Readying for the reset

Summary

Fixed-income turmoil has tested investor resolve as bond markets shift to an inflation-focused environment after years orientated around economic growth. In the first of four articles uncovering how investors can reset bond allocations and inform portfolio positioning, we explore ideas for protecting against volatility.

Key takeaways

|

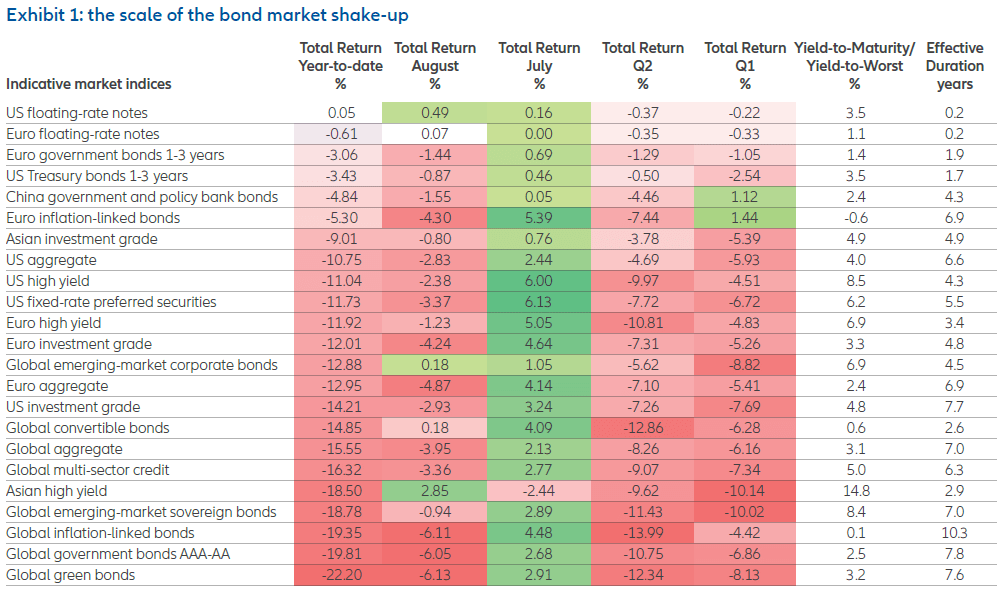

2022 will be remembered as a year of regime change in bond markets. Advanced economies entered a phase of higher inflation shocks not seen since the 1970s oil shocks. Inflation had not attracted such attention since the 1990s. But it has zoomed back into focus in 2022 as policy and markets have become beholden to the twists and turns of rising prices. A return to what may feel to some like an unfamiliar regime has led bond indices to historically outsized losses. Year-to-date, the number of public debt markets that could provide at least some shelter for investors was close to zero (see Exhibit 1).

Source: Bloomberg. ICE BofA and JP Morgan indices; Allianz Global Investors. Data as at 31 August 2022. Index returns in USD (unhedged) except for Euro indices. Yield-to-worst adjusts down the yield-to-maturity for corporate bonds which can be “called away” (redeemed optionally at predetermined times before their maturity date). Effective duration also takes into account the effect of these “call options”. Past performance does not predict future returns. See the disclosure at the end of the document for the underlying index proxies.

The rout has come as a shock for most investors. Many had grown accustomed to the trend of the past 20 years in which markets associated higher (or lower) rates with stronger (or weaker) economic output and employment. In that growth-oriented regime, what were considered relatively safe bonds would generally behave as a good hedge to riskier assets. In contrast, the current environment echoes the pre-2000 period when fear of inflation reigned supreme and drove rates higher. Then, as in now, the outlook for bonds and stocks would brighten in tandem as consumer prices and monetary policy eased but then suffer as inflation and rates rose.

So, with few places to hide in bond markets, where should investors turn for signposts of the way forward?

The bad news is that, at the core of the current inflation-focused regime, nothing much has changed in recent months that offer better clues – on when and how this choppy cycle might start to turn. It is tricky at this stage to narrow the range of economic and policy outcomes. But the good news is that, on the margins, four compelling themes stand out that can help reset bond allocations and inform portfolio positioning for the remainder of 2022. We’ll explore these themes in a series of articles, starting with how investors can protect their portfolios against market volatility.

2022: a year to forget or a year to reset?

The makeup of those outsized bond market losses has shifted to some degree over the year. Drawdowns in the first quarter mainly came from bonds’ sensitivity to higher interest rates, known as duration risk.2 Yields rose in parallel for relatively safe government bonds and riskier sovereign and corporate bonds. In the second quarter, a perceived rise in credit risk led to further losses; the difference between those safer and riskier yields, termed as credit spread, began to widen as the former yields fell and the latter kept rising.

Bond markets then enjoyed a brief summer respite in July and up until mid-August, gaining sharply3 . In the same sequence we saw earlier in the year, but in reverse, duration risk eased first in July. As the odds of a recession rose, markets revised down their rate hike expectations, leading to a broader decline in yields. And to some extent, the first half of August was the mirror image of the second quarter. Further gains were driven by spreads recouping more than half of their year-to-date widening as the yield premium that investors demand on riskier debt fell.

But in the latter half of August came an about-turn. Bond prices dropped again4 , this time driven both by duration and spread risk, especially after a speech by US Federal Reserve (Fed) Chair Jerome Powell at the annual Jackson Hole gathering of central bankers. The message sent was clear. Inflation, not growth, remains the chief tail risk currently paining policymakers, and this is likely to keep US rates higher for quite some time.

Another consequence of the current regime, and a rather constant performance contributor this year for global bond portfolios, is the sharp strengthening of the US Dollar against most other currencies. Dollar appreciation accounts for a significant share of the negative total returns recorded by global bond indices in dollar (unhedged) terms, as index bonds issued in other currencies lost more value when converted to dollars. As expected, the cost of hedging exchange rate fluctuations against the dollar has spiked too, particularly for non-dollar-based investors who may have to continuously revalue their dollar-denominated assets in their local currency.

Ways to protect against rates and spread volatility

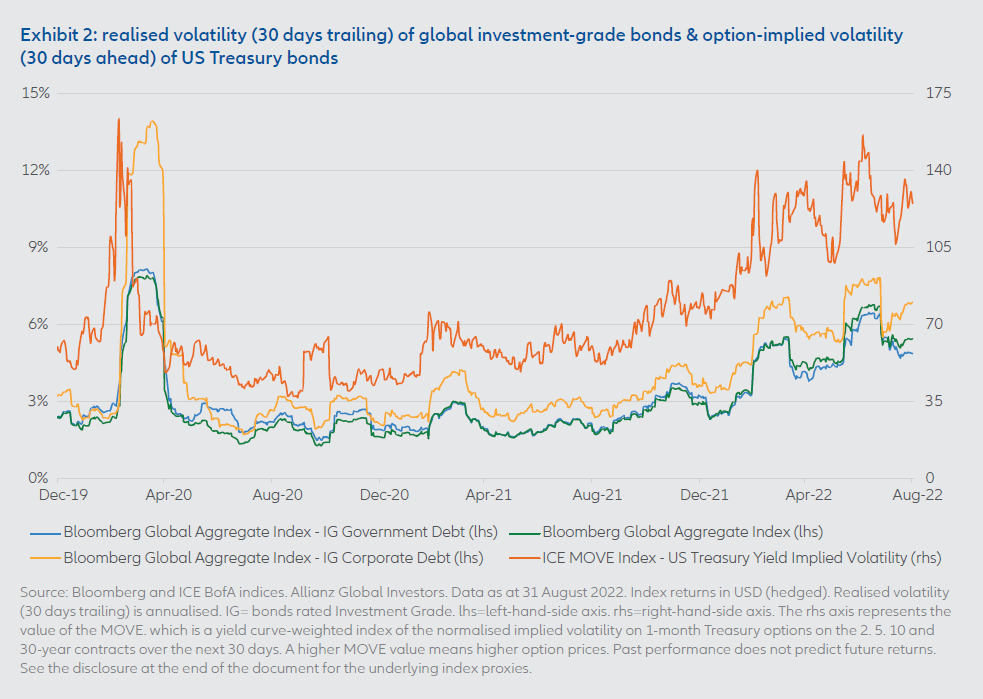

Bond market volatility remains high, as well as highly unstable. Measures of expected and realised bond volatility have come down from their most recent peaks in July5 (see Exhibit 2). However, one-month options-implied volatility for US Treasury yields was still around 50% higher at the end of August compared to the start of 20226 , as was the case for one-month realised volatility for global government bonds rated investment grade. Benchmarks which include similarly rated corporate bonds had recovered even less by summer end, with their one-month realised volatility approximately 90% higher than back in January.7

Both expected and realised volatility measures have seen U-shaped fluctuations, suggesting that they have yet to stabilise around a tighter range. In other words, the volatility of bond volatility remains high too. And there are signs of corporate bond volatility decoupling more visibly from government bond volatility – another illustration that volatility is coming not only from rates but also from spread-driven market moves.

The realised volatility of these investment-grade benchmarks jumped even higher during the 2020 market rout as an extreme liquidity squeeze hit investmentgrade and riskier assets alike. Still, investment grade volatility this year has surpassed the peaks recorded during the 2008-9 global financial crisis.8 Bond volatility following the collapse of Lehman Brothers was driven much more by credit spreads as default risk shot up and rates fell. This time things are different. Markets need to contend with a mix of heightened interest rate and credit risks.

Unpredictable inflation and rising rates

Much will depend on inflation. But that remains far too high and difficult to forecast due to exceptional supply chain, labour market and geopolitical disruptions. Outside the most rate-sensitive sectors, such as housing, most of the collateral damage inflicted on households, businesses and national finances is still coming from inflation, not borrowing costs. Even once month-to-month inflation prints start to come in flat, like in the case of headline US inflation for July, there is still a long way to go. We need many more consecutive month-to-month prints at zero or falling before year-on-year inflation nears the low single-digit range. Only a dramatic deflationary shock, like a pandemic-led shutdown, could arrest inflation faster.

Central banks look set on continuing to hike rates to lower aggregate demand until something “breaks”. That has not happened yet. Unemployment rates in the US and Europe are stuck near record lows, and they would have to rise by several percentage points to inflict a recession that goes beyond technical contractions in GDP growth and economic activity indicators. We cannot be sure when the interest rate setting will once again be governed chiefly by fears over recession rather than inflation. Policymakers aren’t sure either and have ditched forward guidance for a data-reactive approach. Markets are not used to a noncommittal policy stance and may very well hit new volatility highs around releases of major data and policy decisions.

Creditworthiness jitters ahead

Another reason we may see repeated volatility shocks in the months ahead is that the post-pandemic credit cycle has barely begun to turn. A broad-based spillover of refinancing woes could take longer to emerge this time around since riskier issuers took the opportunity in the last few years to extend the maturity of their debt at cheaper rates. The prelude to deteriorating creditworthiness for many companies will be weaker earnings. By some estimates, around half of the firms that make up the S&P 500 equity index are seeing negative sales growth when adjusted for inflation. Earnings may also suffer from less favourable credit terms extended to customers. Several bank lending surveys have started to point in this direction.

Ideas for volatile times

For long-term and buy-and-hold investors, historic paper losses on bond allocations have been especially frustrating since rates and spreads are to blame so far rather than broad-based defaults. Yet, higher inflation means that cash is currently a very expensive place to hide. So, where to turn?

- Short-maturity, highly rated bonds issued by governments and companies are one alternative but may not help much to dampen portfolio volatility as the front-end of yield curves remains vulnerable to further shocks from the repricing of terminal shortterm rates.

- As it is not yet time to aggressively increase beta in portfolios, we believe it is worth considering combining short-term, fixed-rate cash bonds with futures and options on interest rates and credit derivative indices, which can help limit rates and spread volatility. It’s important to note that there can be cash outlay and performance costs associated with these hedging strategies. Also, there may be a mismatch between portfolio holdings and the constituents of available hedging instruments. Actively managing hedge positions is key as they may only partially offset, or even add to, losses on the cash bond portion of a portfolio.

- Another option for cash bond allocations may be floating-rate notes, which have outperformed other bond markets year-to-date. So-called floaters, issued mainly by investment-grade-rated financial institutions and corporates, offer coupons that adjust with some periodic lag to shifts in short-term benchmark rates. Floaters also carry a yield premium over and above those reference rates to compensate for the possibility of floater prices falling due to credit risk. This way, investors who wish to gain exposure to credit can get better protection from rising rates. Keep in mind that floater yields tend to be lower than fixedrate corporate bond yields – it would take several consecutive rate hikes for floater yields to begin to catch up. Also, floater prices can fall if there is a deterioration in the economic outlook and debt issuers’ creditworthiness.

With current market volatility showing no sign of abating, investors may like to consider weatherproofing their portfolios as choppy conditions endure during the shift to an inflation-focused regime.

1Inflation in the US rose to around 14% in 1980, according to Federal Reserve public data, Federal Reserve Bank of St Louis

2Duration losses reflect two types of risk. The opportunity cost of holding bonds with a below-market yield is greater in times of rising rates. That is because those bonds would pay out smaller cash flows than comparable but newly issued bonds offering higher coupon income, which could then be reallocated to higher-yielding assets (reinvestment risk). Then if bondholders had to sell before maturity for some reason (divestment risk), buyers would pay less than the face value of the bond at maturity – pushing up the bond’s yield premium to match the higher fixed interest now offered by comparable bonds as a result of rising rates.

3Bloomberg, ICE BofA and JP Morgan indices, Allianz Global Investors. Data as at 31 August 2022.

4Bloomberg, ICE BofA and JP Morgan indices, Allianz Global Investors. Data as at 31 August 2022.

5Bloomberg and ICE BofA indices, Allianz Global Investors. Data as at 31 August 2022

6Bloomberg and ICE BofA indices, Allianz Global Investors. Data as at 31 August 2022

7Bloomberg and ICE BofA indices, Allianz Global Investors. Data as at 31 August 2022

8Allianz Global Investors calculations based on Bloomberg and ICE BofA indices based on the time series for the Bloomberg and ICE BofA indices from October 2008 to August, 31 2022.

Investing in fixed income instruments (if applicable) may expose investors to various risks, including but not limited to creditworthiness, interest rate, liquidity and restricted flexibility risks. Changes to the economic environment and market conditions may affect these risks, resulting in an adverse effect to the value of the investment. During periods of rising nominal interest rates, the values of fixed income instruments (including short positions with respect to fixed income instruments) are generally expected to decline. Conversely, during periods of declining interest rates, the values are generally expected to rise. Liquidity risk may possibly delay or prevent account withdrawals or redemptions.

Information herein is based on sources we believe to be accurate and reliable as at the date it was made. We reserve the right to revise any information herein at any time without notice. No offer or solicitation to buy or sell securities and no investment advice or recommendation is made herein. In making investment decisions, investors should not rely solely on this material but should seek independent professional advice. However, if you choose not to seek professional advice, you should consider the suitability of the product for yourself. Investment involves risks including the possible loss of principal amount invested and risks associated with investment in emerging and less developed markets. Past performance of the fund manager(s), or any prediction, projection or forecast, is not indicative of future performance. This material has not been reviewed by any regulatory authorities.