Embracing Disruption

Agentic artificial intelligence

The publication of Google’s paper on transform network architectures in 2017 kicked of the development of so-called large language models (LLMs), which form the basis of artificial intelligence (AI) models such as ChatGPT. This technique, combined with other approaches such as reinforced learning (RL), is now leading to an increasing number of AI-models, with a rapidly growing range of capabilities and areas of specialisation. These, in turn, are flowing into a various types of end user applications – these have been rolled out very quickly, but we have so far seen fairly limited adoption.

Now we are seeing the rapid development of so called “agentic AI” applications, that are more capable of acting autonomously by analysing information and devising solutions without constant human input. We believe this represents the start of the first big wave of the monetization of AI technology. The key difference here, compared to other application areas such augmentation and creativity, is that agentic AI applications can bring rapid and measurable improvements in efficiency as the “agents” begin taking over mundane and repetitive tasks, and later on more sophisticated workloads, from humans. And this is coming at exactly the right time, as many economies grapple with labor bottlenecks and increasing cost pressures.

The investment perspective: who will be the beneficiaries of Agentic AI?

The development cycle of these agentic applications is somewhat longer than for previous AI models as they need to be trained to solve real tasks in already defined software stacks. However, developments such as the recent emergence of Deepseek R1 will only accelerate agentic AI development thanks to reductions in the cost of training and improvements in inference. We are also seeing a democratisation of AI technology in another ways, as open source models seem to have caught up – or perhaps even surpassed – the closed models pioneered by the likes of OpenAI and Microsoft. This could certainly make the technology cheaper and easier to adopt by a broader group of developers and software providers.

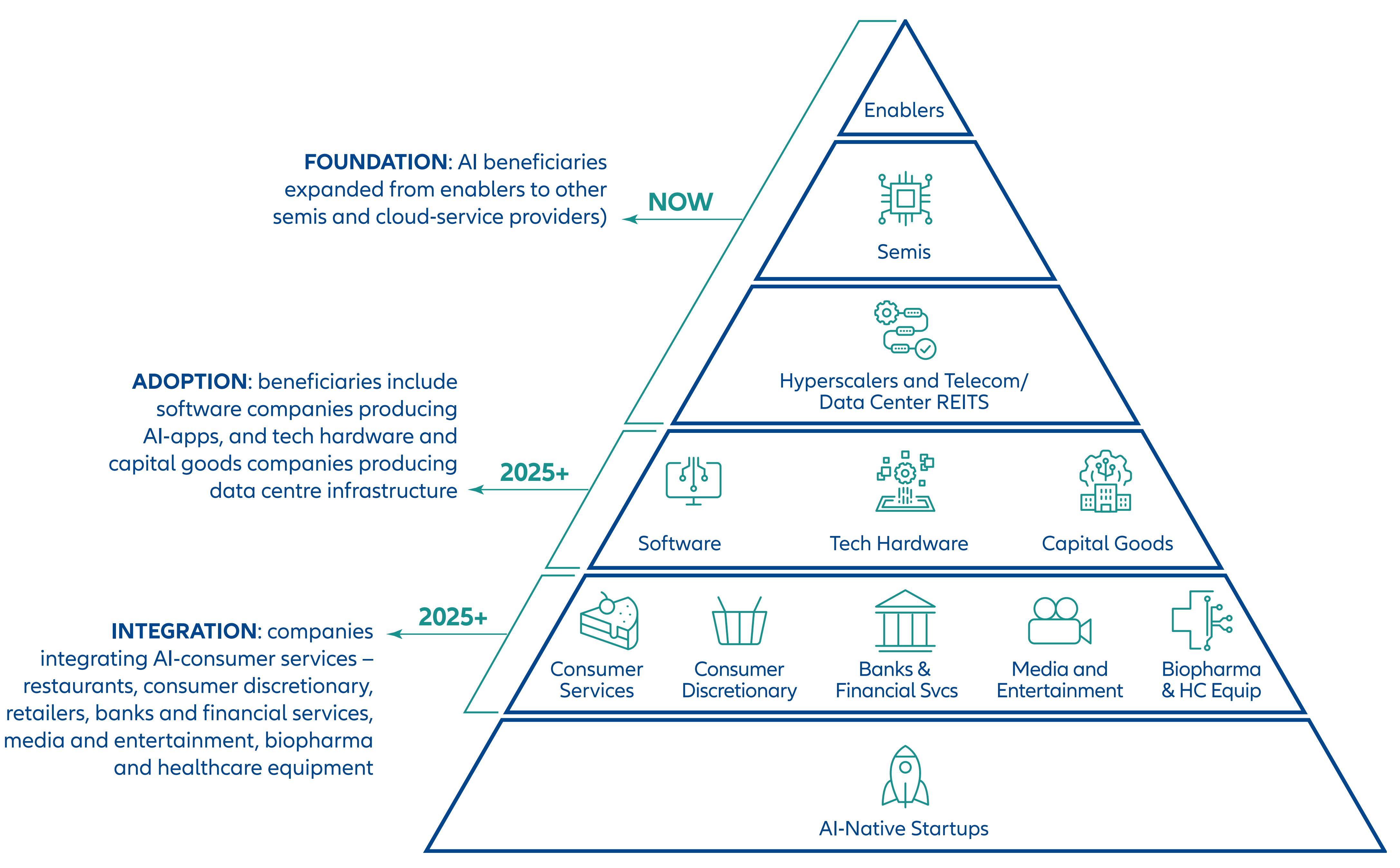

Steps of development

Source: BoA Global Research/Allianz Global Investors

A whole range of companies are in line to benefit from these developments. First, large cloud service providers may be able to slow their expansion in capital expenditure, while at the same time improving the utilisation of their existing capacities as demand for AI inferencing increases rapidly. Second, infrastructure software providers who offer the tools for the organisation and management of daily operations will benefit from the rapidly growing data flow in this areas.

A third group of beneficiaries could be the cloud-native software development companies. These firms are superbly positioned to develop agentic applications or agents which, due to the high computing requirements, will also be cloud-native. This could allow these companies to develop entirely new services, unlock new revenue streams and, eventually, enter a new growth phase that redesigns the software landscape as we know it today.

Another subsector set to indirectly benefit from the accelerated adoption of agentic AI is cybersecurity. AI agents will increasingly be capable of managing and providing access, and running cyber forensics of increasing complexity to secure networks against growing threats also leveraging new AI technologies.

Finally, we should not forget the winners of the previous year – chip providers will continue to benefit from the ever growing amount of computational capacity and datacenters required to train, develop, and maintain the latest AI models.