Embracing Disruption

Tech in 2025 – the same but different

The tech sector in 2024 was, unsurprisingly, dominated by discussion of the artificial intelligence (AI) megatrend and what its implications will be for the major players in this area, as well as industry and commerce more broadly. While AI related investment is certainly set to continue, we expect discussions around this theme – from an investor perspective, at least – to evolve in 2025. Furthermore, tech investors would be remiss to let AI completely take their attention away from other non-AI aspects of the tech sector that should rebound. And, of course, the landscape across the tech sector as a whole will be shaped by the policies of the incoming Trump administration in the US.

Key themes for tech investors in 2025

- Application specific integrated circuits (ASICs) will not displace GPUs, but offer a parallel opportunity for investors.

- High speed networking will grow in importance as removing bottlenecks becomes key to greater efficiency, particularly in AI datacentres.

- Data hygiene will rise up the agenda as enterprises prepare for AI adoption.

- Non-AI semiconductors, somewhat unloved in 2024, are ripe for recovery

- While we expect the Trump Presidency to have a positive effect on the sector thanks to regulatory changes, the trade and tariff effects are yet to be seen.

Artificial intelligence – beyond GPUs and hyperscalers

Much of the AI discussion in 2024 focused on two main areas. First, firms involved in producing chips to facilitate AI applications and usecases – these are mainly producers of graphics processing units (GPUs) that have non-graphical uses, such as training neural networks and deep learning models. Second, there was a great deal of focus on “hyperscalers” who are investing 10s of billions of dollars each in the aforementioned processors and renting out this capacity.

However, as the excitement around AI abates somewhat and the dust starts to settle, we expect to see a Jeremy Gleeson CIO Global Tech Equity range of other providers come to the fore in 2025. First, alongside the predominance of GPUs for AI-based tasks, we will see a much greater focus on application specific integrated circuits, or ASICs. These are integrated circuits, or chips, that are customized for a particular use rather than general purpose computing or calculation. While the development of ASICs for AI tasks is potentially more costly and time-consuming than generalist CPUs and GPUs, the development of specialist chips for, for example, training large language models (LLMs), will begin to come into its own in 2025. While these chips will certainly not displace GPUs in the short-to mid-term, the rise of ASICs – and their manufacturers – is certainly something tech investors should have an eye on in 2025.

Second, we expect to see strong developments in the field of highspeed networking. In datacenters, servers are connected to themselves and the wider internet through a network of high-bandwidth switches, allowing operators to build a network of any size while mixing and matching products from various vendors to create a network architecture specific to their needs. Of course, the speed of this switching network is crucial and higher speed can mean a more profitable deployment of AI applications. Indeed, this becomes even more imperative as complex computing tasks and large workloads are increasingly split across multiple processors. As such, the development of higher speed networking – and, in particular, optical networking – will become imperative and we expect this to be a strong growth area in 2025 and beyond.

A third AI-related theme for 2025 will be addressing data hygiene, cleaning, and migration. While data abundance is clearly necessary for training many of the AI models currently in use or being developed, we will see increased focus on the quality of the data in question. Indeed, as many more enterprises prepare for AI adoption, getting their house in order in terms of data quality will be a priority. From an investor perspective, an eye on both those firms that manage to do this with the greatest efficiency, and the providers that help facilitate this, will be key.

Beyond AI

Of course, there remains more to the tech sector than AI. For investors, one area to watch will be manufacturers of non-AI semiconductors that find utility in the industrial and automotive sectors. For instance, the factory automation sector is an area that has shown strong growth historically but is in a recent cyclical downturn, and where such chips continue to be vital – it is estimated that the average collaborative robot, or “cobot”, on the factory floor will contain over 200 of these non-AI focused semiconductors. Looking at consumer applications, a typical home solar system will also contain several hundred of these chips, while a modern electric vehicle may contain anything from 1,000 to several multiples of this, depending on complexity. Furthermore, the rapidly developing field of humanoid robotics – something that recently garnered a great deal of attention at the Consumer Electronics Show (CES) in Las Vegas – will provide a further market for such chips.

So while the excitement around AI is certainly impossible to ignore, tech investors should not ignore non-AI semiconductors manufacturers and use cases. Indeed, the three areas briefly mentioned above – industrial automation, renewable energy, and automotive – are all set to recover nicely over the coming years.

The political elephant in the room

The Republican sweep of the Presidency and both Houses of Congress in November has certainly raised the possibility of a significant change in course from the US government in 2025, while the proximity of the new President to several prominent tech entrepreneurs is clearly significant. In this respect, the trajectory is likely to be one of loosened regulation that will be to the sector’s benefit. Indeed, there was some perception in Silicon Valley, and beyond, that the Biden administration was unfriendly to the tech sector and so some change in attitudes towards regulation – and taxation – will be welcomed by many. One recent policy announcement – the launch of the “Stargate” AI infrastructure project with several notable private sector partners – also bodes well for a more supportive attitude towards this sector.

Key uncertainties remaining at this point are, first, with respect to the new administration’s stance towards Asia – in particular China – and trade with this region that remains crucial to both semiconductor production and finished tech goods. And second, any potential implications of measures taken by the new Department of Government Efficiency (DOGE), headed by Elon Musk and Vivek Ramaswamy. Indeed, even if Trump’s most uncompromising pronouncements on trade and tariffs are not implemented, there is likely to be some increase in trade frictions, and this will certainly have an effect on the fortunes of major tech players on both sides of the Pacific.

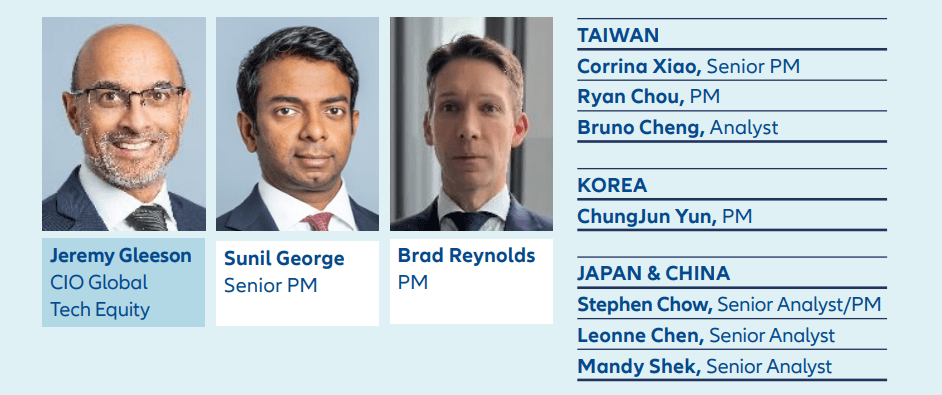

Global tech equity ecosystem