Navigating Rates

Asia fixed income: positioned for outperformance?

With favourable growth and inflation dynamics, relative value against developed markets and potentially some big alpha opportunities emerging in China, we believe the outlook for Asia fixed income is strong in 2024.

Key takeaways

- Asia’s growth outlook is more resilient than in developed markets, thanks to a tech cycle rebound and greater capacity for fiscal support.

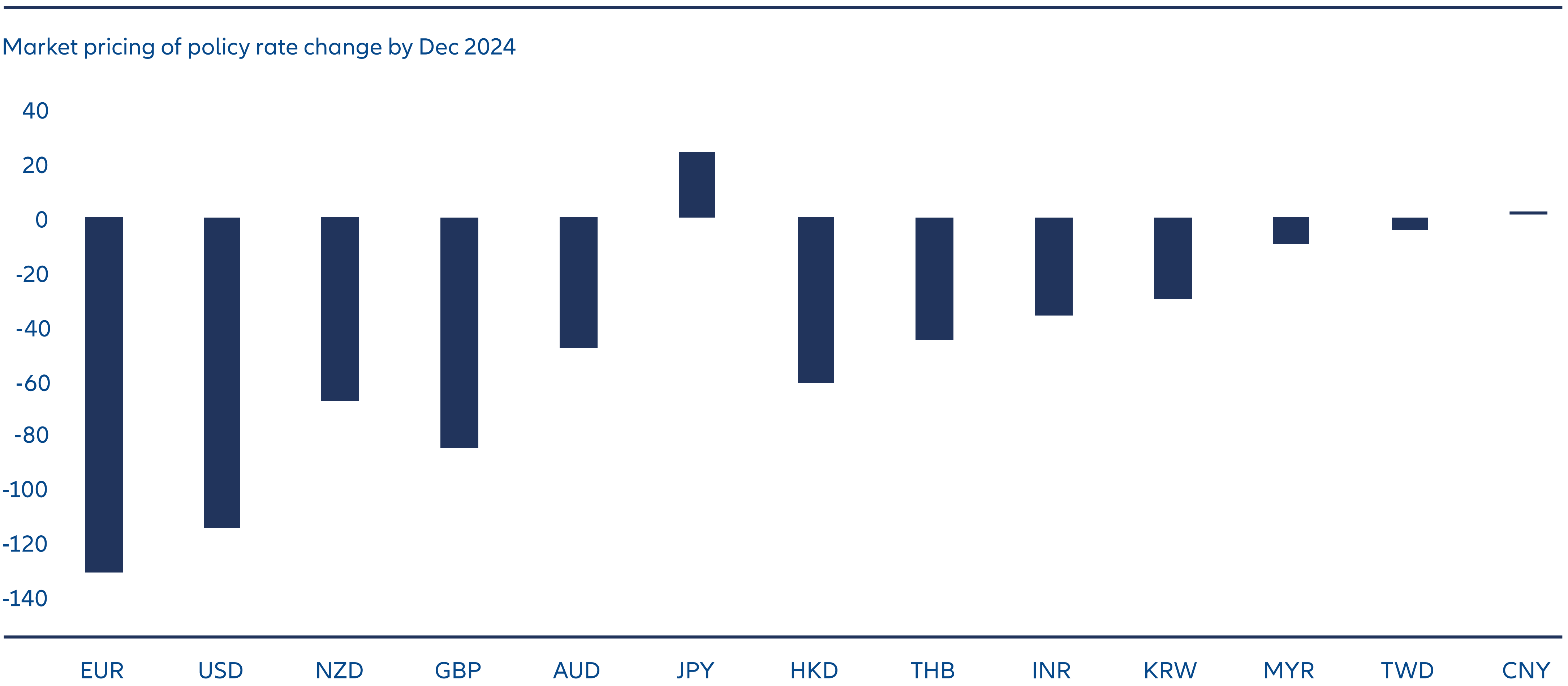

- Asian central banks can ease monetary policy at a slower pace than developed market counterparts, which could mean higher yields and capital inflows.

- Corporate fundamentals look favourable, with most sectors in the recovery phase of the credit cycle which tends to feature improving margins and decreasing leverage.

- We believe investors can look through negative headlines around China’s property sector, and we see some of the biggest alpha opportunities in China high yield bonds.

Despite a challenging global macro backdrop and heightened market volatility, Asian fixed income assets delivered decent absolute returns in 2023, with Asia local currency bonds up 6% and the JP Morgan Asia Credit Index (JACI) – a popular index of USD-denominated Asian sovereign, quasi-sovereign and corporate bonds – up 7%.1 Even China fixed income shrugged off negative sentiment around the country’s property sector crisis and softer-than-expected post-Covid reopening, with investment grade bonds returning 6.8% and Chinese government bonds 3% in USD terms.2

In our view, Asia fixed income is strongly positioned for this year. From a macro perspective, Asian economies’ growth outlook is more resilient than for developed markets, thanks to a tech cycle rebound and selective fiscal support led by China and Thailand. On monetary policy, we see Asian central banks easing less than their developed market counterparts, which would imply better relative value for Asia bonds and potential capital inflows. The six major elections in the region this year are unlikely to derail the core narrative, as we expect smooth transitions and policy continuity in major countries such as India and Indonesia. China’s increased policy support (both fiscal and monetary) is expected to put a floor under growth, and we believe investors can look through negative headlines around the property sector as it searches for equilibrium. However, with sentiment and positioning on China arguably at an all-time low, we see ample opportunities amid significant market dislocation.

Looking longer term, we believe Asia has entered a multi-year virtuous cycle. Stronger economic fundamentals, pro-reform governments, superior infrastructure ecosystems, favourable demographics and relative political stability should all enable the region to capture new growth opportunities and attract large capital inflows, which over time will lead to lower FX volatility and significant repricing of local bonds and credits.

Our positive outlook for Asia fixed income in 2024 is based around four key themes:

1) Favourable growth and inflation dynamics

We expect demand for AI chips and inventory normalisation in electronic products to support a moderate recovery of the technology cycle in Asia in 2024. Cyclical growth will pick up among the electronics exporters, while the ongoing structural tailwinds from electronics supply chain diversification continue to support fixed capital formation in ASEAN countries. For the other economies, resilient domestic demand will continue to support relatively high growth rates. Investment growth is expected to remain a key growth driver for India and the Philippines, while election-related spending and post-election investments will support Indonesia’s growth for 2024.

China’s economic stimulus will mostly be transmitted through investment growth, funded by fiscal expansion. Property investment should gradually pick up from the bottom, supported by urban village redevelopment, while infrastructure and manufacturing investments will benefit from strategic objectives in green infrastructure and advanced manufacturing. Given the trade linkages, Asia is expected to benefit more from the spillover effects of China’s investment growth relative to consumption, potentially lengthening its cyclical rebound in manufacturing.

Disinflationary trends in Asia should continue into 2024, though at a slower pace due to less favourable base effects on energy and food prices as well as subsidies rollback. That said, core inflation momentum remained subdued for most countries in Asia, while headline inflation surprises might persist until the second quarter before the effects of the “El Niño” climate phenomenon fade. Price shocks, if any, would probably be mitigated by fiscal policy, such as the Philippines’ recent extension of reduced import tariffs for food and coal. 3

2) Smoother policy paths point to relative value vs. developed markets

Asian central banks overall pursued a much less aggressive rate hiking cycle during the post-pandemic inflation spike than their counterparts in the major developed economies or emerging market regions such as Latin America.

Instead, Asian countries deployed multiple policy tools to mitigate inflation, such as supply side policies, quasi-fiscal subsidies to smooth the energy shock, FX reserve intervention, and capital flow measures. Overall, Asian economies’ inflation data consistently undershot other regions and many reached their targets much earlier.

Asian central banks can therefore be expected to ease much less than other developed markets, particularly given their more resilient growth. As a result, Asian bond yields should look high relative to developed market bonds, which could drive capital inflows for Asian local currency bonds.

Exhibit 1: Less policy easing priced in for Asia

Source: Bloomberg, AllianzGI, 7 February 2024.

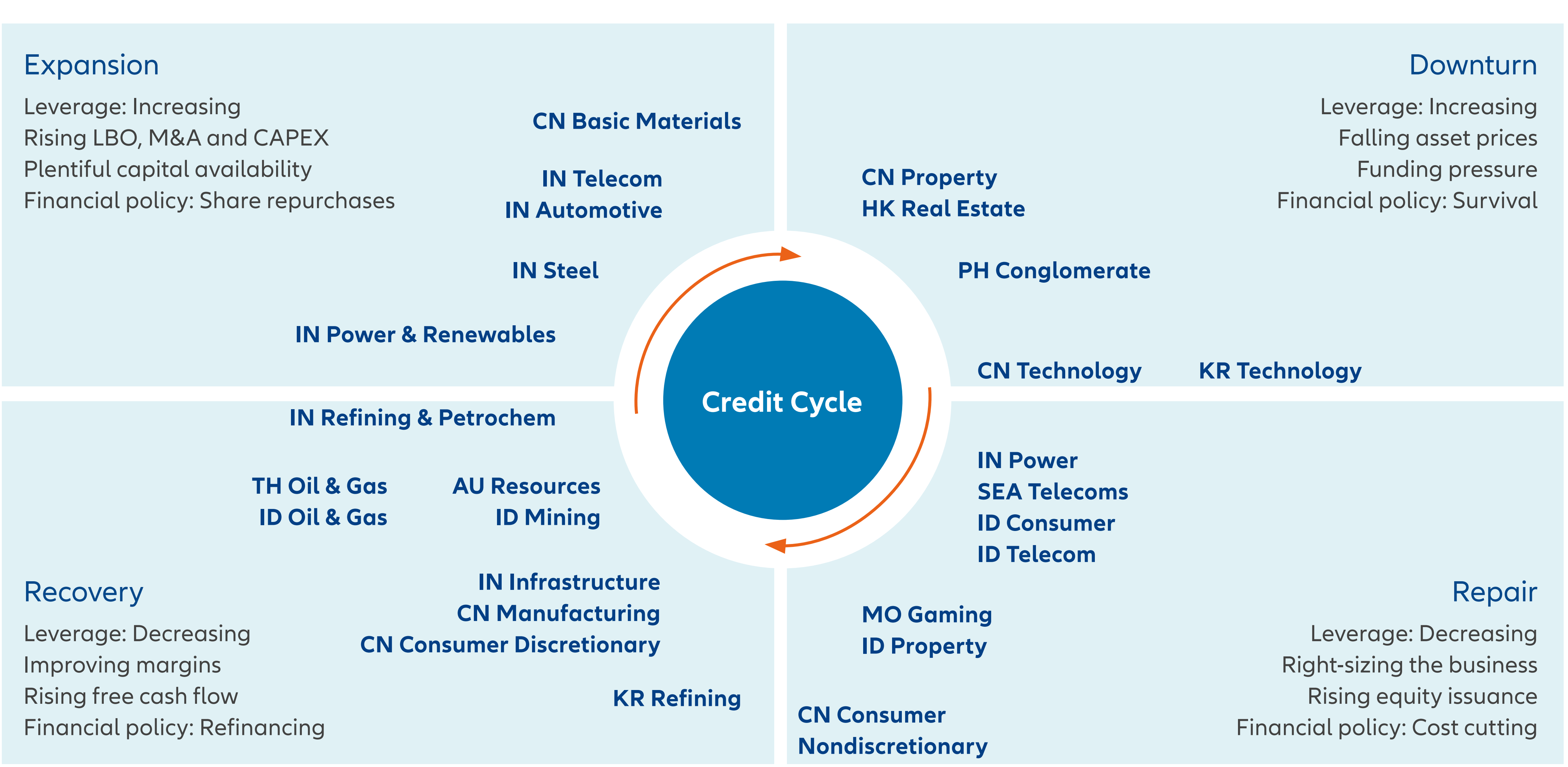

3) A credit cycle “sweet spot” and a floor for Chinese real estate

Most Asian credit sectors are in what we might call the “sweet spot” of the credit cycle – ie, the recovery stage (see Exhibit 2), which generally features right-sized businesses, improving margins and decreasing leverage. We see sectors such as Macau gaming, Indonesia industrials, China manufacturing and India infrastructure as being in this sweet spot currently. Even for sectors that are in the expansion stage, such as Indian utilities and India cyclicals, strong capital structures and balance sheets with solid sponsorship should mitigate excessive capex and re-leverage risks.

Exhibit 2: Asian corporates’ position in credit cycle

Source: AllianzGI, 31 December 2023. The above is for illustrative purposes only and is not a recommendation or advice to buy or sell. Past performance, or any predication, projection or forecast, does not predict future returns. There is no guarantee that these investment strategies and processes will be effective under all market conditions and investors should evaluate their ability to invest for a long-term based on their individual risk profile especially during periods of downturn in the market.

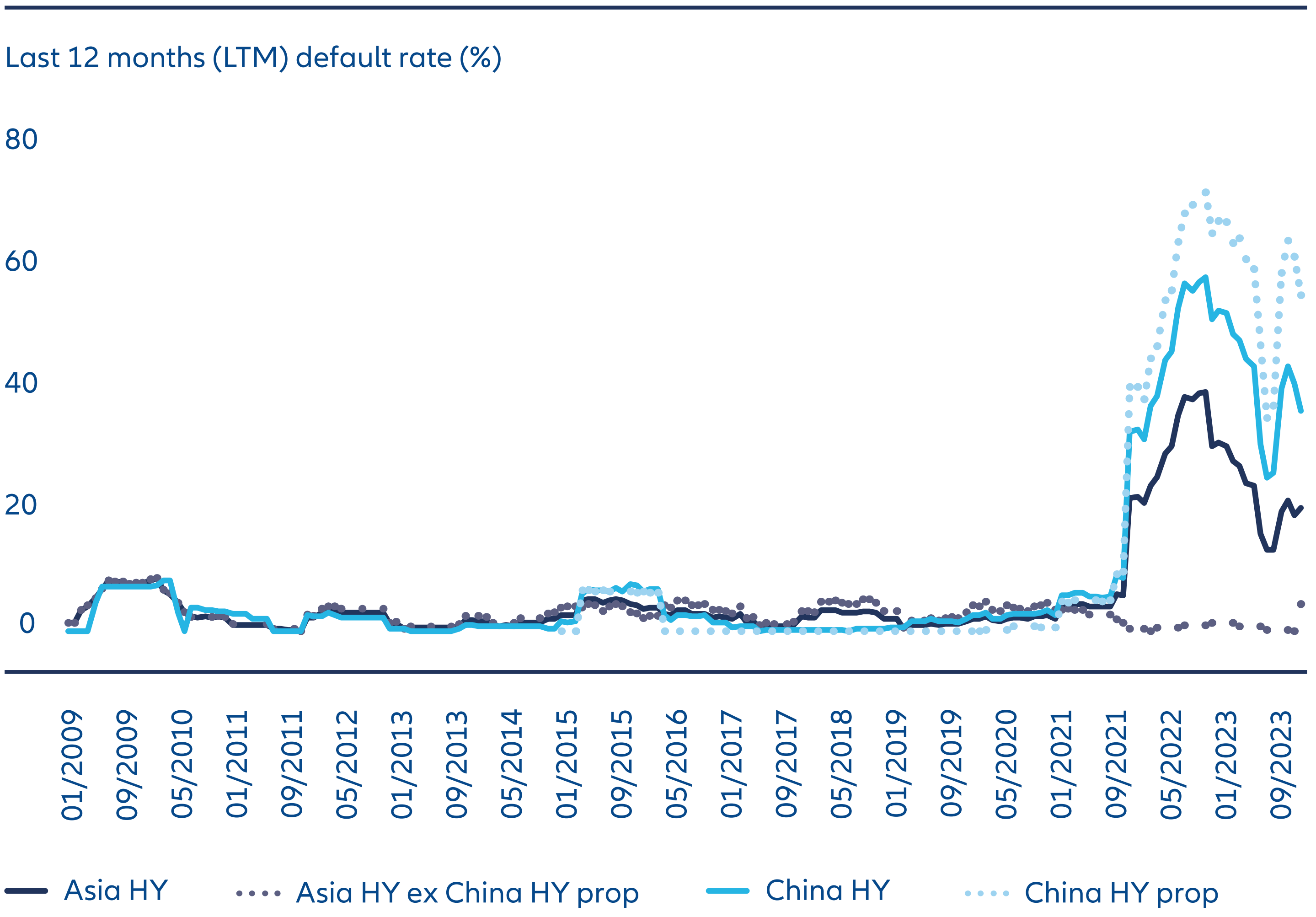

As for China real estate, we believe investors should now look past the headlines regarding the distressed part of the market, which emerged again after a Hong Kong court ordered the liquidation of property giant Evergrande on 29 January.4 Instead, we believe the focus should be on China real estate’s “survivors”, which have weathered the worst credit downcycle in the sector's history. The privately owned developers still standing will ultimately emerge from the crisis much stronger in terms of operations, brand name, market share and financial health.

We believe the default cycle is coming to an end (see Exhibit 3), supported by a clear shift in property policy to help alleviate the liquidity crunch in the market. While the “physical” property market will need a few more quarters to clear up excess inventories before it reaches a new equilibrium sales level for the next 3-5 years, the critical point for credit investors is that the default rate should drop significantly from the level the market has experienced over the past three years. In our view, this makes China high yield bonds more likely to realise the double-digit yields they currently offer.

Exhibit 3: End of China default cycle positive for Asia high yield

Source: BofA Global Research, AllianzGI, 31 January 2024

4) China adapting to new normal

Away from real estate, the challenge for China is the evolution of its economic model. In our view, China is unlikely to go back to its old growth-oriented model, which relies excessively on borrowing and channelling excess savings into unproductive investment to boost GDP. The Chinese leadership has clearly made up its mind to shift towards a new and “high quality” growth model which is more multi-faceted in nature. The shifts in policy and priorities seen since middle of last year are driven by the leadership’s realisation of the challenges brought by both cyclical and structural factors in achieving such goals, and hence the leadership has become more realistic on execution and timeline.

We think this “zigzag” path will be the norm for China macro in the foreseeable future. Such a backdrop would require all participants in the economy – governments, households, corporates, financial institutions and investors – to adjust expectations and adapt to the new normal. It will be a game of survival of the fittest across all sectors. In credit, we think bottom-up fundamental credit selection will be key for alpha generation, particularly given significant market dislocation.

We think China investment grade will continue to deliver low volatility and decent carry in 2024, thanks to solid corporate fundamentals and strong technical support. But it is in China high yield where we see the biggest alpha opportunities. The China high yield credit market will remain volatile, driven by sentiment and high frequency data, but it is credit fundamentals that ultimately lead to repricing. With fundamentals driving credit selection, China high yield may offer opportunities that can withstand the bumpy path to normalisation and repricing.

1 Bloomberg, AllianzGI, 31 December 2023

2 Bloomberg, AllianzGI, 31 December 2023

3 Nikkei Asia, 26 December 2023. Philippines extends tariff cuts on imported rice to fight inflation - Nikkei Asia

4 Reuters, 29 January 2023. China Evergrande ordered to liquidate in landmark moment for crisis-hit sector | Reuters