Robo-Advisors: Early Disruptors in Private Wealth Management

Summary

Although some view robo-advice as a passing trend, it has the potential to help investors and advisors alike, according to two new Grassroots Research surveys. Some advisors are even using the technology to manage smaller accounts more efficiently, which could bring more investors into the advice realm.

|

Key takeaways

|

Is the future of wealth management digital, or is this trend overplayed? While it may be too soon to tell, it’s clear that “robo-advisors” – automated, online wealth-management services that provide algorithm-based portfolio-management advice – are continuing to attract attention from investors. Moreover, increasing numbers of financial advisors are beginning to use “systematic” or “robotic” investment strategies in their own practices.

To learn more about this trend in the private wealth-management industry, GrassrootsSM Research conducted two surveys in February 2017. The first targeted individual investors, while the second focused on independent and corporate financial advisors.

Investors like low fees but appreciate personal advice

The findings from our first survey indicated that, as expected, the lower costs associated with robo-advice are a key factor in the growth of these services. Slightly more than half of the individual investors we surveyed cited the lack of fees, or low annual fees, as the biggest appeal of robo-advisors. However, this didn’t prevent investors who use financial advisors for private wealth management from also appreciating the tailored services their advisors offer.

Only 36 per cent of respondents said they were somewhat to highly willing to try a robo-advisor in 2017 – a decrease when compared with our February 2016 survey results (44 per cent). Among those investors who use a financial advisor, slightly more than half said they are highly unlikely to switch their investments either fully or partially to a robo-advisor.

Advisors see selective value in robo-advice

Financial advisors also told us that robo-advisors are not very disruptive to their businesses: Only 10 per cent saw any client interest vs. 24 per cent last year. Some of this may be due to a slightly older demographic in our newer study, and advisors did say they expect to see a higher impact from robo-advisors as millennials earn more money to invest.

Investor net worth is another important factor: Advisors say that sophisticated investors with large portfolios expect a personalized approach that robo-advisors do not offer. This reinforces the finding that robo-advisors are more relevant to investors with smaller portfolios who are more sensitive to costs. We also found that advisors themselves are beginning to use robo-advisors as part of the services they provide – primarily to manage smaller accounts more efficiently. This again shows the cost-management value of robo-advice, which may end up bringing more lower-value investors into the advice realm.

The future is digital

Looking ahead, robo-advisors could become a greater competitive challenge to financial intermediaries – particularly given that younger investors expect to have more digital engagement with their finances. In the face of this challenge, advisors we surveyed said they will continue to emphasize and reinforce their value propositions, specifically the value of their broad financial-planning expertise and the personal relationship they can form with their clients.

At the same time, we also found that advisors are committed to incorporating the latest technologies into their practices to help them work more efficiently with their clients:

- Several advisors use improved planning and analytics software, including risk tools that help them have more informed conversations with their clients.

- Others are also investing in improved customer relationship management tools.

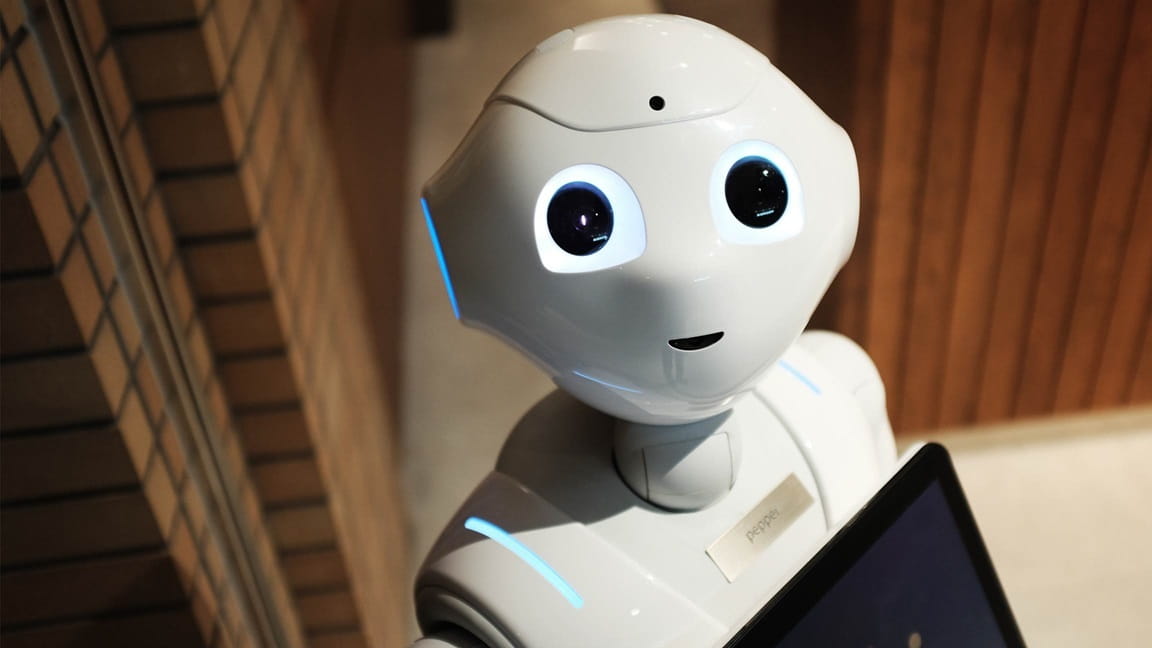

- Some advisors point to the future ability of artificial intelligence and virtual reality to help them customize services for clients and respond more dynamically to their needs.

While robo-advisors may be struggling to gain ground in some areas of the market, there is no doubt that digital technology could play a bigger role in private wealth management in the future.

A Majority of Investors Aren’t Attracted to Robo-Advice

Our 2017 investor survey showed that 55 per cent are somewhat or highly unwilling to try robo-advisors.

Source: Grassroots Research as at February 2017.

This material is for reference only. Information herein is based on sources we believe to be accurate and reliable as at the date it was made. We reserve the right to revise any information herein at any time without notice. No offer or solicitation to buy or sell securities and no investment advice or recommendation is made herein. In making investment decisions, investors should not rely solely on this material but should seek independent professional advice.

This material is published for information only, and where used in mainland China, only as supporting materials to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. The fund, if any, referred to herein has not been approved by relevant regulatory authorities in mainland China.

Issued by Allianz Global Investors Asia Pacific Limited on 12 May 2017.

Allianz Global Investors Asia Pacific Limited (27/F, ICBC Tower, 3 Garden Road, Central, Hong Kong) is the Hong Kong Representative and is regulated by the HK SFC (35/F, Cheung Kong Center, 2 Queen's Road Central, Hong Kong).

New Opportunities for Investors

Summary

As a high-tech force with the potential to disrupt entire industries, artificial intelligence could transform today’s world even more than the internet once did. And with AI at an inflection point, investors have an exciting opportunity to tap future sources of growth potential across the market.

|

Key takeaways

|