3 policy differences for investors to watch in the US presidential race

Summary

President Trump and former Vice President Biden have notably different views about corporate taxes, energy and US-China trade, which may have a substantial impact on markets and portfolios.

Key takeaways

|

Corporate taxes, energy and US-China trade could affect portfolios the most

As the 3 November US presidential election draws closer, the race is tightening between Mr Trump and Mr Biden. While much is at stake in this election cycle, the three policy areas noted below could have a large impact on the markets and portfolio allocations. Investors should plan to adjust portfolios depending on the direction of policy after election day – though emerging technology and infrastructure may be winners regardless of the outcome.

The two candidates have similar views on drug pricing, tech giants and infrastructure

Despite their many differences, Mr Biden and Mr Trump are aligned in some areas that markets may not appreciate. For example, both candidates support some form of lowering pharmaceutical drug prices. Both also favour more regulation of – and have even called for breaking up – certain large US tech firms. And both hope to pass substantial US infrastructure packages, supporting areas like smart cities, roads and airports – though Mr Biden also supports developing clean-energy infrastructure.

The global pandemic is the big wild card in this election year

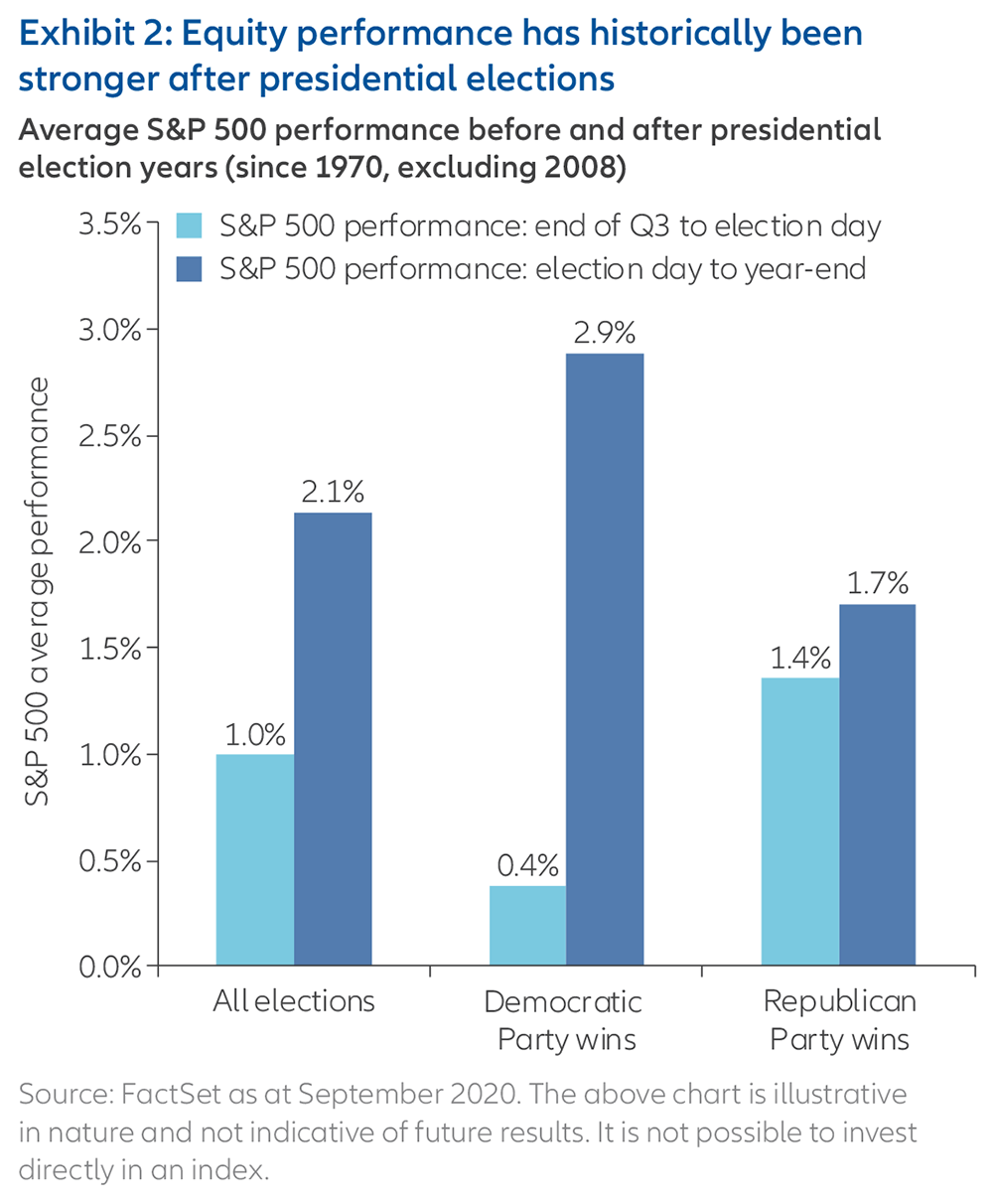

Historically, markets have done worse in the weeks before election day than in the period from election day to year-end (see chart). This is likely because the markets don’t like uncertainty: once an election is over, the markets are able to start factoring in the next president’s policies.

At the same time, the global Covid-19 pandemic makes this a very unusual election year for the markets. While the presidential candidates spar over how they would approach the pandemic, the markets are processing new data points about regional outbreaks, vaccines, drug therapies and the pace of economic recovery – in addition to the level of monetary and fiscal support that has provided a floor for markets so far.

If the global economy does rebound in the next 12-18 months, we expect to see broader sector and geographical participation in the market’s upside – beyond the large-cap US technology stocks that have led through the crisis. Investors may want to factor this in, along with the candidates’ proposals, to consider allocations to select sectors. Cyclicals (such as select industrials, energy and financials), emerging technology with long-term growth potential (such as 5G, AI and cybersecurity), infrastructure and clean energy may all be potential winners in a post-2020 US election era.

US elections Q&A: investors can find an advantage in volatility

Summary

Financial markets could remain volatile as we head towards US elections in November – particularly with the prospect of a contested result. But this could provide a tactical opportunity for investors to add risk to portfolios, or to further diversify their holdings.

Key takeaways

|

Corporate tax policy: while Mr Trump’s corporate tax policies are ostensibly more market-friendly, Mr Biden’s plan may be offset by other growth initiatives

Energy policy: a Biden presidency could create opportunities for clean energy, while another Trump term would support the existing energy regime

US-China trade policy: both candidates would be “tough on China” and aim to strengthen US tech leadership over China