As MPF members reach retirement age, they can withdraw the accrued benefits from their accounts. However, suppose they do not have pressing financial needs and therefore aren’t required to use the money, how should they manage it to enhance retirement security? In a near-zero-interest-rate environment, placing the money in a bank may cause the capital to depreciate, as inflation erodes its purchasing power. Therefore, members are advised to stay invested after retirement for potential long-term capital growth.

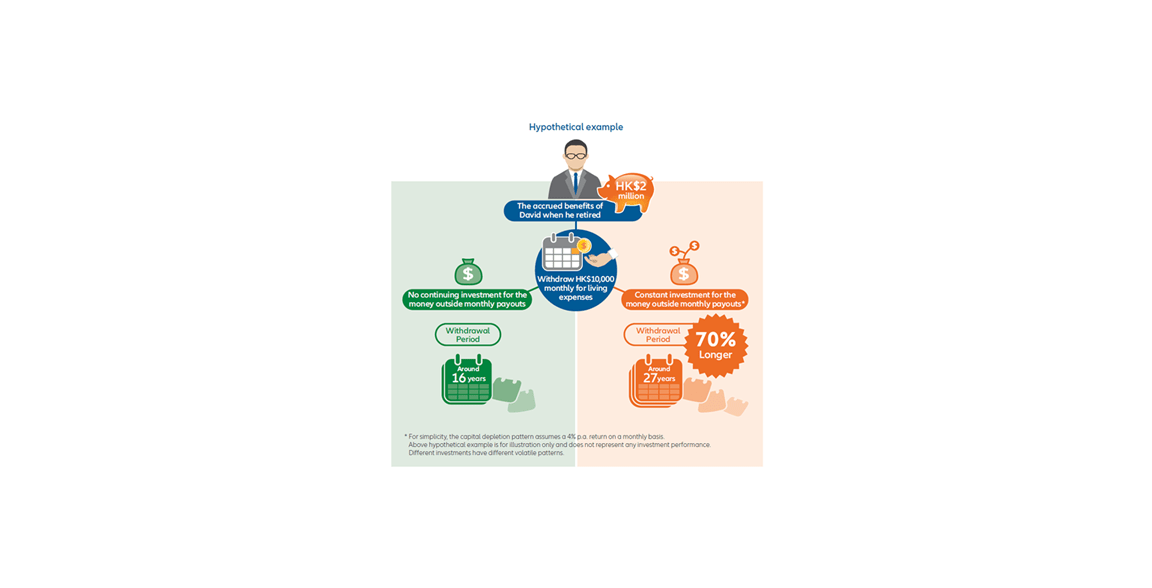

Suppose a person has HK$2 million accrued benefits at retirement and withdraws HK$10,000 monthly for living expenses, given there is no continuing investment, the retirement money will be depleted in around 16 years. However, if the money outside the monthly payouts is constantly invested, assuming a 4% annual return, the retirement fund will last for around 27 years, which is 70% longer. This helps mitigate the pension pitfalls of a longer life expectancy.

In truth, MPF schemes allow members to withdraw their accrued benefits in instalments after retirement. After setting up regular instructions in their Special Voluntary Contribution (SVC) account, members can receive a stable payout regularly, whilst allowing the remaining capital to stay invested and grow. Besides, members can change their payout arrangement anytime to suit their personal financial needs, ensuring them a secure retirement life.