Global Investors, as of 31 August 2025. MSCI Indices separated Real Estate from the Financials sector in the Global Industry Classification Standard (GICS) in 2016.

- Aligned with this growth focus has been renewed support for the private sector, after a turbulent few years.

- Perhaps the most visible signal was the appearance of Jack Ma at a symposium chaired by President Xi Jinping in March, also attended by China’s other highest-profile business leaders.

- Linked to this, the DeepSeek announcement, and growing recognition of China’s advanced technological capabilities, has sparked much of the strong market momentum.

- There is now more optimism that China’s AI industry has passed a turning point and entered a more self-sustaining cycle of rising investment and higher profitability. China’s internet platforms and telecoms carriers are spending heavily on data centres and domestic chipmakers are ramping up production of advanced chips.

- Aside from AI, capex has also been rising in many other tech-oriented areas. One example is next-generation solidstate battery technologies where China has made more than 7,000 patent applications, more than a third of the total worldwide.2

- To reinforce this point, the Shenzhen-Hong Kong-Guangzhou region has recently been recognised as the top innovation cluster in the world by the World Intellectual Property Organization.3 This is based on an analysis of patent-filing activity, scientific article publication and venture capital activity.

- While Silicon Valley might beg to differ, it is nonetheless further recognition of China’s rapid progress.

- We regularly get asked about the divergence between the muted macro outlook and the resurgence of equities.

- Part of the explanation is based around a significant change to the structure of China’s equity markets.

- These have evolved from a previous focus on more mature, slower-growth sectors (financials, traditional heavy industry, etc) to having much stronger representation of China’s future growth engines.

- The weighting of the information technology sector, for example, has almost tripled over the past decade. It now accounts for close to 25% of the market.4 That’s before you include exposure in other sectors related to advanced driver assistance systems (ADAS), robotics, biotech, the EV supply chain and so on.

- There are two other key factors contributing to the more positive market sentiment.

- The first is geopolitics. News this week of a framework for resolving the TikTok impasse is another apparent step in the right direction.

- There is, of course, still uncertainty about how trade negotiations will evolve. At this stage, China appears to have a stronger bargaining position as a result of its dominance in rare earth production. And this suggests improved odds of a more substantive trade agreement.

- Given the unpredictable nature of tariff negotiations elsewhere, we should remain prepared for sudden “jolts”. Nonetheless, there is currently a significantly reduced degree of risk related to geopolitics.

- The final and very important factor relates to the improved market liquidity, and the return of domestic retail investors who have been in savings mode for the last few years.

- We have written about this extensively already. But recent data showing the smallest annual growth in bank deposits since 20185 is another pointer that the rebuilding of household balance sheets in response to falling property prices is at a turning point.

- In conclusion, we continue to have an optimistic outlook and see a very different market environment as compared to the gloom of recent years.

1 Source: Bloomberg as at 16 September 2025

2 Source: JPMorgan as at 10 September 2025

3 Source: Innovation Cluster Ranking 2025

4 Source: IDS as at 31 August 2025

5 Source: BNP Paribas as at 15 September 2025