How to Enhance Compounding with A-shares in Your Retirement Portfolio?

Summary

How big of an impact would it be if you could raise your investment return by 1%? As the saying goes, “many a little makes a mickle”; never overlook the difference that the important 1% can make! A-shares will soon enter Hong Kong’s pension market, giving employees an additional long-term investment option to prepare for retirement.

Key takeaways

|

We all wish for a happy retirement. Realistically, modern society and the high living prices make it really hard to depend only on cash savings in retirement. The 2020 Retirement Confidence Survey, conducted by Allianz GI, found that the ideal retirement savings of the surveyed respondents was HKD 4.39 million on average. In contrast, they expected to only save HKD 3.49 million. In other words, their actual saving pot may be short by as much as HKD 900,000!

Early planning and smart retirement investing can bridge the gap between the ideal and actual amount of the retirement pension. Retirement investing is about long-term returns. Investing for the long haul is the key to opening the door of compounding effects.

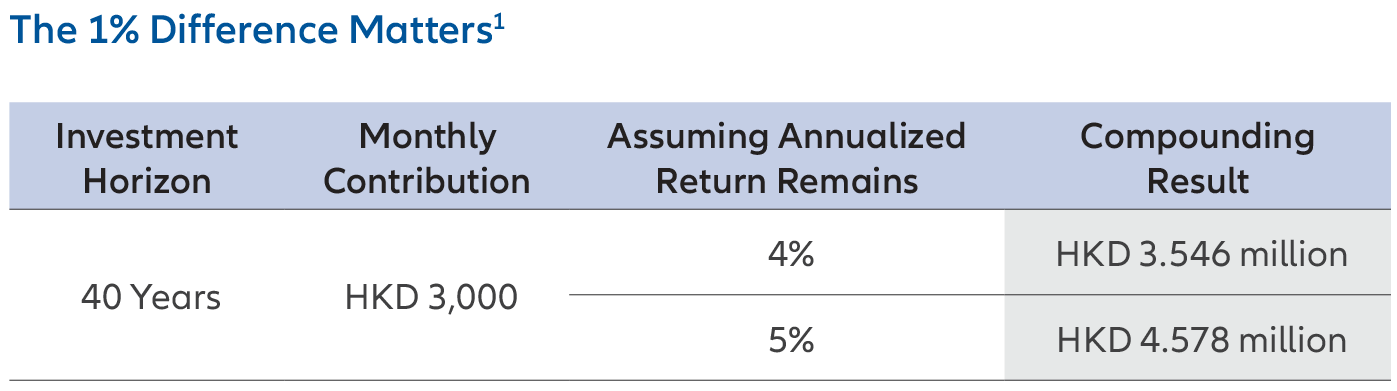

Assuming a 25-year-old worker makes a monthly pension contribution of HKD 3,000 (including employer’s contribution), if the annualized return differs by 1%, the compounding effect will result in a difference of HKD 1 million1 after 40 years! This is the power of the compounding effect.

Hence, young workers, who are still a long way from retirement and can afford a higher level of risk, might want to consider choosing more aggressive equity funds to leverage on the time advantage. Even if the return is as little as 1%, the benefits will play out from a long-term perspective.

This material is for reference only, it should not be considered an investment advice or opinion. Past performance is not indicative of future performance.

With the addition of China A-shares to the pension market, young workers, who can afford high investment risks, can consider more aggressive A-share funds. This would flex the muscles of long-term investment through compounding.

1 Calculated with the Savings Goal Calculator of the ‘Chin family’ under Investor and Financial Education Council’s.

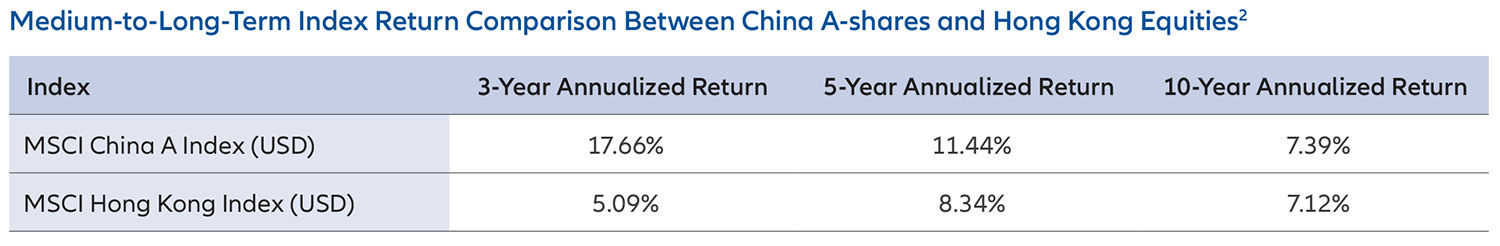

2 Source: MSCI. Data as of 30 July 2021.

New Economy A-Shares in Focus for Retirement Investing

Summary

Investment strategies vary – some prefer short-term speculation, while others belong to the school of long-term investment. In the realm of retirement investing, long-term is trusted as being central to wealth planning. In Hong Kong, working citizens are allowed to take back their pensions after their retirement at age 65, meaning that we can have decades to accumulate our retirement wealth.

Key takeaways

|