The China Briefing

Recovery of retail sentiment

Why retail investor sentiment in China is continuing to push the markets higher, despite the US election results.

Please find below our latest thoughts on China:

- It has been interesting to observe the different reaction of China’s onshore and offshore equity markets to the US election results.

- The swing to Donald Trump started to become clear mid-morning yesterday in local trading time (Wed 6 Nov). Offshore stocks moved sharply lower, with the Hang Seng China Enterprises Index – a proxy for H-shares – ending the day down 2.9%.1

- In contrast, China A-shares were much less volatile. The overall market ended down slightly, but some sectors such as small caps were up on the day.2

- Indeed, small caps have been on a relative tear recently. The CSI 1000, for example, is up by close to 40% since the last week of September.3

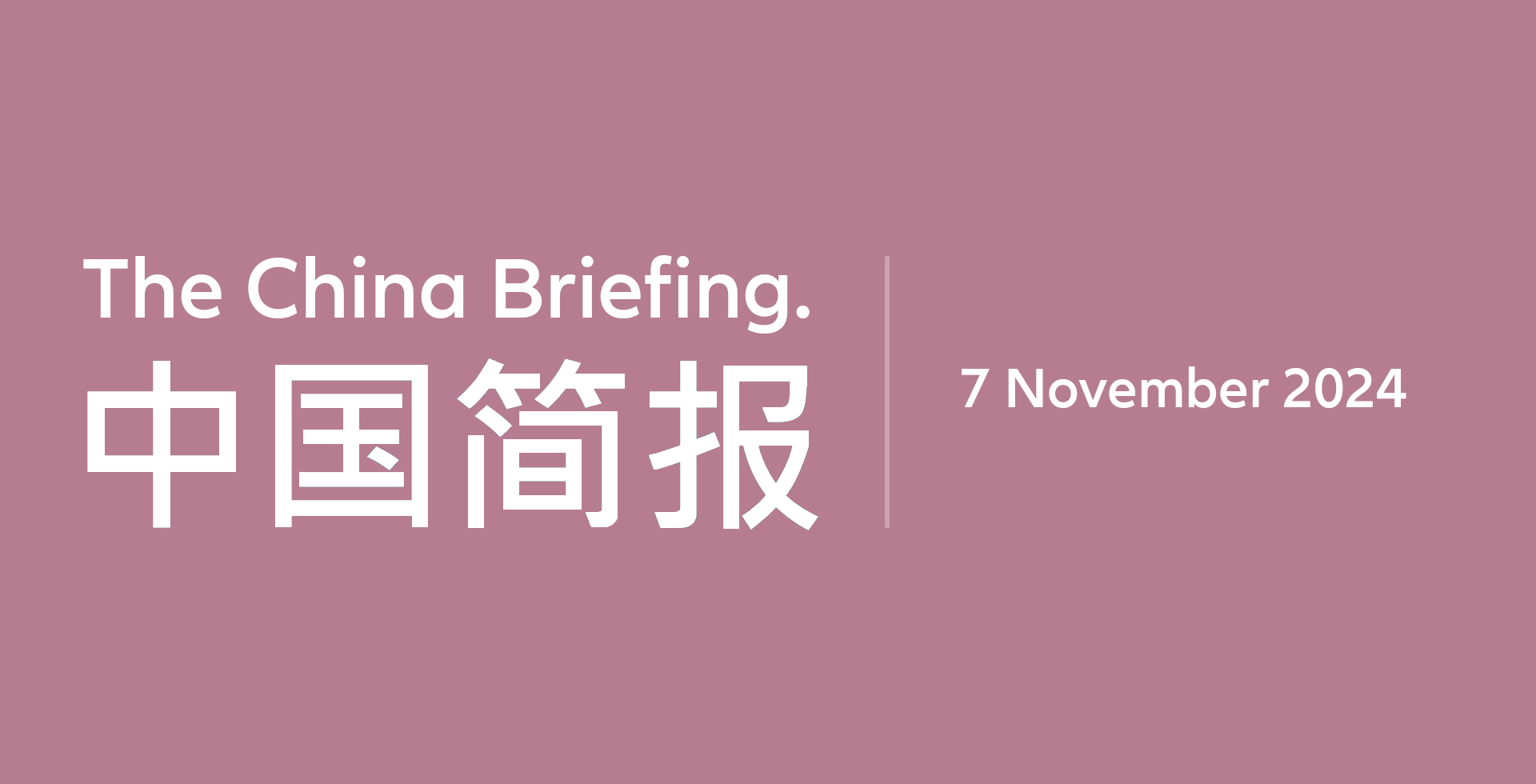

Chart 1: Margin trading outstanding balance in China A-Shares (CNY billion)

Source: Wind, Allianz Global Investors as at 4 November 2024.

- This was when China announced a raft of stimulus measures, including a number of policies clearly designed to support domestic equities.

- The effect has been to reinvigorate the China A market. Trading volumes have picked up. And the level of margin trading, a good real-time sentiment indicator, has increased significantly back to levels last seen three years ago.4 This suggests that retail investors are now far more highly engaged.

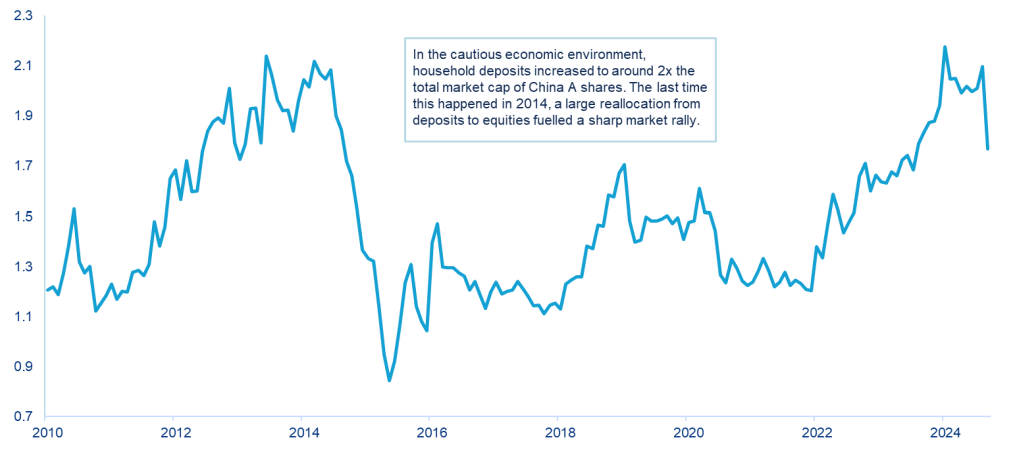

- Importantly, retail cash levels are close to record high levels – household deposits in banks have reached the equivalent of two times the entire market capitalisation of China A-shares. The last time they were at this level was in the second half of 2014,5 which presaged a strong market rally when interest rates were cut and retail investors flocked to equities

- A key question from here, therefore, is to what extent retail sentiment will continue to recover.

- Perhaps the most important issue for now is whether the risk of higher US tariffs, which weighed heavily on sentiment in 2018, will again become a threat. Or whether there will be concrete signs that China’s policy package is working, which would then potentially outweigh the tariff concerns.

- In terms of China’s stimulus plans, the government is expected to produce numbers for the fiscal component of the package at the National People’s Congress which wraps up tomorrow (Friday 8 Nov).

- The focus is likely to be on clearing up local government debt and recapitalising banks, which would allow more credit to be extended. The Ministry of Finance has also said there is ample room for the central government to leverage up, which suggests a more expansionary approach will be continued in next year’s budget.

- In our view, we don’t see fiscal policy as aiming to deliver a major boost to either infrastructure investment or consumer spending; instead the focus is on stabilising expectations and averting financial risks.

Chart 2: Ratio of household deposits to China A-Shares market capitalisation

Source: Wind, AllianzGI, as at 30 September 2024.

- The key to the success of this new approach – and the most likely path to stronger growth – is through an improvement in the property market.

- Much of the reason for the higher savings rate in recent years, in our view, is related to fears on future income prospects and the erosion of wealth as housing prices have fallen. Stabilising housing prices, or even seeing some modest gains, would help to start rebuilding confidence and ultimately reverse this cycle.

- In this area, recent news has been encouraging. National new home sales volumes in October expanded for the first time in more than a year.6 Big cities such as Shanghai and Shenzhen have taken the lead.

- Pulling these various strands together, overall we are now in a situation where the government is easing both monetary and fiscal policies, and actively looking to boost asset prices. This is a different position from just a few weeks ago.

- The government has stepped in several times this year to stabilise equity markets. As such, we believe this helps to provide a market floor.

- And if the more pro-growth policy setting is successful, this should also remove some of the headwinds that have been blowing hard in the face of China equities, undermining both valuations and corporate earnings.

- Naturally there will be uncertainty regarding what the Trump presidency will bring. However, with the likelihood of more supportive government measures to come in China, and with market valuations still reasonable, our view is to buy the dips rather than to sell the rallies.

1 Source: Bloomberg as at 6 November 2024

2 Source: Bloomberg as at 6 November 2024

3 Source: Bloomberg as at 6 November 2024

4 Source: Wind as at 4 November 2024

5 Source: Wind as at 30 September 2024

6 Source: Nomura as at 1 November 2024