How Artificial Intelligence accelerated the development of the Covid-19 vaccine

Summary

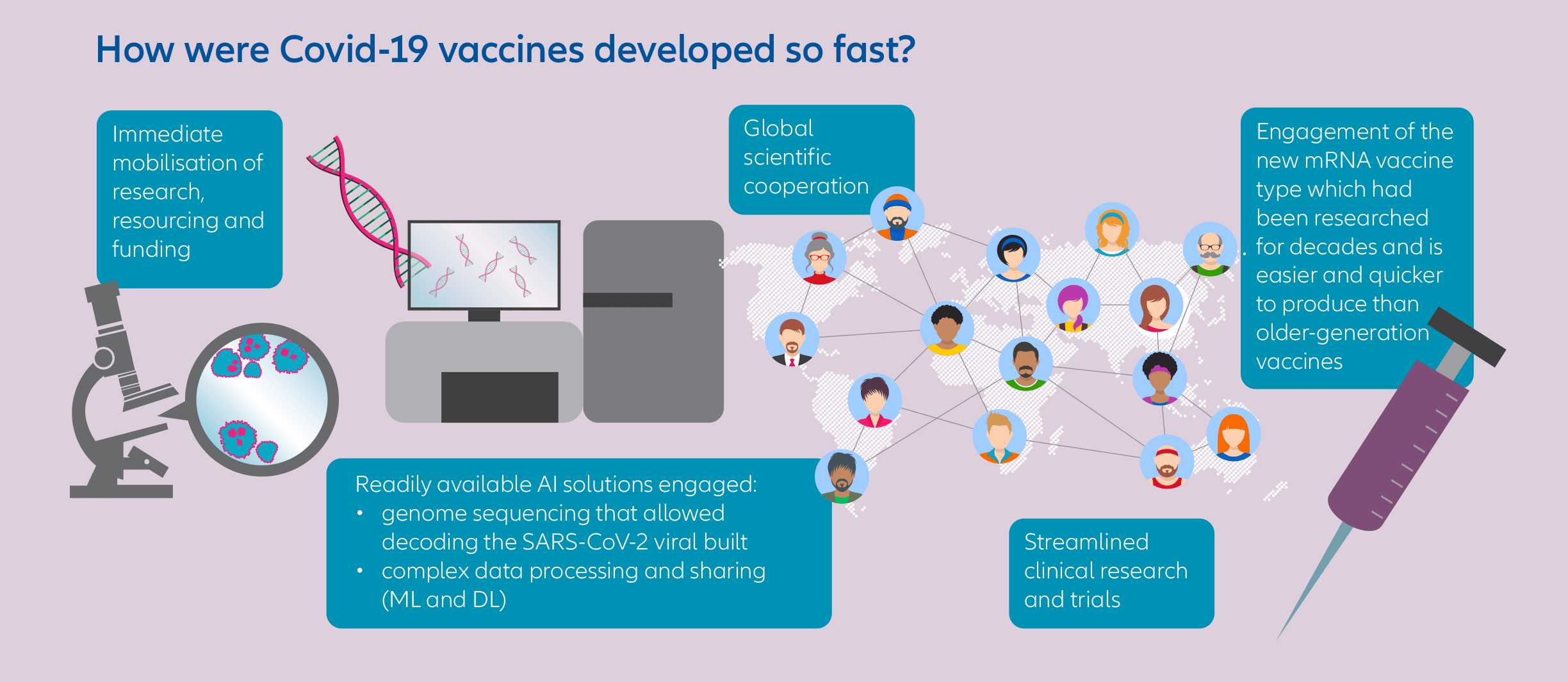

It was incredible! Within 41 days of identifying, isolating and fully sequencing the Covid-19 virus, pharmaceutical company Moderna had delivered a vaccine candidate. To top this, the company did all of this in January and February 2020 – a full month before lockdowns began in most parts of the world.

It was incredible! Within 41 days of identifying, isolating and fully sequencing the Covid-19 virus, pharmaceutical company Moderna had delivered a vaccine candidate. To top this, the company did all of this in January and February 2020 – a full month before lockdowns began in most parts of the world.1

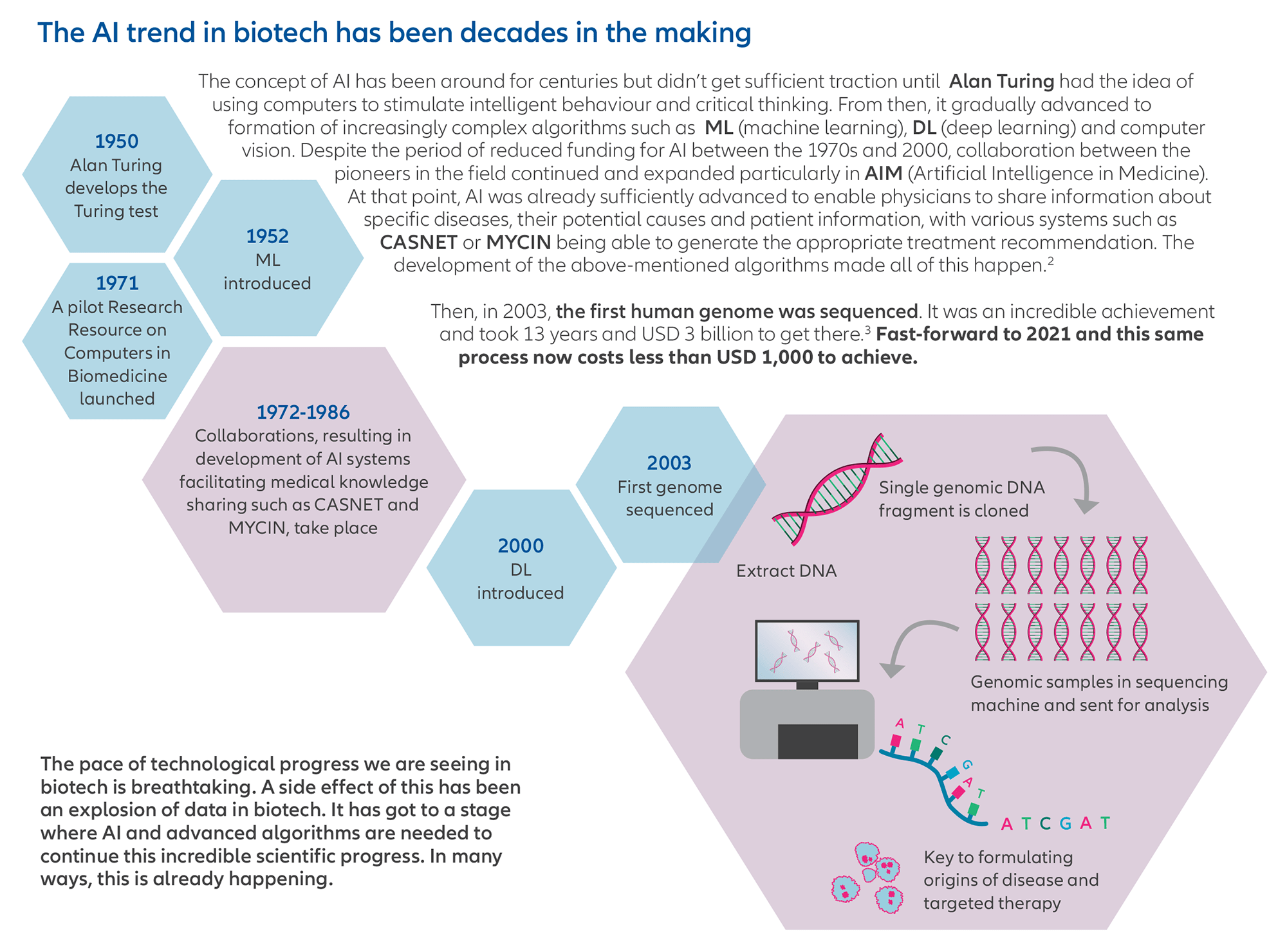

It was thanks to a mixture of Artificial Intelligence (AI) algorithms and advanced analytics that this feat was achieved. But why should it not surprise us?

AI is making what is extraordinary, seem almost ordinary

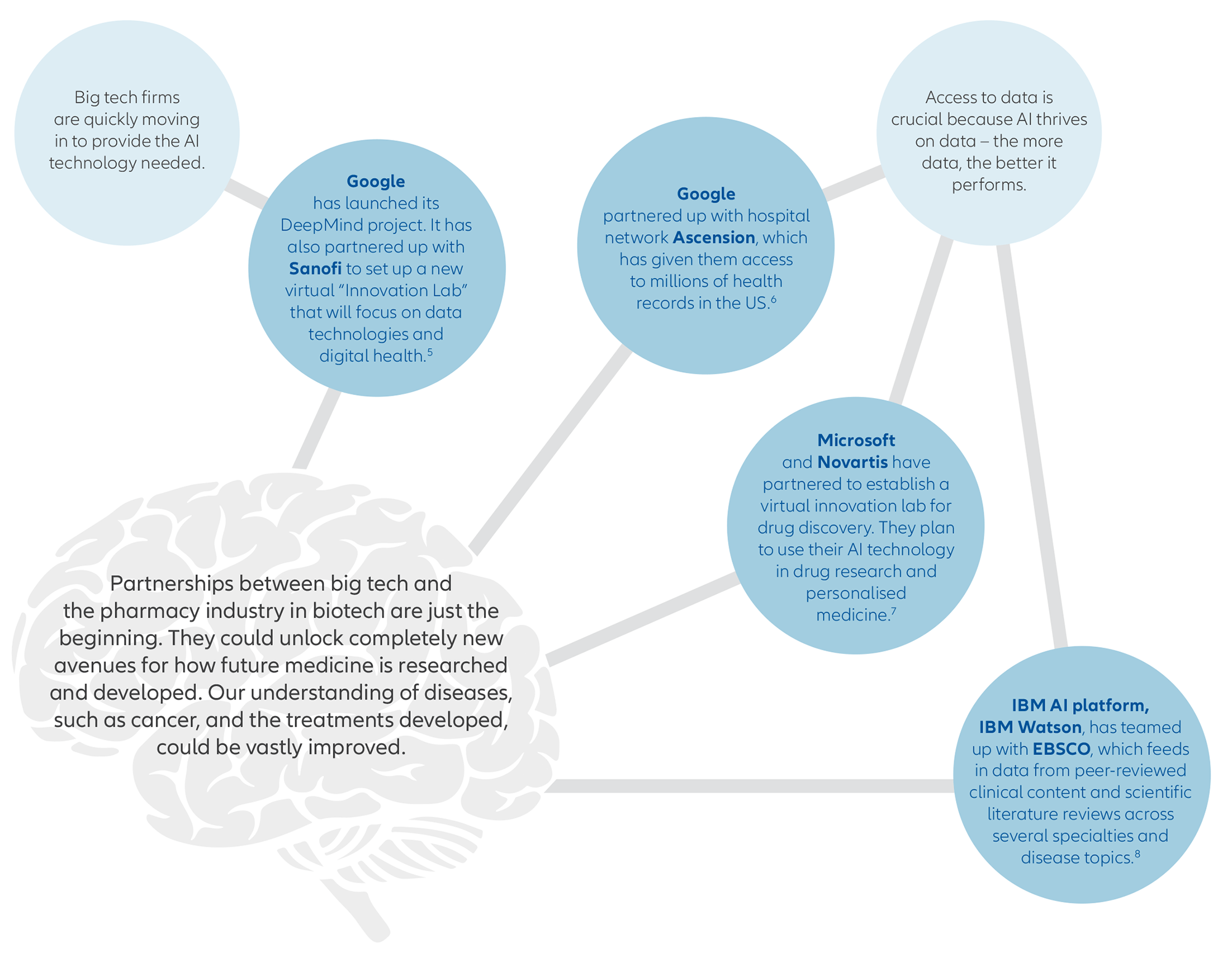

AI is now being used widely in biotech. According to the Genetic Engineering & Biotechnology News, it is already being used for "drug target identification, drug screening, image screening and predictive modelling. It is also being used to comb through scientific literature and manage huge amounts of critical clinical trial data that is now produced".4

Johnson & Johnson and Pfizer are already using IBM Watson to analyse patient data and recommend better treatment options.10

When it comes to oncology, IBM Watson is able to analyse the meaning and context of both structured and unstructured data in clinical notes and reports that might be important for selecting the right treatment. By combining data from a patient's file with clinical expertise, external research and data, the best treatment for the patient can be selected.11

IBM has also launched Medical Sieve, a cognitive medical assistant with analytical reasoning capabilities and a range of clinical knowledge. It is being used in clinical decision-making in radiology and cardiology, and can analyse radiology images to spot and detect problems faster and more reliably.12

Personalised and precision medicine will need a myriad of disruptive technologies to work on a scale that is cost effective and practical. The boom in data in the information age, coupled with the advances being made in AI, could therefore be a real game changer.

AI is making its presence felt in biotech, in ways that were unimaginable a decade ago. This is arguably just the beginning. The potential therefore should not be under-estimated.

Reference

1. Kelly, M. (2020, November 24). Lessons from Moderna: Leverage the Power of Artificial Intelligence. Stern Speakers.

2. History of AI in medicine, Gastrointestinal Endoscopy Volume 92, No. 4 : 2020

3. Vella, H. (2019, January 2). The Institution of Engineering and Technology. Engineering and Technology.

4. Shaffer, C. (2020, April 16). Artificial Intelligence Is Helping Biotech Get Real. GEN - Genetic Engineering and Biotechnology News.

5. Terry, M. (2019, June 18). Sanofi and Google Partner on Digital Health and Real-World Evidence Analysis. BioSpace.

6. CB Insights. (2020, June 26). Big Tech Is Coming For Pharma. CB Insights Research.

7. Novartis.

8. Hale, C. (2020, March 13). IBM Watson Health to tap EBSCO’s DynaMed libraries for a combined AI drug information suite. FierceBiotech.

9. Payne, A. (2020, September 22). The role of AI in advancing personalized healthcare. TechRadar.

10. Johnson & Johnson to IBM: ‘Watson, come here. I want you.’ (2014, October 11). Fortune.

11. Motzer RJ, Barrios CH, Kim TM, et al. Piloting IBM Watson Oncology within Memorial Sloan Kettering’s regional network. J Clin Oncol [Internet]. 2014;32(25):2765–2772.

12. Syeda-Mahmood T, Walach E, Beymer D, et al. Medical sieve: a cognitive assistant for radiologists and cardiologists. Proc SPIE - Prog Biomed Opt Imaging [Internet]. 2016;9785.