The China Briefing

Half time check in

The key reasons for the recent turnaround of China's equity markets – government policy, recovery of the private sector especially tech-related, DeepSeek, improved market liquidity.

Please find below our latest thoughts on China:

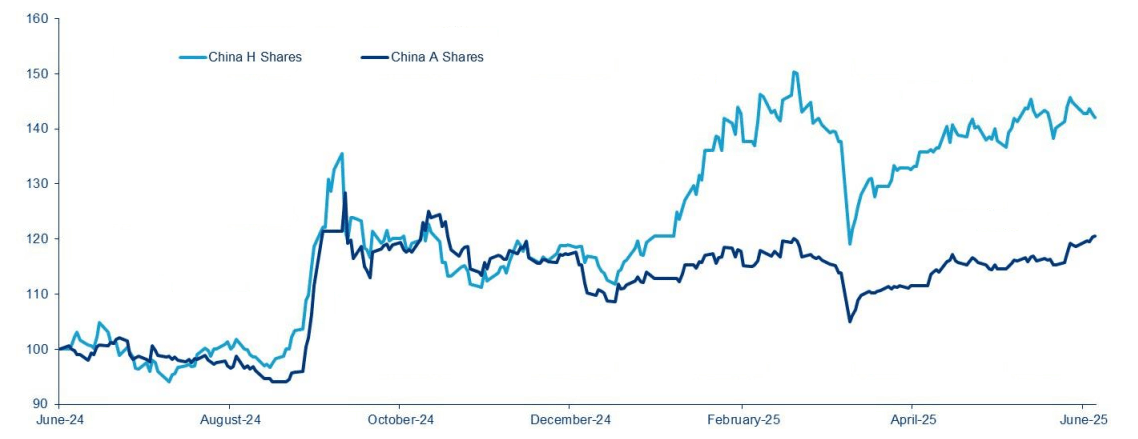

- Recent weeks have seen further gains for both onshore and offshore China equities, defying the ongoing uncertainty related to trade negotiations with the US.

- Since the middle of last year, a time when China’s equity markets were being described as “uninvestable”, China Ashares have rallied by nearly 20% in USD terms. China H-share returns have been even stronger.1

- Just past the half-way point of the year, it’s timely to reflect on the reasons for this turnaround and to what extent the factors supporting it remain in place.

Chart 1: China A and China H share performance (1 year, USD, rebased to 100)

Source: Bloomberg, Allianz Global Investors, as at 4 July 2025. Index used for China A shares is MSCI China A Onshore, for China H shares is Hang Seng China Enterprises Index.

- On the one hand, some factors that previously weighed heavily on markets have eased. Local government financing has been significantly restructured, for example, and the property market is more stable, albeit still weak.

- This is reflected in bond markets, where the Markit iBoxx China Real Estate High Yield Index is up by almost 80% since its low point in Q4 2023.2

- But perhaps more positively, in our view there are some new factors at play.

- A key change has been a shift in government policy. Overall, the key long-term policy objective of developing a future growth model based on technology-intensive manufacturing has not changed.

- However, economic momentum last year weakened significantly, putting the longer-term goals at risk. And this prompted an important course correction towards a more pro-growth setting for both monetary and fiscal policy.

- With recent economic data looking quite mixed, we expect policy support will need to be further strengthened during the second half to achieve the 5% GDP target.

- Linked to this has been a renewed focus on the private sector. The high-profile symposium chaired by President Xi Jinping earlier this year and attended by China’s highest-profile business leaders, including Alibaba founder Jack Ma, sends a clear policy signal, in our view.

- Indeed, it has been notable how there has been a marked recovery in the share price performance of private/nonstate-owned companies year to date.

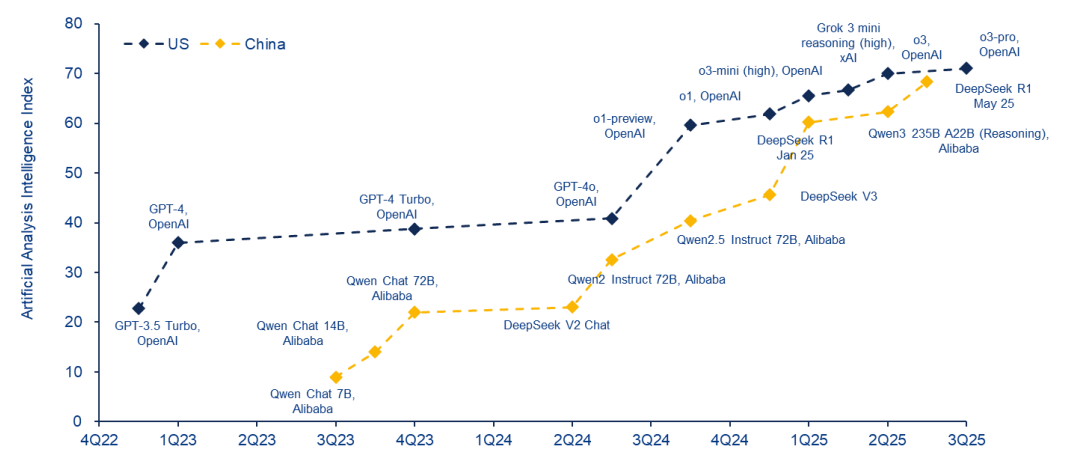

- An important catalyst was the DeepSeek moment, which illustrated how China’s technological progress is far more advanced than previously understood.

- While some people remain locked into the idea that China is at best an imitator of technology rather than an original creator, in our view the reality is different.

Chart 2: China and US – Frontier Language Models performance

Source: Allianz Global Investors, Artificial Analysis Intelligence Index, July 2025

- China has invested heavily in science and technology over a sustained period. Of China’s 12 million university graduates this year, around 40% will have a degree in a STEM discipline (science, technology, engineering, mathematics).3

- As a result, China now awards more science and engineering doctoral degrees than the US. And over the past decade, China has filed 2.7x more patents than the US, highlighting a boom in intellectual property.4

- Of course, not all patents have value or can be commercialised. But the number of patents granted still gives a good sense of overall commitment to innovation and the pursuit of technological leadership.

- A recent example was the first humanoid robotic football match (Chinese AI robots compete in first ever soccer match - YouTube).

- While Messi and Ronaldo won’t be quaking in their boots, nonetheless the fact this took place within China is another pointer towards the intense research efforts ongoing in tech-oriented industries.

- A further key support for China markets has come from a structural improvement in the liquidity environment.

- Previously, a heavy supply of equity in the form of IPOs and secondary issuance averaging around 1-2% of total market capitalisation5, had been a big weight on the China A market in particular. This has been significantly reduced by regulatory changes.

- Conversely, there has been a meaningful pick up in both China A dividends and share buybacks, which doubled last year.6

- In addition, state-led buying of domestic ETFs during periods of higher volatility – most recently post the tariff announcements on “Liberation Day” – has also provided downside support.

- Overall, our view is that the key factors that have contributed to a more positive market environment over the last year remain in place.

- And while there are uncertainties, especially related to how China’s relationship with the US will unfold, the market has become less reactive to the shock factor of trade and tariff announcements in recent months.

- Combined with still reasonable valuations, we believe there should continue to be ongoing support for China equities.

1 Bloomberg as at 4 July 2025

2 Bloomberg as at 4 July 2025

3 JPMorgan as at 22 June 2025

4 JPMorgan as at 22 June 2025

5 Wind as at 31 December 2024

6 Wind as at 31 December 2024